In the final meeting of the year, RBA decided to keep rates on hold 0.75%, whilst keeping the door open for further cuts.

What made this meeting more interesting was that it followed on from Lowe’s (NYSE:LOW) highly anticipated speech last week, title “Unconventional Monetary Policy: Some Lessons From Overseas”. After all but ruling out negative rates and saying they were extraordinarily unlikely to happen, he clearly stated that QE would not occur until rates were at 0.25%. This leaves two -25b bps but on the table.

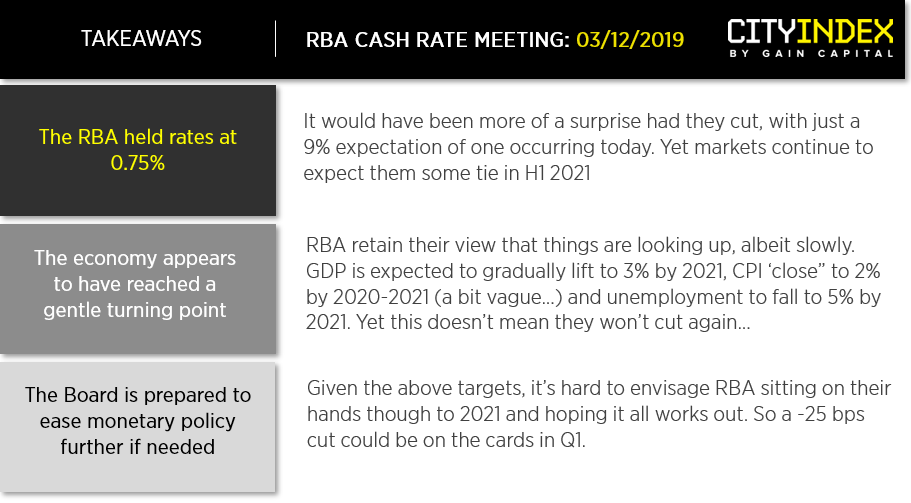

So today was all about if RBA were going to cut sooner or later in 2021, as expectations for a cut today were only around 9%. Upon first glance, the statement is its usual reserved format with talk of the ‘gentle turning point’ with the economy and expectations for growth, inflation and unemployment data to improve. Yet these weak targets, once compared with Dr Lowe’s (NYSE:LOW) comments that the RBA will implement QE if they’re not on track to meet their objectives over the medium-term, then we struggle to see how they’ll sit on their hands through most of next year. If anything, today’s statement reinforces the view that RBA could ease as early as Q1 2020.

Still, markets are bid the Aussie over the near-term which provides bullish opportunities, so long as tomorrow’s GDP data and Thursday’s retail sales allow. Yet there’s potential for GDP to hold up looking at today’s trade figures and provide another tailwind for AUD.

AUD/NZD is enjoying a very minor rally at the lows of an extended, bearish leg. Due to the lack of retracements and the fact that RSI reached its most oversold level this year, then a corrective bounce could be due. Yet we expect it to be short-lived, so remains a pair to consider fading into as this still could form new lows.

AUD/JPY finally burst above the resistance levels highlighted yesterday and appears set to challenge 75. Given that the bullish trendline held and we’ve now seen a solid breakout from compression, the cross could be headed for the highs around 75.50 is sentiment allows.

The bias remains bullish above the 74.25 low, whereas a break beneath here takes it back within the compression pattern and raises the risk of a reversal (and break of the bullish trendline).

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."