The week promises a plethora of economic data, starting this morning with the ISM manufacturing data at 10 AM. This will be followed by Jay Powell participating in a roundtable discussion with Philly Fed President Patrick Harker at 11 AM ET. The week concludes with the September job report. Each day presents new data: JOLTS data on Tuesday, ADP and ISM services on Wednesday, and jobless claims on Thursday.

What Powell shares today will be pivotal. However, it’s hard to envision him deviating from the remarks at the Fed meeting approximately two weeks prior. This session will involve a Q&A with business leaders from the Philadelphia area.

Thus, price stability and labor imbalances will likely remain the subjects. NY Fed President John William’s speech on Friday, September 29, indicated that the Fed is nearing its peak policy rate, emphasizing that the rates might remain restrictive for a significant period. Some attribute this statement to Friday’s market sell-off. The bond market continues to grapple with this message. The more I hear the Fed discussing completion, the more I observe nominal rates and real yields rising. This could signal the market’s belief that rates are not adequately restrictive and that the market perceives the neutral rate as higher than the Fed’s estimation.

The bond market continues to grapple with this message. The more I hear the Fed discussing completion, the more I observe nominal rates and real yields rising. This could signal the market’s belief that rates are not adequately restrictive and that the market perceives the neutral rate as higher than the Fed’s estimation.

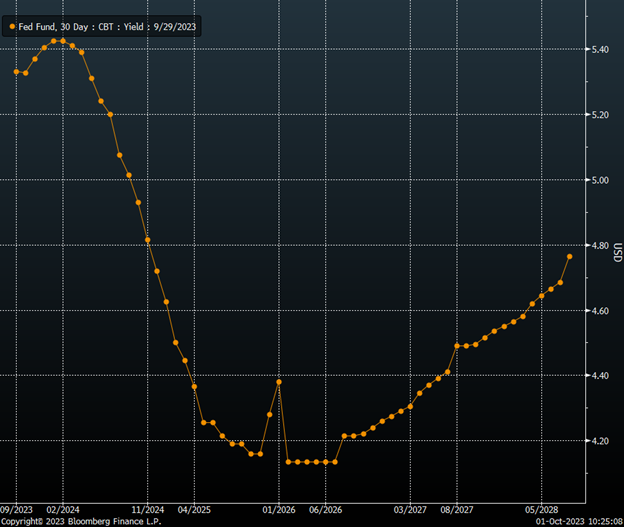

One only needs to examine the Fed Funds Futures curve to realize that the market doesn’t anticipate the Fed Funds rate dropping below 4.1% anytime up to August 2028, while the Fed projects the long-run rate at 2.5%.

This is likely why we’re observing a rise in the 30-year breakeven inflation rates. They have exceeded the average rate of the past three years and are on the verge of surpassing the one-standard deviation boundary. While some might attribute this to oil, it seems that this trend has been consistent since May, predating the recent surge in oil prices.

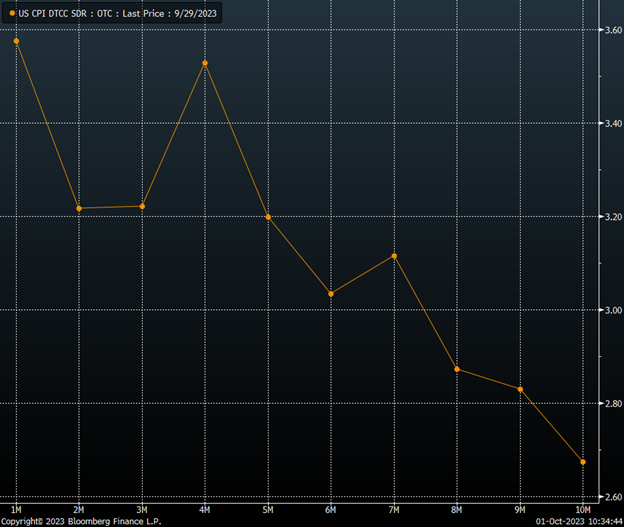

This might also explain why, as of Friday, the inflation swaps market was pricing in the CPI remaining above 3% from now until April of the following year and not dipping back to that June 2023 3.0% print until May 2024.

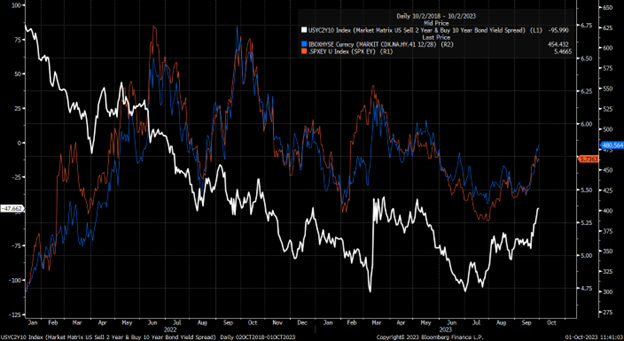

Considering this, it suggests that as the Fed becomes more cautious about raising rates on the shorter end of the curve, the longer end will likely increase, leading to a steeper Treasury curve. We’ve already seen this trend with the 2/10 spread rising as the 10-year yield catches up to the 2-year. Based on the yield curve’s technicals, it seems plausible that the 2/10 spread could adjust to around -35 to -25 bps from its present -47 bps. If the 2-year yield remains steady and the 10-year continues its ascent, the 10-year might increase by approximately 15 to 20 bps from its current 4.58%, settling in the vicinity of 4.75% to 4.8%.

The re-steepening of the yield curve appears to play a significant role in the stock market’s direction. Notably, the CDX high yield spread index has been moving in tandem with the 10-2 curve since June of 2022, and this correlation seems to have strengthened since March 2023. Concurrently, the earning yields of the S&P 500 have been tracking the CDX high yield spread for an even more extended period.

Moreover, the CDX HY index appears to have surpassed a crucial downtrend and has now climbed above significant resistance levels. This could potentially propel it further into the 500 to 525 range.

On the other hand, technical patterns indicate that the earnings yield of the S&P 500 is on an upward trajectory, moving from approximately 5.6% to a range of 5.85% to 5.9%. While this might not seem substantial at first glance, it equates to the PE ratio of the S&P 500 transitioning from 17.9 to 16.9. This represents a decrease of about 5.5% from the current value of the S&P 500.

One silver lining for the S&P 500 this week is that it has already seen declines for four consecutive weeks. It’s relatively rare for it to drop for five straight weeks. Given this, there’s a likelihood of some rebound this week.

The most evident target for such a bounce would be around the 4,400 mark, aligning with the gap from September 20th and coinciding with a 61.8% retracement level of the decline that began around the time of the Fed meeting. However, should the index breach the recent lows of 4,240, the subsequent potential level could be around 4,195.

MY Free YouTube Video: