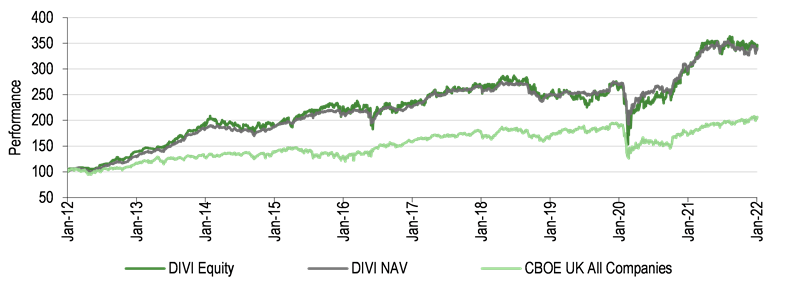

Alpha generation and low correlation of Diverse Income Trust (DIVI) with major UK indices has resulted in a steady long-term total return. After celebrating its 10-year anniversary last year, multi-cap DIVI continues to be among the top-ranked UK high dividend-yield trusts over periods longer than three years, despite some setbacks in short-term performance against peers due to its relatively high AIM exposure. About a third of DIVI’s portfolio is in AIM-listed stocks, while most peers are more exposed to large caps. Looking ahead, portfolio managers Williams and Turner expect their multi-cap income approach to continue to deliver over the medium to long term, and for the UK equity market to outperform the US.

DIVI’s 10-year performance*

Why invest in DIVI now?

The trust has continued to deliver an attractive dividend income throughout the COVID-19 pandemic. The board intends to at least maintain the FY22 dividend payment at the FY21 level (3.75p per share), when the ordinary dividend was increased by 1.4%. The managers only buy shares that generate a substantial cash payback. New holdings with high dividends and growth potential constantly refresh the portfolio. When markets fall, cash-rich companies that populate DIVI’s portfolio can expand and strengthen, taking advantage of acquisition opportunities at bargain prices. The managers expect this to happen with a number of UK companies and look for more opportunities in 2022 and beyond.

The analyst’s view

DIVI’s multi-cap strategy and the portfolio’s diversification (c 130 holdings) mean the trust’s portfolio stance has not changed significantly either during the pandemic or throughout its life. The trust has delivered attractive returns on the still dominating high-beta markets of the past decade. In 2021, as the AIM market underperformed the broader UK market, DIVI’s performance lagged peers. DIVI’s 14% NAV TR over the 12 months to end-January 2022 was below the peer group average of 20%. Whether or not the UK stock market recovers, we expect DIVI to capture extra returns amid a potential market shift from growth to value as global growth slows. High equity valuations took a hit at the start of 2022. If they continue to unwind, DIVI is well positioned to outperform indices and peers, given its income-generating multi-cap strategy and diverse sources of income.

Fund objective

The Diverse Income Trust’s objective is to provide an attractive and growing level of dividends, coupled with capital growth over the longer term. It invests in a diversified portfolio primarily of quoted or traded UK companies across the market-cap spectrum, with a bias to high-quality small- and mid-cap stocks. Building a stock-specific portfolio, the team does not use a benchmark.

Bull points

■ Multi-cap strategy helps to diversify away from dividend concentration risk.

■ Consistent growth in regular dividends since the trust’s launch in April 2011.

■ Revenue reserves can be used to help maintain the pattern of dividend growth.

Bear points

■ The UK market could remain out of favour and retain the valuation gap with developed markets.

■ A multi-cap strategy is not a clear-cut asset class to fit into an investor’s portfolio.

■ A labour intensive, active multi-cap mandate results in a relatively high management fee.

Managers’ view and portfolio positioning

As the UK emerged from 2021 Christmas festivities into a volatile January 2022, DIVI’s managers expect a ‘bumpy ride’ in UK equities during 2022, with periods of rallies and setbacks.

They believe companies with the potential to generate cash surpluses each year, such as equity income stocks, have a natural advantage during more unsettled periods. The managers estimate that about a fifth of UK private and public companies that have borrowings, are ‘zombie’ companies, unable to pay interest on their debt. When stock markets peak and decline, many such businesses become forced sellers of their assets to settle debts. During such unsettled times, portfolio managers Williams and Turner expect cash-generating companies to acquire some of the over-levered, but otherwise viable, businesses from the administrator-receiver. These acquisitions could enable cash-rich companies to generate more cash, contrary to the general trend, as others go bankrupt or struggle.

The proportion of AIM and small-cap stocks in DIVI’s portfolio increased to 37.2% and 17.1% (at end-December 2021) from 31.7% and 11.4% respectively (at end-January 2021, Exhibit 1). Together they represent the largest share of DIVI’s portfolio at 54.3%.

Click on the PDF below to read the full report: