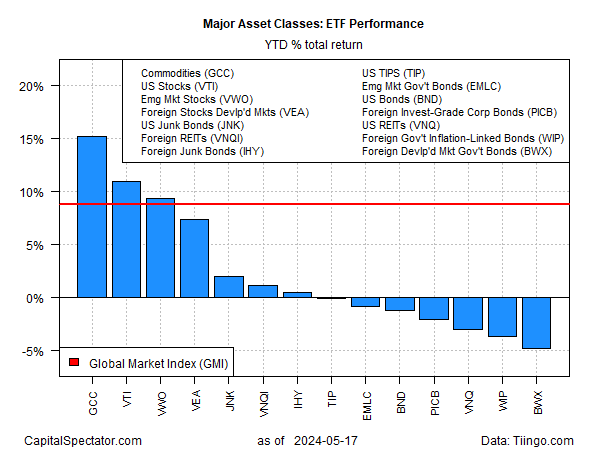

Last week’s strong rally in commodities expanded the performance lead for the asset class over the rest of global markets, based on a set of ETFs through Friday’s close (May 17).

WisdomTree Enhanced Commodity Strategy Fund (NYSE:GCC) (GCC) is up 15.4% this year, more than four percentage points above the year-to-date rise for US stocks (VTI), the second-best performer for the major asset classes in 2024 via an 11.0% increase.

Several bullish trends have helped drive key commodities prices higher recently. For example, copper, a key component in renewable energy, hit a record high in early trading today. Gold also traded at a new peak today, as concerns about government debt and inflation animate buying in this corner. Meanwhile, crude oil, although it’s fallen sharply since April, has stabilized this month.

Meanwhile, Bloomberg last week reports:

“Global grain supplies will be tighter in the coming season, setting the stage for higher prices for agricultural commodities as economies are still coping with stubborn inflation, according to a key US forecast.”

The big losers so far this year continue to be government bonds and US real estate investment trusts. The deepest year-to-date loss: sovereign bonds in developed markets ex-US (BWX) with a 4.8% decline in 2024.

The prospects of a rate cut by the Federal Reserve later this year has renewed hope that the worst is over for government fixed-income securities (bond prices and yields move inversely).

Thanks to encouraging US inflation news last week, Fed funds futures are now pricing in moderately confident odds that the central bank will trim its target rate at the Sep. 18 FOMC meeting.