Stocks finished mostly lower on the day, with the S&P 500 dropping 19 bps and the NASDAQ 100 falling by 83 bps.

Today, we get PPI and Retail sales, and based on the VIX 1-Day, the market doesn’t seem as concerned, with the implied volatility gauge closing at 11.9 and well below the 19 levels seen ahead of the CPI print.

So, it seems unlikely that we see a volatility crush today.

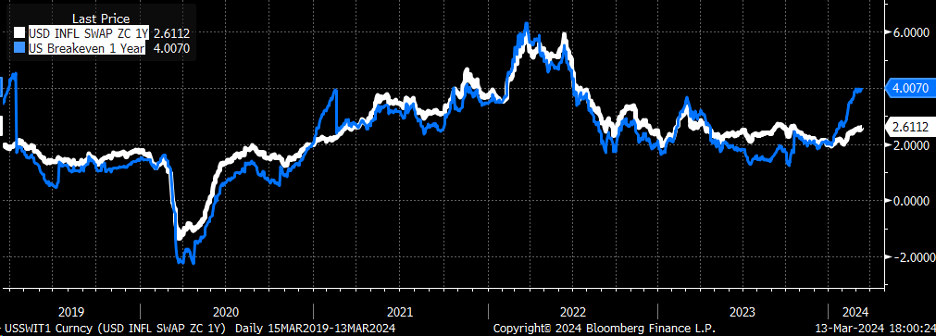

In the meantime, one-year inflation swaps closed yesterday at their highest levels since October 2023 (white line), and one-year breakevens (blue line) closed at their highest since the summer of 2022.

But yesterday was a big day for things like gasoline, which broke out and surged 3% above resistance and probably has room to run to around $2.70.

It was a big day for copper which rose almost 3.5% and appears to have broken out.

It is no wonder why inflation expectations are surging. The things that have helped suppress and tell the disinflationary tale are now coming back to life.

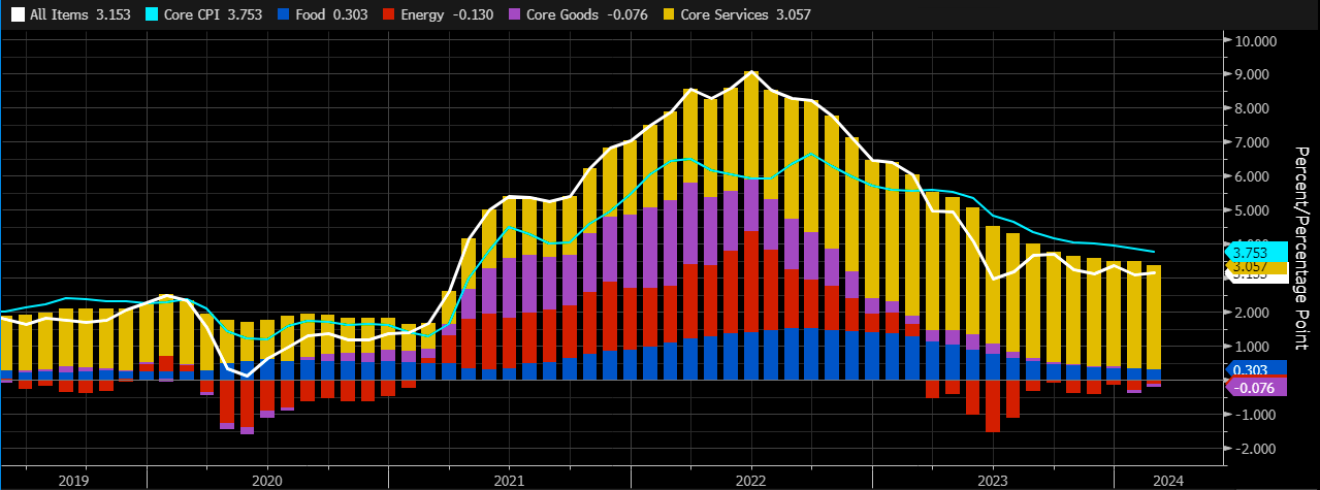

When you look at the CPI index, the only thing that is accounting for inflation is core services. Food, energy, and core goods are all non-existent.

But suddenly, this can start to look much different if oil, copper, and gasoline breaks and starts to pick up steam. I haven’t mentioned the shipping rate surge seen since the start of the year.

(Bloomberg)

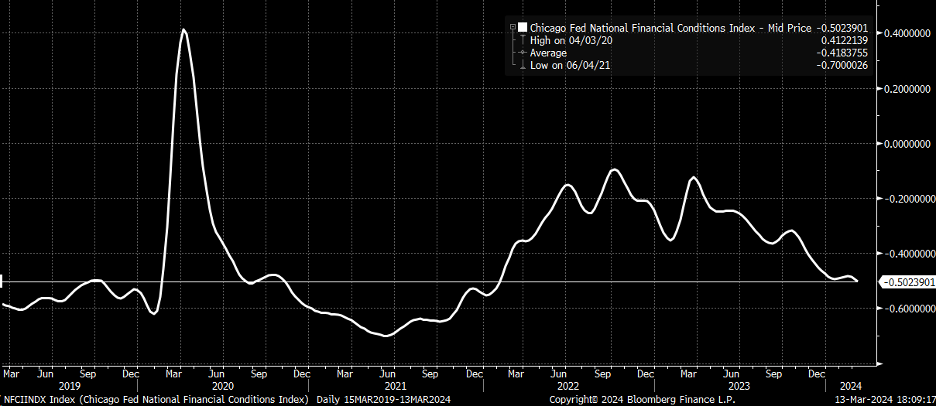

Why shouldn’t risk assets be rising? Financial conditions, as measured by the Chicago Fed, are in the same spot as they were in February 2022, before the Fed Funds rate was 535 bps lower, and the balance sheet was more than $1 trillion larger.

At the end of the day, stocks are risk assets, and you know what: copper, gasoline, and oil are risk assets.

So why should stocks go higher and other risk assets not go higher? This is the same reason that gold is going higher. They are saying the same thing: financial conditions are too easy, and inflation is now at risk of coming back.

The only good news is that rates are slowly waking up to the idea that rate cuts may not manifest this year as this inflation risk is starting to build.

Yesterday, we had 10-year rates move back above the 4.19% level, which potentially opens the door for a rise back to the 4.35% region if the data today is supportive.

That’s it.