Whoops...Tesla (NASDAQ:TSLA) shares plunged 12% on very high volumes as investors worried that Elon Musk would be forced to sell down a tonne of his stock to finance the $21bn cash element of his Twitter (NYSE:TWTR) purchase. Twitter shares also fell nearly 4% to under $49.68, about 10% below the offer price. Whilst this was against a backdrop of broad-based tech selling with the Nasdaq down almost 4%, it underscores that investors are naturally anxious about what Musk is up to and whether he can pull it off. For now, he is said to be in talks with other investors about helping to stump up the requisite $21bn...but as I asked yesterday: who’s going to hand over, say conservatively, $200m for a stake in a private company with free cash that won’t even cover the interest on the buyout? Could Musk’s ultimate plan be to re-float Twitter a year from now, the offer sprinkled with a touch of Musk-y stardust – a new WallStreetBets/cult type stock? I don’t know the answer to this question, but it’s interesting to think about what might be going on. Could he still walk away? Certainly, a $21bn cheque is a lot even for him to write. A $1bn break fee might in the end seem less painful. Is it all a ploy to get rid of more Tesla stock at these still lofty – albeit not ATH lofty – levels without attracting criticism? Sell the TSLA now saying it’s for Twitter purchase then find a due diligence type reason further down the road to pull out? I don’t know. The amount of Tesla stock collateral MS is requiring for the other bit of the purchase is revealing too since it indicates that corporate financiers at the bank are maybe a touch more sceptical on the stock than their auto analyst, who has a price target of $1,300. Maybe Musk is already selling and that’s why it’s down…

Clearly, Tesla shareholders are a little peeved. Even with a cult stock, acolytes can get annoyed at stuff their dear leader might do. Like, say, the co-owner (Musk) of the business (Telsa) mortgaging a chunk of his holding to buy up a business (Twitter) that has nothing to do with making and selling cars or space rockets. Tesla shareholders get nothing from this except a CEO with yet another distraction. Margin call price is at $571...at which point all manner of bad things will be happening. We are a long way from that level, but yesterday’s steep decline highlights the extreme leverage and therefore risk involved in this transaction.

Tech

European stock markets edged lower in early trade on Wednesday morning with a huge raft of corporate earnings in the mix along with the familiar concerns about tech earnings, inflation, interest rates, China’s lockdown slowdown, and the war in Ukraine. Gold is steady at $1,900, whilst US US oil is up at $102, back above its 20-day SMA.

Meanwhile, stocks took a beating yesterday on chiefly a round of tech fears. The Nasdaq 100 dropped 4% to its lowest close since December 2020. The weighting of tech dragged heavily on the S&P 500, which declined by 2.8%, finishing below the key 4,200 support. With the Nasdaq taking out the lows from earlier in this cycle it’s clear we are still in a bear market, even if the S&P 500 is just about holding the line at the Fed/Mar lows for now. Whilst bear markets can be susceptible to very abrupt short-covering rallies like we saw in the second half of March, they nevertheless remain anchored in a drawdown mentality. Is megacap capitulation could be the last leg of the move lower? I don’t think there is confidence right now in renewed leadership...but with the declines there will be attempts to find entry points into some of these major names. Greedy bulls will try to move it up and then get whammed...the big boys are not on this one. Futures are up a touch this morning from the lows last night but still look pressured...look for the Vix to move ahead.

Alphabet (NASDAQ:GOOGL) added to worries as it reported a miss on both the top and bottom lines as YouTube numbers notably underwhelmed. The Google parent partly blamed Russia’s invasion of Ukraine...ok whatever, I guess if people are spending a bit less you can blame that on Putin...but as with inflation, the setup was all there before anyway. The worry is YT starts to go Facebook (NASDAQ:FB) as it loses eyeballs to TikTok. Traffic acquisition costs soared 23% - a key indicator that competition is heating up.

Earnings per share came in at $24.62, vs. $25.91 expected. Revenue was $68.01 billion, vs $68.11 billion. YouTube advertising revenue fell short at $6.87 billion vs the $7.51 billion expected. Overall, the revenue growth was 23%, down from 34% a year before. Shares fell 2.5% in after-hours trading, having slipped 3.6% in regular trade and down 18% YTD.

Whilst Alphabet’s earnings will undoubtedly add to concerns about megacap tech growth, Microsoft (NASDAQ:MSFT) was a lot more encouraging, beating expectations on both the top and bottom lines. EPS came in at $2.22 vs $2.19 expected on revenues of $49.36bn, vs $49.05 expected. CEO Satya Nadella also brushed aside macroeconomic concerns and boasted that in an inflationary environment, software is “the only deflationary thing”. Cloud growth remains key with total revenue growth at Azure and other cloud services up 46%. MSFT shares rose over 4% in the after-hours market.

Banks

Seven straight quarters of profit and the best results since 2014...it cannot be Deutsche Bank (NYSE:DB)?! But it is. Shares, however, fell over 4% as the lender warned of increasing cost pressures – a big theme from the Wall Street reporting season this quarter. Credit loss provisions rose and CET 1 ratio declined to 12.8% from 13.7% a year before. The new DB, Credit Suisse (SIX:CSGN), posted a loss of $444m as revenues fell 42%...it’s earning its Debit Suisse moniker with the third profit warning since the Archegos/Greensill fiascos.

Lloyds (LON:LLOY) rose in early trade after reporting a 12% rise in revenue and a decent 26% pop in underlying profits before impairments to £2bn. Good loan and mortgage loan growth, good deposit inflows. Given the good performance, management raised a couple of forecasts: return on tangible equity now expected to be greater than 11 per cent, whilst bet interest margin is expected to be above 270 basis points.

FX

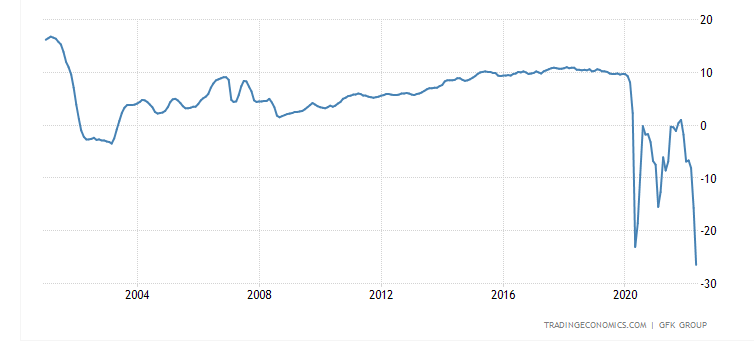

Theeuro sank to a fresh 5-year low against the dollar – market clearly believes the Fed is going to town on rate hikes and the ECB is going to sit on its hands and do nothing. Which I can’t really argue with since the ECB seems to have forgotten what symmetric monetary policy looks like. Does the ECB respond? It’s a pain in the backside for the central bank since not only is it weak against the dollar it’s actually still quite strong against a basket of other currencies...makes exports tough and inflation worse. Headache time....not enhanced by the fact that Russia is set to ban gas supplies to Poland and Bulgaria. Germany meanwhile is reported to be searching for an alternative to Russian oil ‘within days’. Meanwhile, German consumer morale has plunged to an historic low with the May GfK consumer sentiment report down to –26.5 from –15.7 last month. “The war in Ukraine and rates of high inflation have dealt a severe blow to consumer sentiment. This means that hopes of a recovery from the easing of pandemic-related restrictions have finally been dashed,” says Rolf Bürkl, GfK consumer expert.

Sterling is also under severe pressure with GBP/USD taking a 1.25 handle, dropping below the September 2020 lows to test the July 2020 lows. Three black crows on the daily candles is a headache for any bulls but the RSI is deeply oversold. Potential support eyed at the 61.8% retracement of the rally from the Covid low to last year’s cycle high.