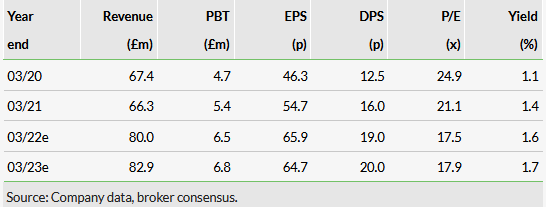

Solid State’s trading update this morning notes that the strong performance achieved in both the Systems and the Components divisions during H122 has been maintained so far during H2 despite continued supply chain disruption. Consensus FY22 and FY23 adjusted PBT estimates have both been raised by 10%.

- Price - 1,155p

- Market cap - £98m

Securing components to fulfil demand

At the interims in December, management noted potential for upside during H222, dependent on careful management of constraints due to supply chain challenges. In the event, the group has been able to secure scarce components and has not needed to delay some shipments into FY23, as had previously seemed likely. Moreover, Active Silicon, which the group acquired in March 2021, performed very strongly, reflecting demand for board level solutions for high-performance digital image capture, processing and transmission driven by increased automation. However, supply chain issues have meant that, as flagged at the interims, the group has absorbed cash in working capital as it has invested in inventory to mitigate the impact of component shortages and in some instances committed to longer order schedules to secure parts. Net cash (ex-IFRS leases and deferred consideration) has dropped from £3.3m at end September to £0.4m at end January 2022. The group has a £3.0m overdraft facility and a £7.5m revolving credit facility.

Record order book supports FY23 growth

The order book at the end of January 2022 reached a record £74.1m, ahead of £70.3m at end November 2021. The increase is partly attributable to two significant contract awards: a $2.1m order for radio frequency components from new customer CyanConnode and a multi-million-pound contract from BAE Systems (LON:BAES) to design, develop and qualify computer consoles for maritime platforms. The increase also reflects additional customers placing orders covering longer periods to address concerns about critical component availability.

Valuation: Shares close to highest level for five years

The shares are trading on a year one P/E multiple at a modest discount to the mean of our sample of specialist manufacturing companies (17.5x for Solid State versus 19.0x for peers) and a larger discount to the mean for our sample of value-added distributors (17.5x versus 31.4x).

Consensus estimates

Share price graph

Business description

Solid State is a specialist value-added component supplier and design-in manufacturer of computing, power and communications products. It supplies the commercial, industrial and military markets with durable components, assemblies and manufactured units for use in specialist and harsh environments.

Bull

■ Added-value design capability supports long-term relationships with customers and higher margins.

■ Core competences in computer, power and communications serve markets growing in response to central government funding priorities.

■ Active Silicon and Willow acquisitions enhance the group’s own-brand portfolio and strengthen international activities.

Bear

■ Revenue development dependent on OEM customers’ sales and marketing activity.

■ Potential programme delays because of global semiconductor supply chain issues remain.

■ Delays affecting high value-added manufacturing projects for government-funded and major infrastructure programmes are commonplace.