By Benjamin Schroeder

10Y Bunds got pushed back to 2.2% but still struggled to move past that hurdle despite a heavy supply slate. The same goes for the 10Y UST at 4% ahead of tomorrow’s potentially more market-moving US CPI data. Meanwhile, markets accounting for tail risk scenarios in their pricing can imply too loose financial conditions – tempting central banks to hold longer

Markets Accounting for Less Benign Scenarios in Their Pricing

There was little in terms of data for markets to work on as we await tomorrow’s US CPI release.

Benign inflation outcomes have indeed been a main driver in terms of rate cut expectations, so sensitivity to the upcoming data looks likely. But we should also note that market pricing does not reflect an expected baseline scenario – which is still more about a soft landing – but rather a probability-weighted average outcome. And downside tail risks have been the key to lower market rates – think for instance of concerns around delinquencies in consumer loans or commercial real estate which could again send jitters through the US banking system, especially for smaller banks. The Federal Reserve's Michael Barr indicated last night that the emergency Bank Term Funding Program might not be expanded beyond its 11 March expiry date, which only adds to the uncertainty.

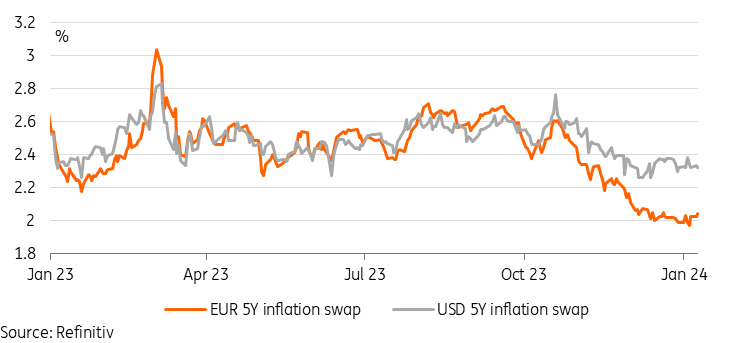

Benign Inflation Has Helped Drive Rate Cut Expectations, But It's Not The Entire Story

Means Rates Are Likely Too Accommodative, Only Tempting Central Banks to Hold Long

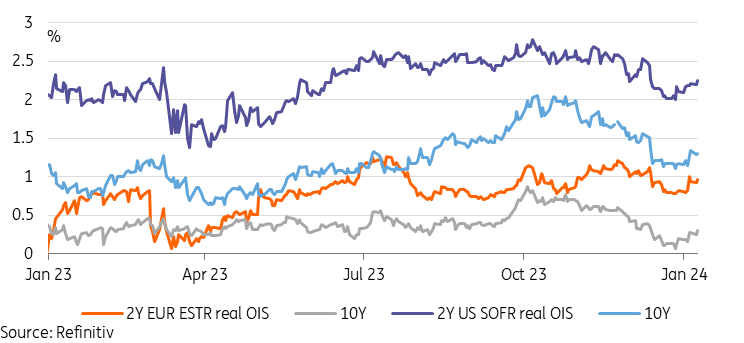

While these possible outcomes must be accounted for in pricing, it also means that market rates at current levels are probably too accommodative. A look at real interest rates also shows the 2Y US real OIS rate is still at its lowest level since early June. In the EUR space, real rates have been more range-bound, although longer tenors are closer to the bottom of last year’s range.

In the end, heightened uncertainty about the outlook manifesting itself in very inverted money market curves could have a bit of a self-fulfilling effect. If lower and more accommodative market rates persist, then central banks could be all the more tempted to keep key rates on hold for a little longer. Unless of course, a tail risk materialises in the meantime.

Pricing for Tail Risk Possibly Renders Effective Rates Too Accommodative

Today’s Events and Market View

The data calendar remains light, but it will get busier on the central bank communications front. The European Central Bank’s Isabel Schnabel participates in a live Q&A on Twitter, now X. Other appearances today are Vice President Luis de Guindos and Spain’s Pablo Hernandez de Cos. In the UK, Bank of England Governor Andrew Bailey testifies to parliament and in the US the Fed’s John Williams will speak on the economic outlook later in the day.

The primary market remains busy. In European government bonds, Spain has mandated a new 10yr benchmark, and we're expecting a new 10yr bond from Estonia. This comes on top of an already scheduled auction of a new 10Y Bund.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more