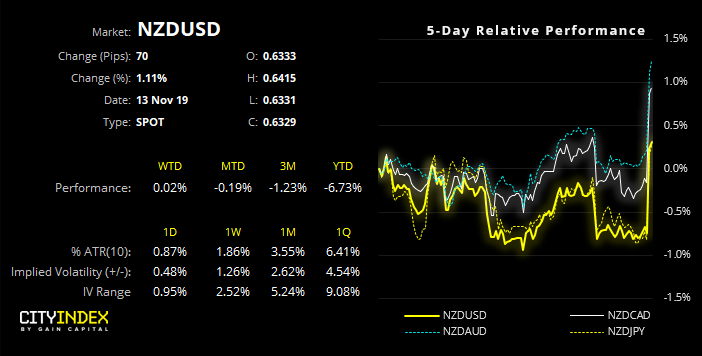

RBNZ held and refrained talking their currency down, seeing the Kiwi dollar spiked higher across the board.

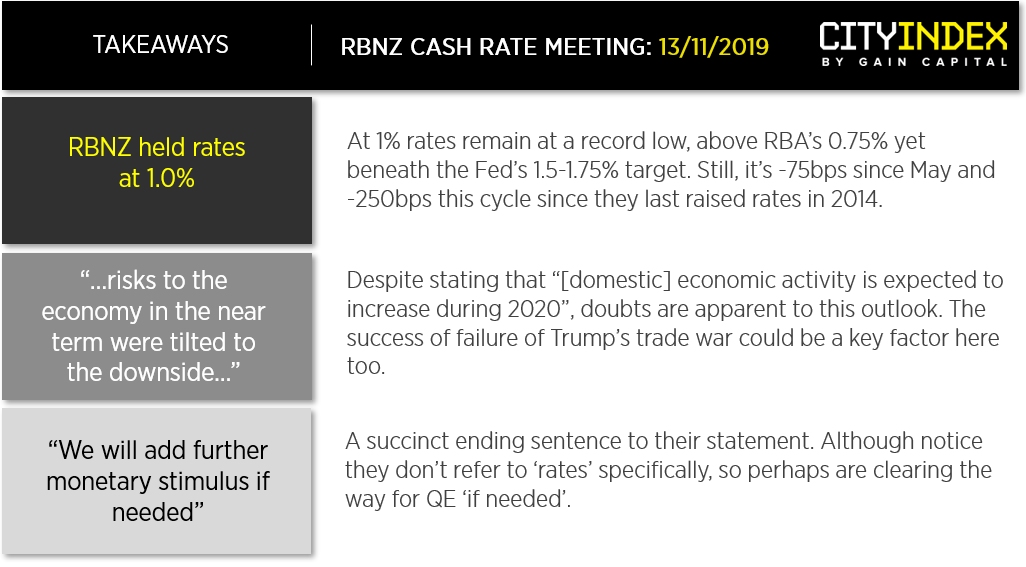

Official Cash Rate unchanged at 1 percent

Today’s hold caught markets and economists off guard. As of yesterday, 80% of economists polled expected a cut, and markets were pricing in >85% chance of a cut, following a weak read on inflation expectations from RBNZ’s own survey. On that note, whilst markets focussed on inflation expectations of 1-2 years ahead, the minutes state that “long-term inflation expectations remain anchored at close to the 2 percent target mid-point,” showing that, where CPI is concerned, they’re playing the long game.

Still, at -75bps over just five meetings, they could still be waiting for their actions to take effect on the economy. Furthermore, this means RBNZ has cut by -250bps since they last raised rates back in 2014 yet still have room to ease if they require.

However, the press conference was not dovish. During his speech, Adrian Orr stated, “we have the ability to observe the data, knowing we’re providing plenty of monetary stimuli” after providing a “significant cut in August.” He also added that QE is not a tool that is currently part of their bigger plan. So, unless data is to deteriorate notably from here, perhaps the low is in at 1%. By the end of the press conference, markets were pricing in just a ~6% chance of a cut over the next 1-3 months.

AUD/NZD: At the time of writing, it’s the most bearish session since September 2017. Its daily range has also expanded over 200% of its 10-day ATR and is just above key support, so there is potential for mean-reversion over the near-term. Yet, given its failure to break above 1.084 and the potential that RBNZ is to hold rates at 1% from here, AUD/NZD could be overbought and poised to break to new lows eventually.

Related analysis:RBNZ Expected To Cut Rates, Yet Their Degree Of Dovishness Is Key | NZD/USD, NZD/CAD

Rising Unemployment Weighs on NZD | NZD/USD, NZD/JPY, AUD/JPY

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis, and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."