There is a big obsession about the Fed being done raising rates. If you listened to the press conference, it would seem that the risk is that they are not done, and the problematic part is that they seem to be entirely data-dependent at this point, with really no plan or course of action. Powell made it fairly clear they aren’t even confident that rates are sufficiently restrictive at this point.

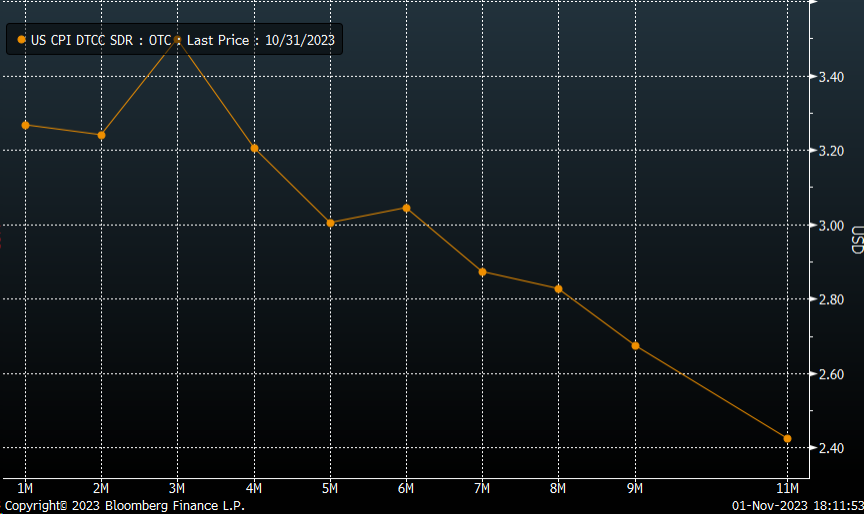

If the Fed isn’t sure if the policy is tight enough, then it would seem the odds favor the Fed overstaying their welcome or overtightening. Because, at this point, the market still sees rates staying above 3% on headline CPI for the next six months.

Based on that, there will be no rate cuts coming anytime soon, and higher rates and tighter financial conditions will need to be persistent before they can be substituted for monetary policy. One or two months of high rates on the back of the curve will not substitute for monetary policy.

His voice may have been soft, but nothing was soft about what was said. The market’s positive reaction had everything to do with Vanna and implied volatility melting, then what Powell said. It is the same thing that happens at every meeting. Granted, yesterday’s IV crush came a bit later, but that is all I think that rally was, as we see from time to time, very visible when looking at the VIX 1-Day.

S&P 500 Approaches Another Resistance as Volatility Eases Further

The S&P 500 Index has done a good job of powering through some intense Fibonacci levels that could easily be marked turning points, which leaves us with the next level of resistance, around 4,250. That is the gap fill from October 25, and a spot that served as resistance for a few days back around October 20, and we were very close yesterday as well.

Perhaps more importantly, it is the 200-day moving average, which we hit at the high of the day and then backed off. This region will be much more difficult for the index to get through, I think.

The rally has used a lot of energy, with the VIX moving from 21.3 on Friday to 16.85. On October 16, when the VIX was last at 17.20, the S&P 500 was 4,373. So we have certainly rebounded, but the S&P 500 is about 135 points lower. So, it may take the VIX to return to 15 to get the index back to the region of 4,400.

US Dollar Continues to Consolidate

Meanwhile, the dollar was flat on the day and continues to consolidate. It looks like a bull flag on the dollar, and that would mean that the dollar index goes higher. But that means that the data will have to support the dollar moving higher, and there will be plenty of data coming the rest of this week to support this potentially.

US 10-Year Rates Set to Retrace Lower

I believed the 10-year was heading higher, but yesterday certainly didn’t help. The Treasury refunding didn’t help, the ISM data didn’t help, and that was enough to push rates lower, so I think there was a lot of positioning and covering going on.

When Powell didn’t give the bond bears anything else, the shorts appeared to be covering. My nice bull flag pattern is certainly in doubt at this point, and if rates don’t rise today, it will probably mean we retrace back to around 4.6%.

It is also important to remember there have been no auctions this week.

AMD Stock Rebounds Strongly

After hours, AMD (NASDAQ:AMD) initially went down by around 4% yesterday. Then, on the earnings call, they went on to talk about their AI chip, and the stock rallied 10%. At least for them, the stock held $94.

The next couple of days should be interesting.