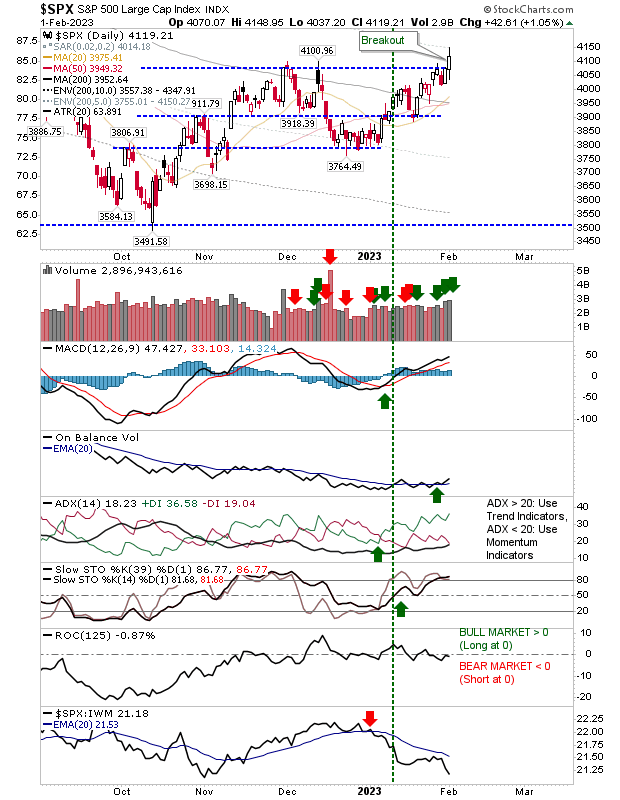

Buyers returned after the brief visit of potential bull traps across indices. Yesterday's action delivered the breakouts and today's should be the icing on the cake. The one index which did break yesterday was the S&P 500.

The S&P 500 breakout followed two days of buying on higher volume accumulation. The concern is the expanding relative underperformance to peer indices, but the chart breakout looks good and support at 4,000 should be good for measuring risk:reward. There is also going to be a "golden cross" between 50-day and 200-day MAs over the next couple of days.

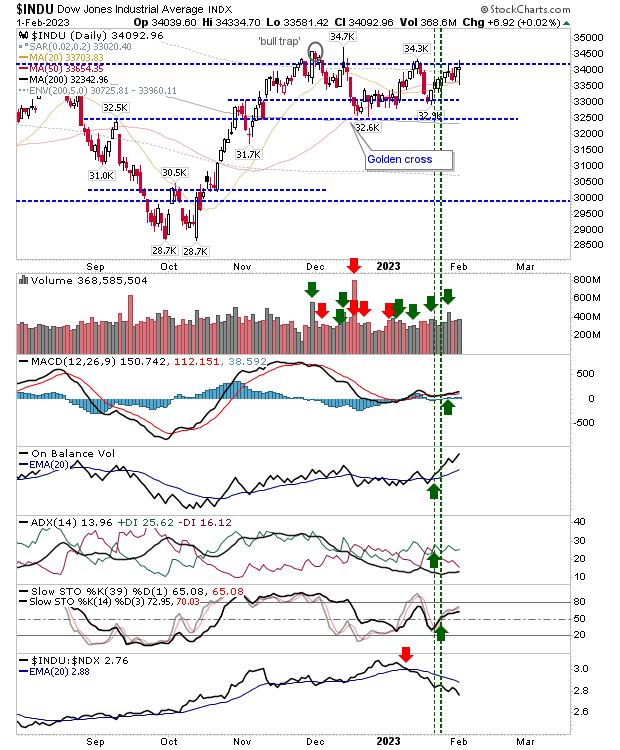

Just to give it a mention, the Dow Jones Industrial Average has stalled out below resistance. It had looked like a leading index but other indices have stolen its thunder. Like the S&P, it suffers relative underperformance to peer indices - but supporting technicals are net bullish.

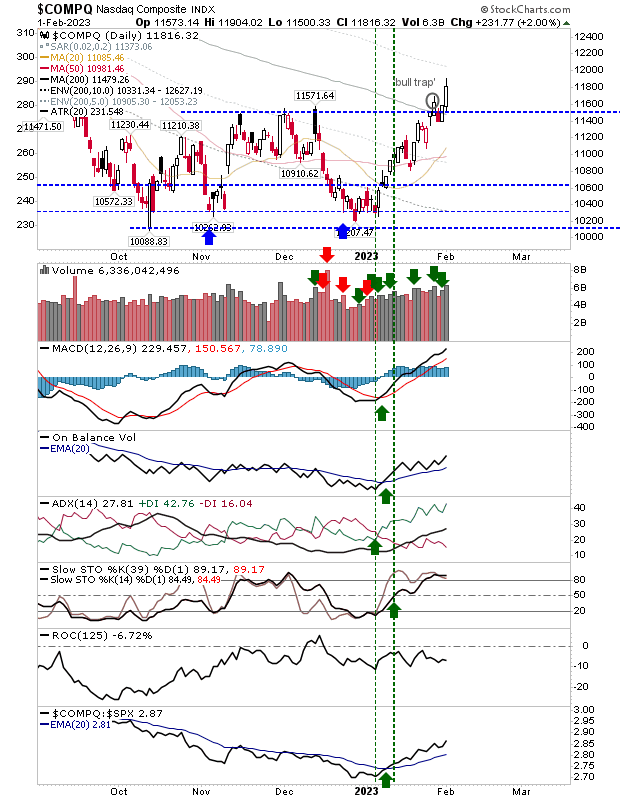

The Nasdaq clocked in with a 2% gain on higher volume accumulation. The index is outperforming peer indices and has negated the 'bull trap'. Add to that, a push through its 200-day MA, to leave the index in good shape to build a right-hand-side base to 2021 high.

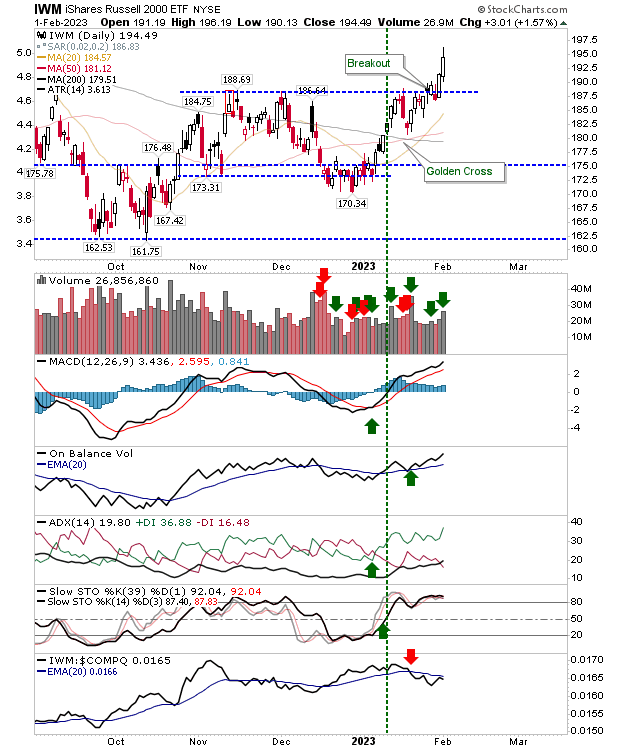

The Russell 2000 (IWM) reversed its bull trap' yesterday, so today was just icing on the cake. Volume climbed to register as accumulation, although it's underperforming relative to the Nasdaq (but outperforming Large-Cap indices). Other technicals are net bullish.

The gains over the last two days give the bulls some wiggle room. Breakout support for all indices is again in play - along with moving averages, not just the 200-day MA, but 20-day and 50-day MAs too. However, we are only looking at the start of new right-hand bases, which in themselves can deliver solid gains.