The Bankers Investment Trust (LON:BNKR) has continued to post good returns for investors during the financial year ended October 2021, which also saw the 55th consecutive year of dividend increase. Long tenured lead manager Alex Crooke oversees a team of in-house regional managers, allocating capital on the basis of where he sees attractive fundamentals. Over the past 12 months the allocation to European and Pacific ex-Japan equities has been increased on the basis of attractive valuations and the prospects for dividend growth. In addition, part of Crooke’s remit is to decide upon the level of gearing, which has risen on the back of new long-term structural borrowings secured in July 2021. The manager anticipates the recent spike in global inflation will moderate but is likely to persist at 2–4%, which he feels is supportive for long-term equity market returns.

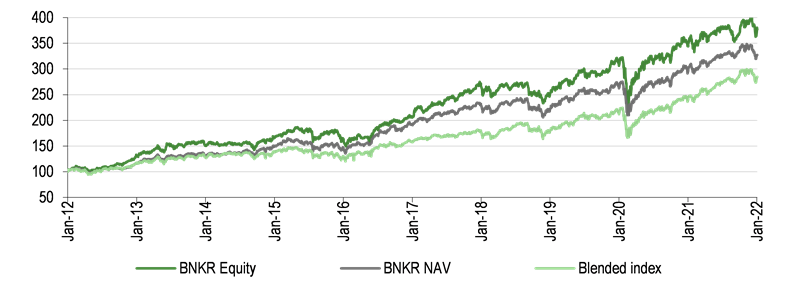

Long-term outperformance

Source: Refinitiv, Edison Investment Research. Note: Total returns in sterling.

Why invest in global equities now?

Crooke believes that the current inflationary pressures will ultimately moderate into a long-term 2–4% range with an associated move to a more normalised interest rate environment. In this central scenario, companies that are able to pass through higher input costs will maintain margins and consequently the aggregate positioning remains towards quality growth at the right price. Crooke and the regional managers are valuation conscious. While in aggregate global equities in terms of their consensus forward earnings are a little more expensive than their 10 year average, there are pockets of relative value such as UK and Japanese equities that in total account for around 30% of the fund.

The analyst’s view

BNKR is a diversified global equity portfolio that benefits from an experienced fund manager able to cherry pick the best ideas from a wide pool of well-regarded Janus Henderson fund managers. This gives him a much closer appreciation of the regional sleeves than in a conventional ‘manager of managers’ arrangement and keeps costs relatively low. Despite its very competitive fees (ongoing charges of 0.48% in FY21), with an active share of 80% it is far from an index tracker. Through Crooke’s steady hand, BNKR has been able to provide shareholders with good long-term returns and dividend growth substantially over and above inflation.

Fund objective

Over the long term, The Bankers Investment Trust (BNKR) aims to achieve capital growth in excess of the FTSE World Index and dividend growth greater than inflation, as measured by the UK Consumer Price Index, by investing in companies listed throughout the world.

Bull points

■ The experienced manager is well placed to manage this dual mandate portfolio.

■ One of the longest records of dividend growth in the sector.

■ Competitive fees.

Bear points

■ Continued UK bias sets BNKR at odds with the available opportunity set.

■ Reliance on JHI managers could restrict choice of styles and alpha generation.

■ Arguably still over-diversified at the stock level.

Click on the PDF below to read the full report: