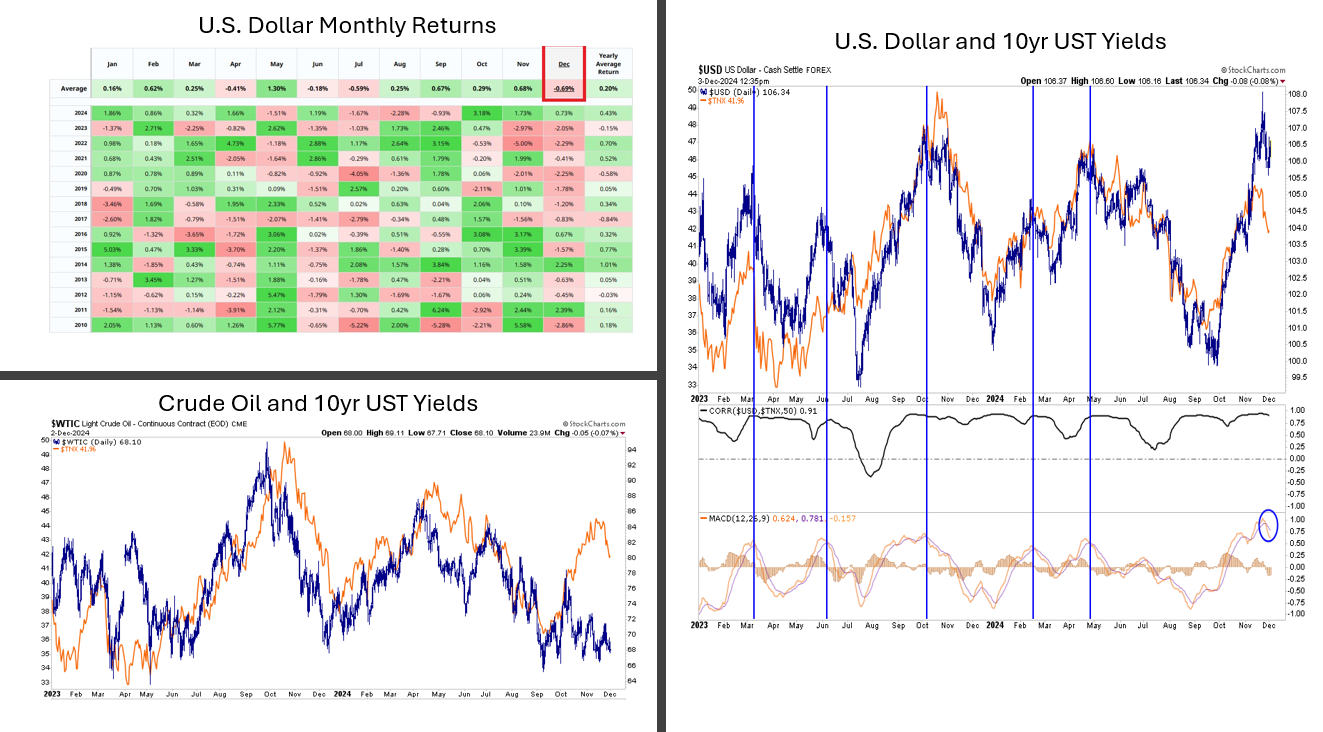

Bond yields are primarily driven by macroeconomic factors such as inflation and economic growth. Given their impact on inflation and the economy, the US dollar and oil prices are frequently well correlated with bond yields. Therefore, bond traders often take their cue from the dollar and oil markets.

The dollar (blue), as graphed on the right, has been on a tear since early October. As is typical, bond yields (orange) closely followed the dollar higher. The graph below the dollar/yield shows the correlation between .75 and 1.00 over the period. The dollar is now at the upper end of a two-year range, and its MACD sends a strong sell signal.

The blue vertical lines show the prior periods when similar sell signals were triggered. The technical sell signal for the dollar, thus a buy signal for bond prices (lower yields), aligns with the table on the left. It shows that the dollar has traded down in the last seven December’s. Moreover, since 2010, December has been the worst month for the dollar.

The graph on the bottom left highlights the strong correlation between crude oil and bond yields. In this case, crude oil trades at the lower end of its two-year range. However, bond yields have yet to “catch down” to oil prices. Assuming the correlation holds up, which is not necessarily a given, bond yields could revisit September’s lows.

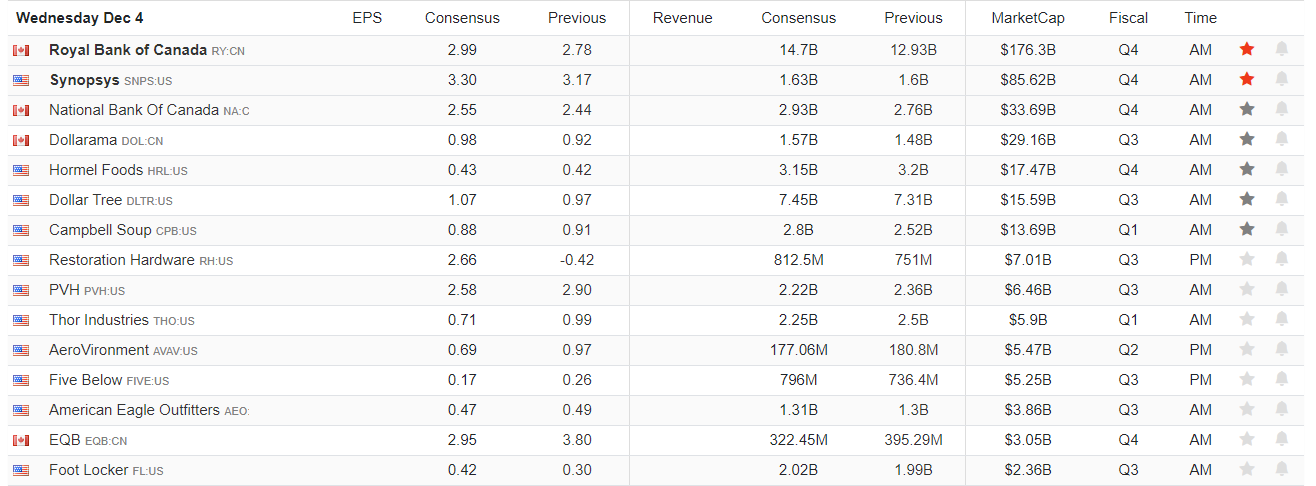

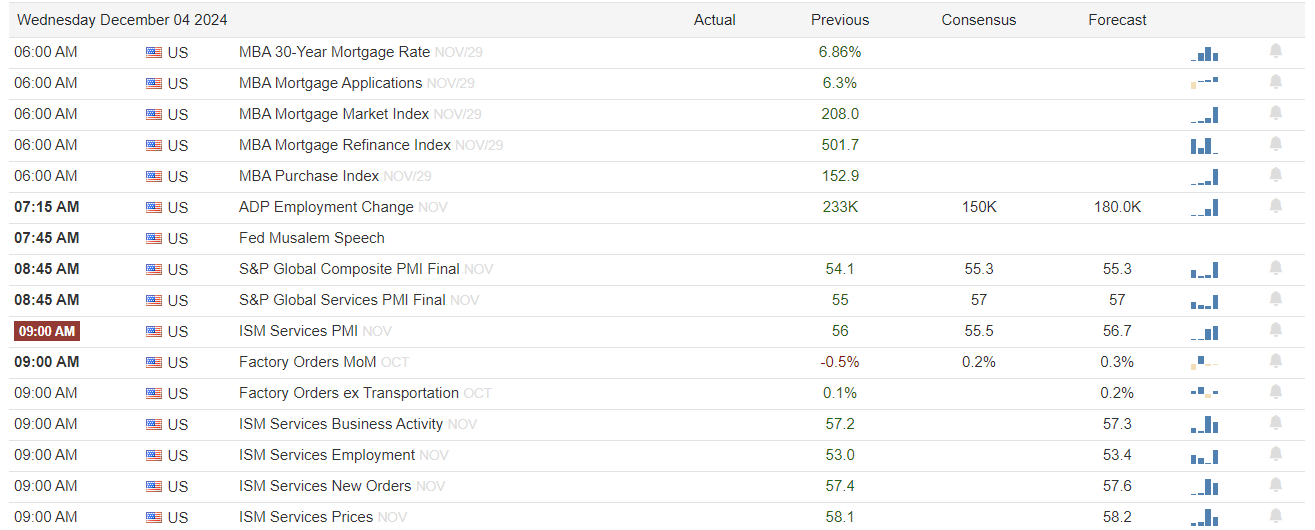

What To Watch Today

Earnings

Economy

Market Trading Update

Yesterday, we discussed the market’s more extended and overbought conditions. This suggests that some “sloppy trading” action is likely over the next week or so until that reverses somewhat.

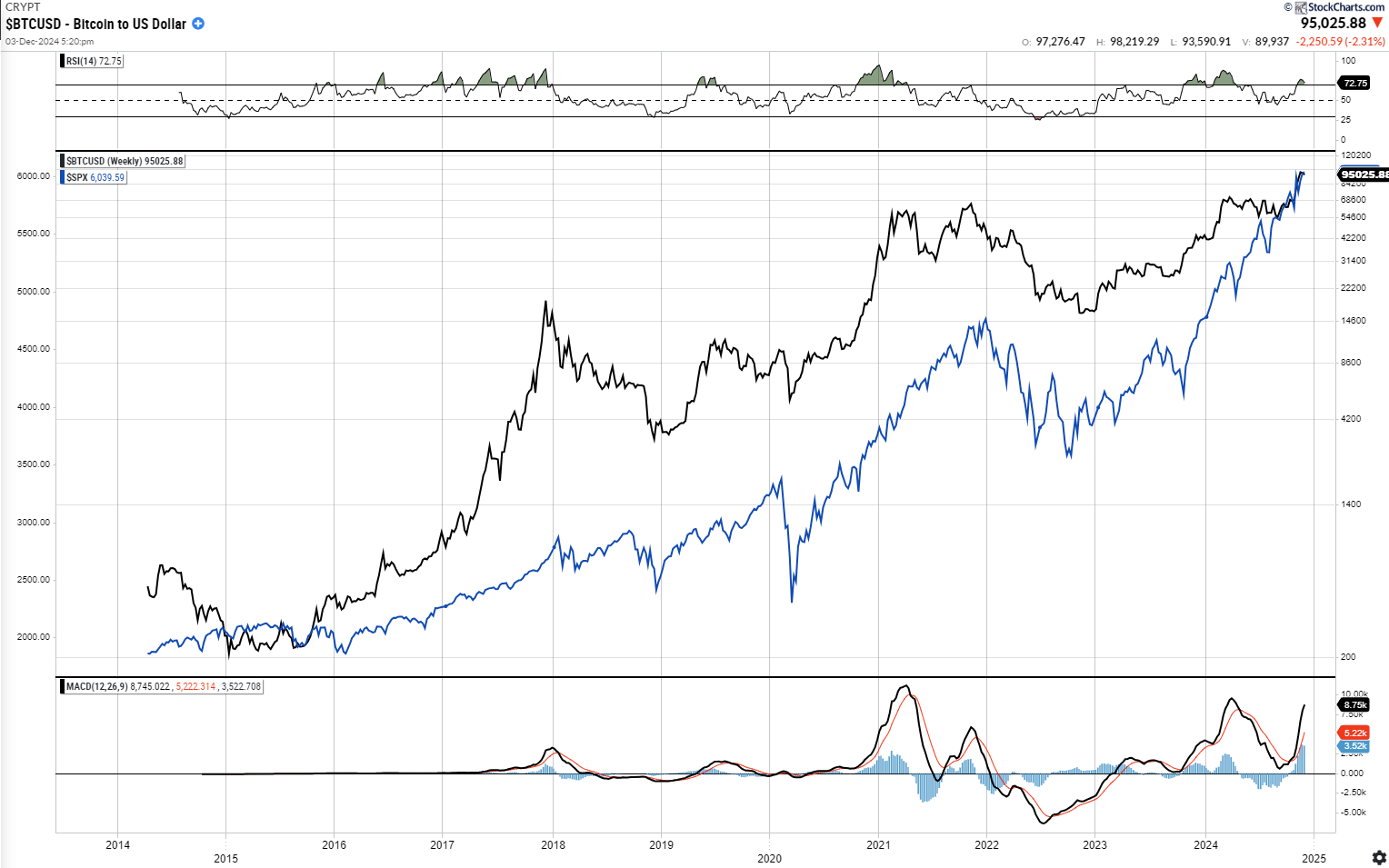

As discussed in our blog post yesterday, one thing to note is the more speculative positioning in the market. We have seen that positioning in various assets this year, from gold to stocks to bitcoin. Unsurprisingly, a “thesis” is generated when assets increase significantly, explaining why this time is different. History has taught us that it never is, and speculative risk-taking, particularly when combined with leverage, always ends badly. For example, the chart below compares Bitcoin to the S&P 500 index. The high correlation suggests that despite the many stories behind the rise in Bitcoin, such as decentralization, an offset to fiat currency, etc., the real reason is that it is an asset being chased by investors. Eventually, the speculative chase will reverse, as it always does, and the price will likely decline along with the general shift in sentiment in the broader stock market.

It is worth noting that when Bitcoin’s RSI and the MACD indicator were elevated in previous periods, a correction or long-term consolidation occurred, along with the S&P 500 index. Given the more extreme run in both asset classes over the last two years, it may be prudent to expect a rise in volatility as we head into 2025 and a reversal of those overbought conditions through stagnation or reversion.

This is just something to consider as we wrap up the year and Wall Street analysts become increasingly emboldened in predicting higher stock prices next year.

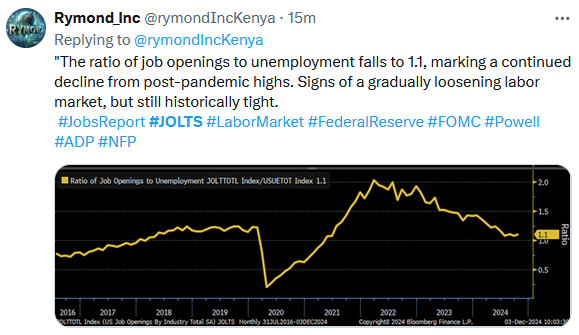

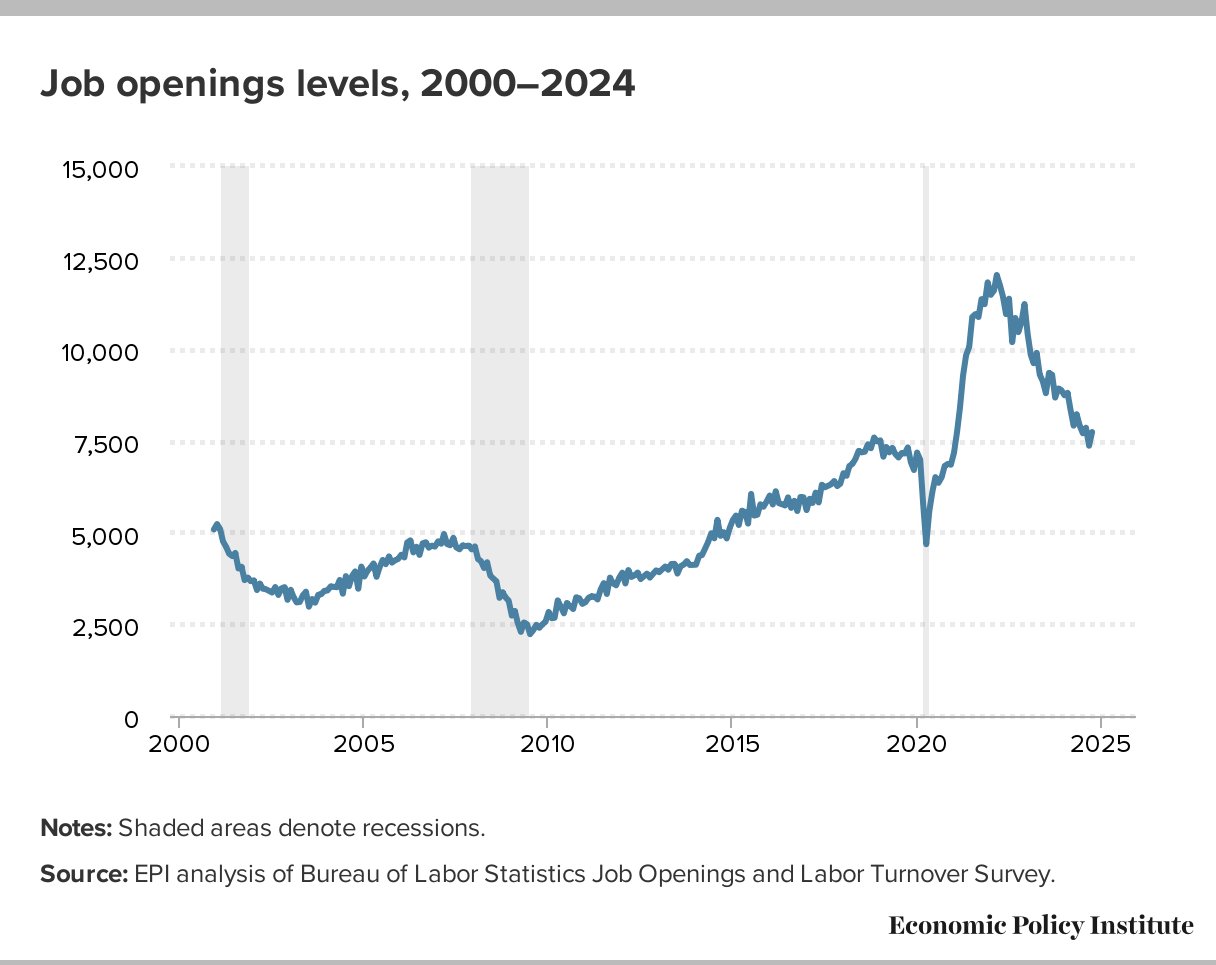

JOLTs

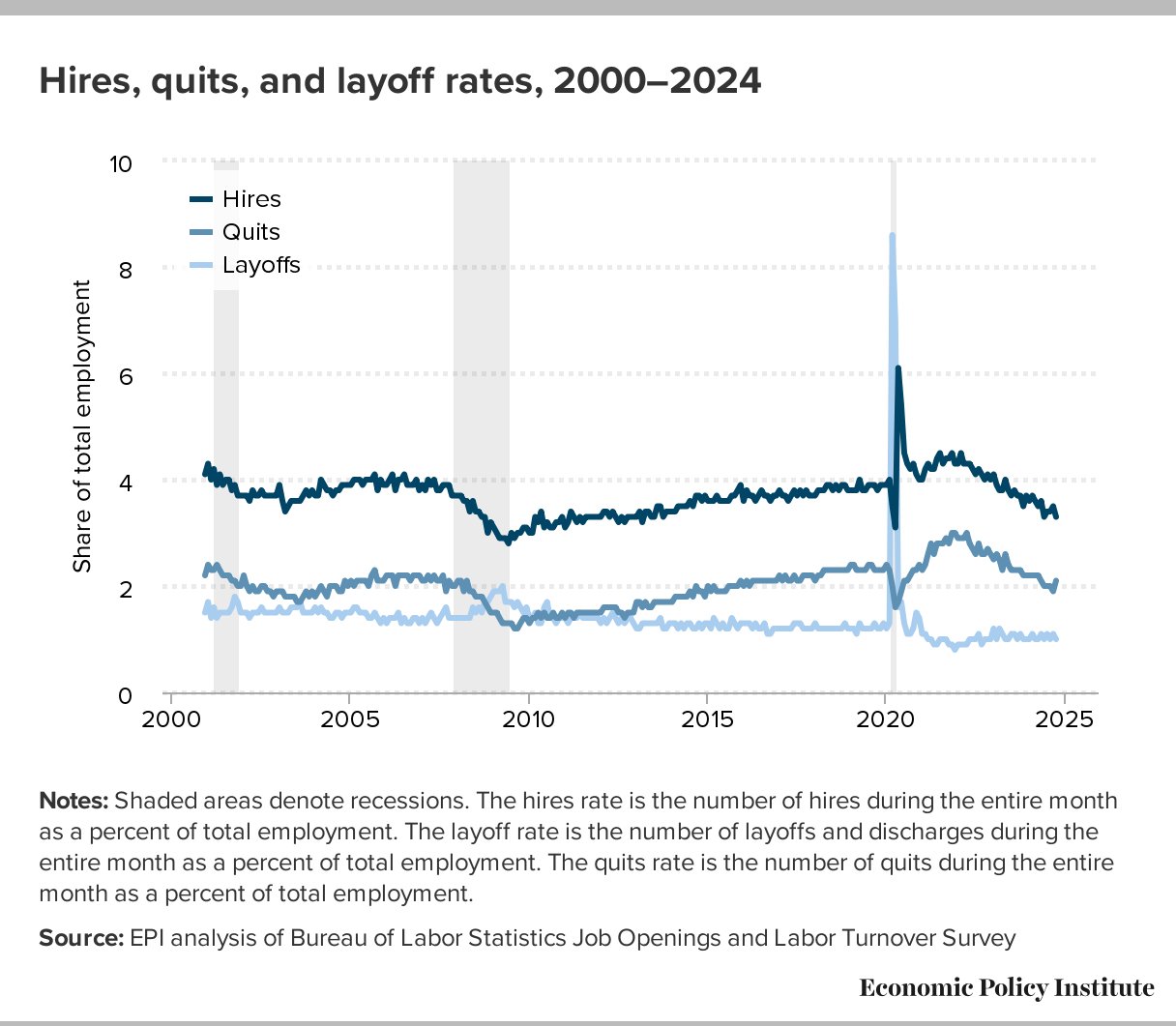

The BLS JOLTs data, a precursor to today’s ADP and Friday’s employment reports, registered an uptick in the labor market. The downward trend in job openings remains intact despite the better-than-expected reading of 7.74 million, well above the consensus of 7.52 million.

Additionally, the rising quits and layoffs rates were better than expected and point to a healthy jobs market. The only fly in the ointment is the hiring rate, which fell to 3.3%, the lowest since the pandemic started.

Leverage And Speculation Are At Extremes

Financial markets often move in cycles where enthusiasm drives prices higher, sometimes far beyond what fundamentals justify. As discussed in last week’s BullBearReport, leverage and speculation are at the heart of many such cycles. These two powerful forces support the amplification of gains during upswings but can accelerate losses in downturns. Today’s market environment shows growing signs of these behaviors, particularly in options trading and leveraged single-stock ETFs.

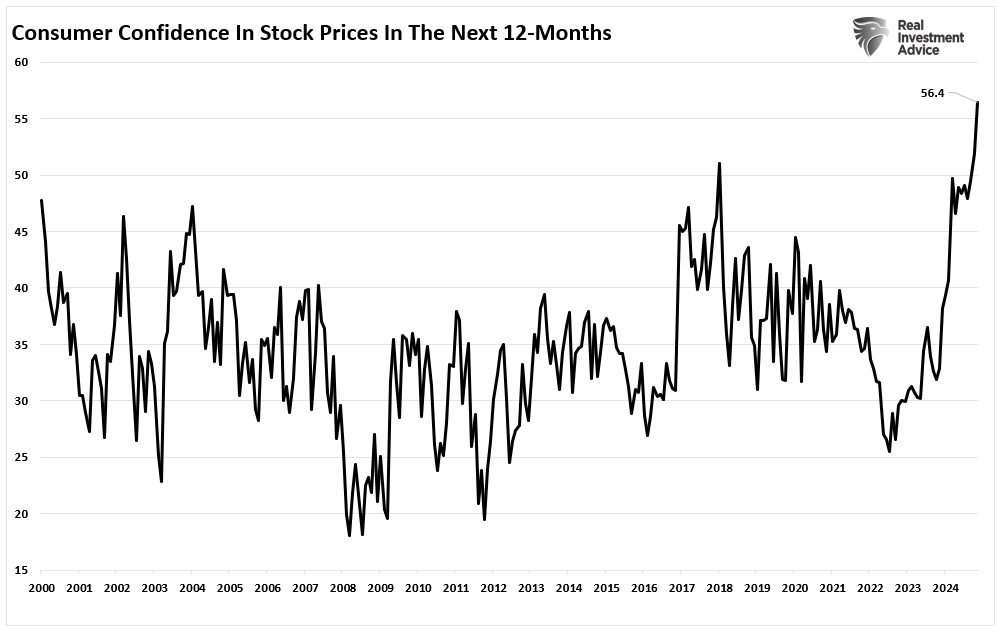

While leverage and speculation are not new to the financial markets, they manifest investor exuberance. We made this point in a recent post on “Exuberance,” as consumer confidence in higher stock prices has reached the highest level since President Trump enacted sweeping tax cuts in 2018. However, that was before his re-election in November; since then, investor confidence has soared to record levels.

READ MORE…

Tweet of the Day