European stock markets are a bit higher again today as oil prices slide back. Crude slipped lower, with WTI taking a $100 handle for a time, as the White House indicated it would release as much as 180m barrels from its Strategic Petroleum Reserve. It would be the largest ever release, the third in six months, and amount to almost two days of global oil demand. This is large enough to make a dent, but releases never alter longer-term imbalances. US stock markets gave back a bit yesterday with the S&P 500 down 0.63% and the NASDAQ down 1.21%. Asian indices were mainly lower as Chinese output data disappointed, with the China NBS manufacturing PMI falling to 49.5 and non-manufacturing dropped to 48.4. UK Q4 GDP was revised higher but counts for little now so much has changed. US PCE inflation data is due later, whilst OPEC is expected to confirm sticking to +400,000 bpd monthly increases in output.

A scary quarter is nearly over. The FTSE 100 is on to finish this rollercoaster quarter up almost 3%, well ahead of peers. The DAX is on course to end the quarter down by more than 7%, whilst the S&P 500 is around 3.5% lower YTD, but 12% above its Feb low. The Nasdaq Composite down almost 8%, as tech has taken a bruising from rising rates and a pricking of the bubble, albeit the rally off the recent lows has been remarkable. Small caps have slightly outperformed, down almost 7%, but still a weak performance as rising rates exposes the zombies. Chinese stocks have endured a bruising quarter, with the Shenzhen Composite –18% and China A50 –12%. Russian equities have obviously been the hardest hit over the first quarter. Elsewhere, bonds have had their worst quarter in many years, as has the yen, whilst commodities have enjoyed one of the biggest-ever recorded gains. BofA says commodities are on for their best year since 1915, government bonds on course for their worst year since 1949.

Yesterday I read a speech by ECB head Christine Lagarde. I wouldn’t recommend it. In it she lays all the blame for inflation at the door of the war in Ukraine. For example, this is just plain obfuscation of the facts: “The economic impact of the war is best captured by what economists call a “supply shock”, which is a shock that simultaneously pushes up inflation and reduces growth … How much inflation rises and growth slows will ultimately hinge on how the conflict and sanctions evolve.”

The supply shock and demand imbalance was already there prior to the war as a result of bad Covid policies that were made worse by not rescinding them swiftly enough – indeed barely has the ECB done anything except signal it will wind up asset purchases this year. Meanwhile they, the ECB cronies, are still pouring fuel onto the fire by buying bonds and rates are still negative. On what planet can she make statements like this and be taken seriously:

“First, optionality means that we are prepared to react to a range of scenarios, and the course we take will depend on the incoming data … Second, gradualism means that we will move carefully and adjust our policy as we receive feedback on our actions. Any adjustments to the key ECB interest rates will take place some time after the end of our net purchases under the APP and will be gradual.”

So, the ECB plans to do ‘whatever it takes’ but ‘gradualism’ will apply to ensure ‘optionality’...utter nonsense. There is only one course of action, and it needs to be done yesterday. Capital Economics thinks the ECB is waking up to the danger: “Our new forecast is for three 25bp rate hikes this year and five next, bringing the deposit rate to 1.5% by end-2023.”

Meanwhile, German inflation is going through the roof, rising to its highest since 1981, and Berlin is implementing emergency energy policies to stem demand for gas. German CPI rose to 7.3% in March, against expectations of 6.2%, and up from 5.1% in Feb. Talk is that Ms. Lagarde could be shuffled out by September…

There was also a speech by Ben Broadbent, deputy governor of the Bank of England, who said there is value in forward guidance as long as it’s clear. Communication from the Bank of England has been anything but clear lately. I hope this presages a change.

Meanwhile, reports indicate Fed officials are becoming concerned about a wage price spiral – the exact thing several weeks ago they said they saw no evidence of. But it’s exactly what we were warning about; it’s the natural order once inflation expectations become unhinged. After the Dec payrolls report I said: “Now at the point where the narrative goes from transitory > supply side problems > demand/wage spiral.” JPMorgan : “We are now replacing our expectations for 25 basis point hikes in May and June with 50 basis point moves, reverting to 25 basis point hikes in July and thereafter.”

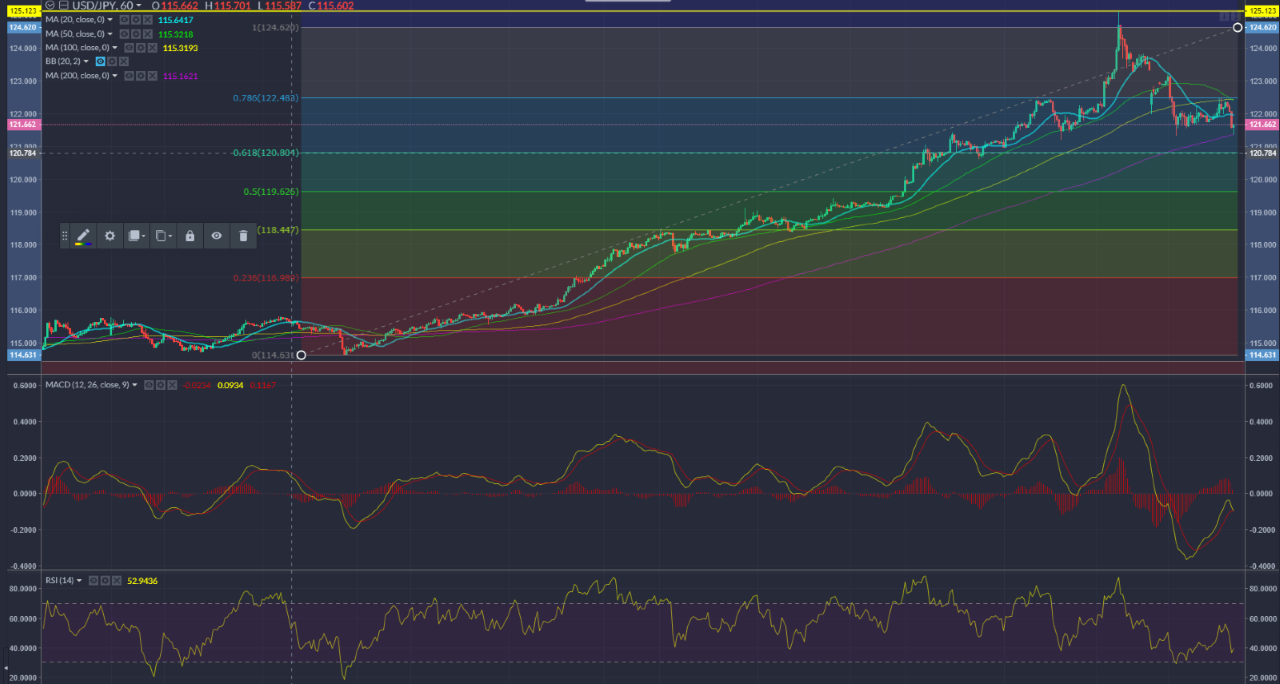

In FX, USD/JPY bounced a 1.2130 and then retested this area again this morning, where it coincides with the 200-hour SMA.

EUR/USD maintains momentum to upside, but encounters resistance at 50-day SMA.