Last week’s review of the macro market indicators which heading into the February Operations Expiration Week, saw the equity markets came in with a weak move lower and then consolidation and ended with a promise last Friday. Elsewhere gold (N:GLD) looked overdone to the upside and ready for a pullback while crude oil (N:USO) bounced in the downtrend.

The US Dollar Index (N:UUP) had short term strength in the downturn while US Treasuries (N:TLT) might be overdone to the upside and ready to pullback. The Shanghai Composite (N:ASHR) was back after a week off and looked to consolidate while Emerging Markets (N:EEM) consolidated in their downtrend. Volatility (N:VXX) looked to remain elevated keeping the bias lower for the equity index ETFs N:SPY, N:IWM and O:QQQ. Their charts showed possible reversals higher in the downtrend in the short run, but intermediate weakness remained.

The week played out with gold pulling back but finding support and rebounding while crude oil continued higher but then gave some ground back Friday. The US dollar moved slightly higher while Treasuries continued lower but found support and bounced into the weekend. The Shanghai Composite found some strength after a week off while Emerging Markets moved higher.

Volatility melted lower all week but remained elevated. The Equity Index ETFs all started the week well then consolidated at the end of the week, leaving some open gaps below. The positive moves have yet to make a higher high though and break 2016 ranges. What does this mean for the coming week? Lets look at some charts.

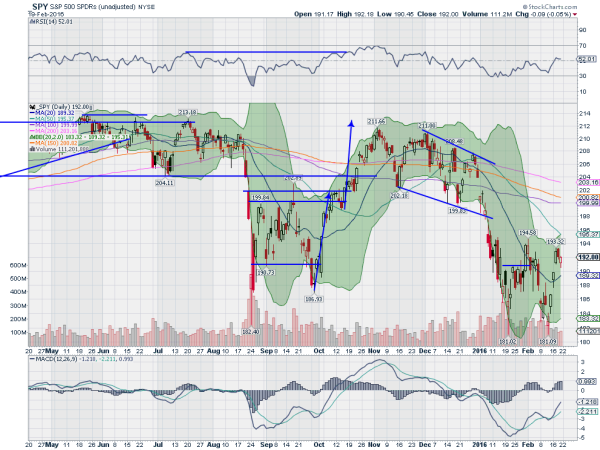

SPY Daily

The SPY started the week with a second gap higher in a smaller candle Tuesday, followed by another gap Wednesday. This made 3 gapping candles, an Ad Block, often a sign of exhaustion of a trend. The trend did die off with a stall Thursday in a Dark Cloud Cover candle that confirmed lower Friday. This made for a lower high in the wide range since the early 2016 drop.

The Bollinger Bands® are tipping higher though, which will make many look at the Hollow Red Candle Friday, with its intraday strength, a bit longer. The RSI on the daily chart has moved above the mid line, where some would call it bullish, but I like to see a move over 60 for this. The MACD is rising but still short of being positive. Signs of promise for the upside but not strength. The weekly chart shows a strong candle higher confirming a Hammer from last week. But all the action is still in a range.

The RSI on this timeframe remains in the bearish zone with the MACD falling, but possibly turning flat. More consolidation at support than any real strength or weakness. There is resistance above at 194.50 and 196 followed by 198.50. Support lower comes at 191.50 and 189.50 followed by 188 and 187 before 184.60. Consolidation with a Short Term Bias Higher in the Down Move.

SPY Weekly

Moving past February Options Expiration the equity markets showed some strength in the week but also a need for more upside before starting to talk about a reversal. Elsewhere look for gold to consolidate in its recent uptrend while crude oil turns lower in the consolidation zone in its downtrend. The US dollar index looks better to the downside in its broad consolidation while US Treasuries are biased lower short term in the uptrend.

The Shanghai Composite looks to continue the slow move higher in the downtrend and Emerging Markets look to consolidate their move up in their downtrend. Volatility looks to remain elevated but biased to the downside starting to ease the bias lower for the equity index ETFs SPY, IWM and QQQ. Their charts all show short term digestion of the large moves higher and possible exhaustion short term, which could resume the downward path. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.