RTW Venture Fund (LON:RTW) (RTWVF) is managed by healthcare specialist RTW Investments (RTW), which was founded in 2009 by Dr Roderick Wong. It has an innovative approach, focusing on attractive individual assets rather than on companies, so it engages across the corporate lifecycle, from business formations through to investing in much larger listed biotech and medtech companies. RTW is focused on identifying and developing next-generation therapies to significantly improve patients’ lives. Since launch, RTWVF’s number of investments in private companies has accelerated and the manager is very excited by the global opportunities available.

Fund objective

RTW Venture Fund (RTWVF) was launched on 30 October 2019 and is focused on identifying transformative assets with high growth potential across the biopharmaceutical and medical technology sectors. The portfolio contains private as well as publicly listed companies. RTWVF’s performance is measured against an index of small-cap biotech stocks and the NASDAQ Biotechnology Index.

Bull points

- Full lifecycle approach to investment provides a wide opportunity set.

- RTW’s investment team has deep and growing industry expertise.

- RTWVF provides flexible financing options for its investee companies.

Bear points

- Biotech sector can be volatile.

- Key person risk. RTWVF is heavily reliant on RTW’s company founder and managing partner Roderick Wong.

- Concentration risk, with c 15% of the fund invested in Rocket Pharmaceuticals.

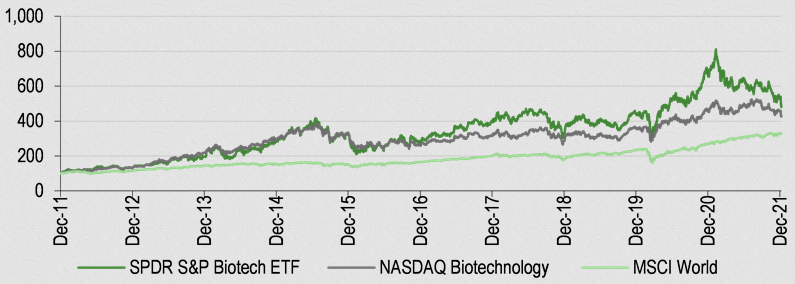

Despite periods of volatility, biotech stocks have outperformed the global equity market over the long term

Why invest in biotech now?

Fundamentals within the biotech industry remain favourable, with increased demand from a growing, ageing global population. There is a high level of innovation, and the regulatory environment remains accommodative, as evidenced by record numbers of novel drug approvals in the United States in recent years. Long-term investors in the biotech sector have been rewarded with above-average total returns. However, the sector can be volatile; during 2021 there was a sharp drawdown in smaller-cap biotech stocks in particular (as shown by the SPDR line in the graph above), which may point to an opportunity for risk-aware investors with a longer-term horizon.

The analyst’s view

RTWVF provides investors with broad exposure to the global biotech (c 85% of the fund) and medtech (c 15%) sectors. Since inception in late October 2019, the fund has outpaced the performance of both small- and large-cap biotech indices. Its approach of being science-based and a full lifecycle investor, including early-stage, means that the manager is constantly adding to its knowledge bank. RTWVF is prepared to build businesses around attractive assets and supports investee companies as they mature, via a range of financing options. Holdings in private companies are often maintained following their initial public offerings (IPOs) to ensure maximum value is realised, while RTWVF also invests in companies that are already public. RTW has announced it is setting up regional offices in the UK and Shanghai, which should broaden the fund’s opportunity set.

Click on the PDF below to read the full report: