By Andrey Goilov, analyst at RoboForex

Early in another week of May, the commodity market is steadily rising. Brent is looking good and trading towards $113.30.

Positive factors for the commodity market are increasing car traffic in the U.S. due to the start of a travel season and the easing of anti-COVID restrictions in China. However, the global oil supply remains limited. At the same time, shale companies in the U.S. do not increase their investments in shale drilling as much as they might have.

The latest report from Baker Hughes showed that the Oil Rig Count in the U.S. gained only 13 units, up to 576. In Canada, the indicator increased by 3 units, up to 20. So far, it’s just a single signal in favour of expansion in the shale industry activities. However, if it becomes a tendency, the U.S. might produce about 12 million BPD as early as June.

China is slowly easing quarantine restrictions and planning to get back to normal life by 1 June. In this light, the demand for energy might go up and it’s a good factor for oil prices.

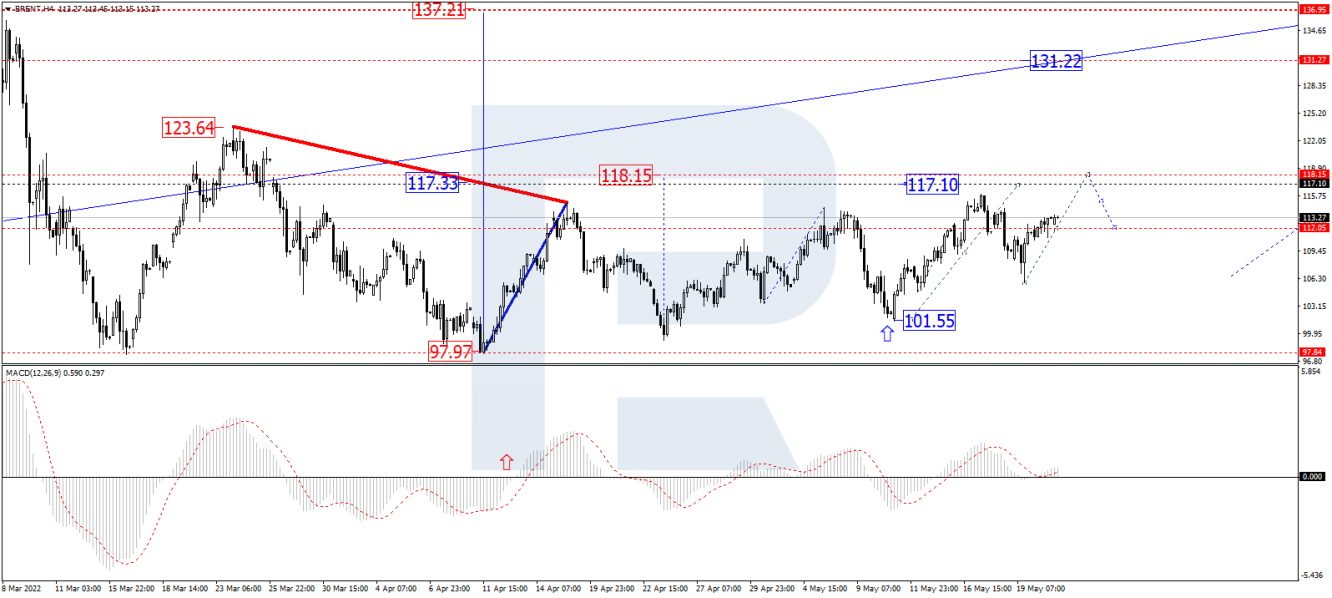

In the H4 chart, after completing the correction at 105.85, breaking 112.00 to the upside, and then forming a new consolidation range around the latter level, Brent is breaking it and may later continue trading upwards to reach 118.15. After that, the instrument may correct to return to 112.00 and then resume moving within the uptrend with the target at 131.22. From the technical point of view, this scenario is confirmed by MACD Oscillator: after breaking 0 to the upside, its signal line is still growing within the histogram area, which means that the uptrend in the price chart may continue.

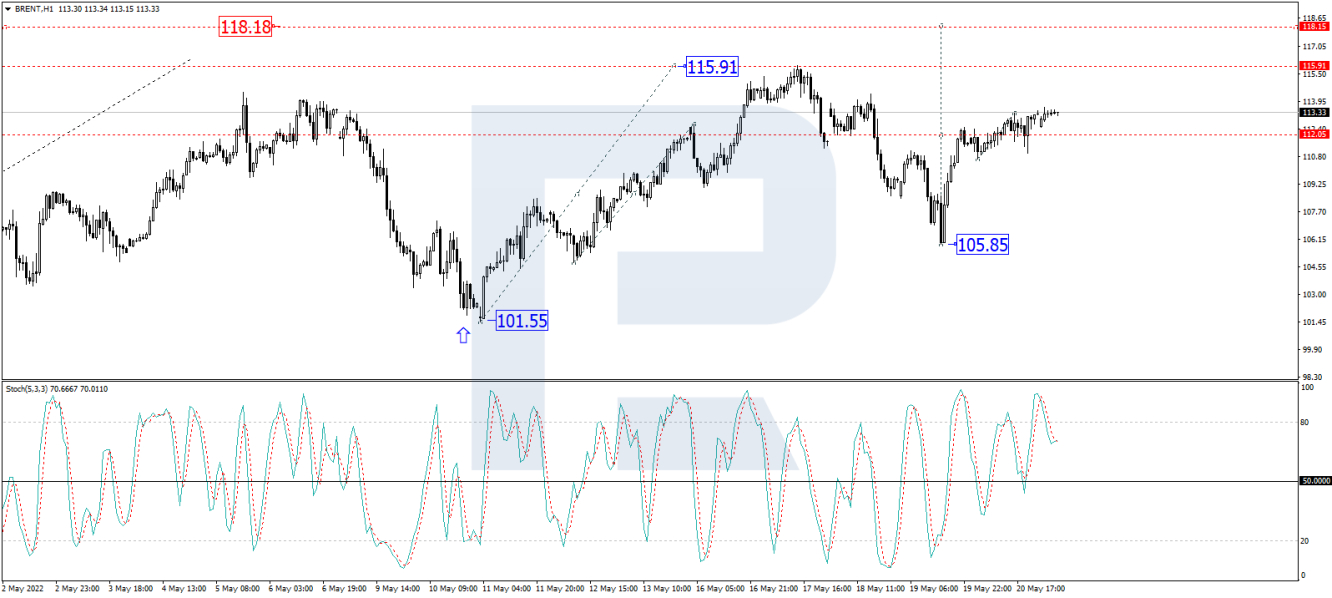

As we can see in the H1 chart, having rebounded from 105.85, reaching 112.00 and then forming a new consolidation range around the latter level, Brent has broken it to the upside. Possibly, the pair may continue trading upwards with the target at 118.18. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is moving above 50 and may later continue moving upwards and reach 80.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.