US market rates fell after the Federal Reserve decision but this looks more like a market positioning effect than anything specific from the meeting. Expect some retracement. Both the European Central Bank and Bank of England are likely to hike by 50bp today, but the undertones could be quite different

Net Stand-Alone Outcome From the Fed Meeting Is an Excuse for Market Rates to Push Higher

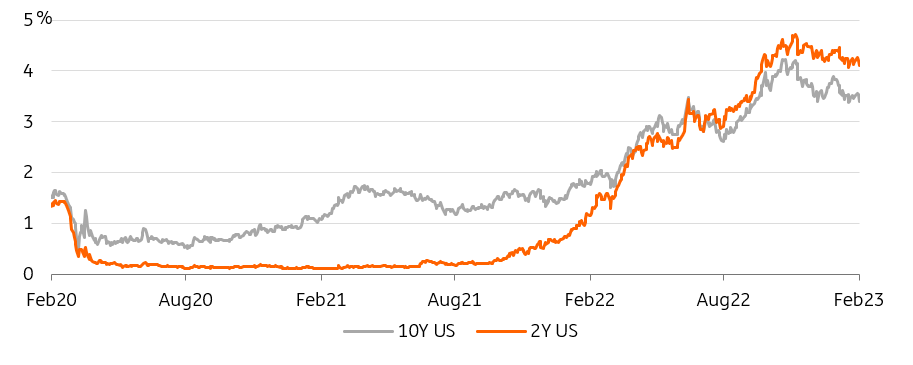

The initial impact was upwards pressure on rates – mostly at the front end – and mostly in the real rates space. This fitted with the market's reading that the Fed is not impressed enough yet with the reduction in inflation risks. But that was quickly reversed, and we doubt that the reversal will be sustained.

We probably need to see the payroll report (Friday) before we get the next big move. In the meantime, the market now knows that a March hike is on. That keeps the rate hiking pressure in the mindset over the rest of the first quarter. Whether or not the Fed's view stands at the May meeting won't be known until then, which means the hawkish tilt should be sustained at least till then.

A March hike is on. That keeps the rate hiking pressure in the mindset

While “over-hiking” can be good for the long end, this is also a higher carry cost associated with higher front-end rates, and that’s a bond negative in a static market. In other words, if you are long bonds and yields don’t fall, you’re in a negative mark-to-market position. That’s a partial argument for further compensatory upward pressure on market rates. The other argument comes from the shape of the curve, which remains remarkably inverted. In fact, it’s unprecedented (at least in the past four decades) for long-tenor market rates to be this far below the Fed funds rate, specifically while the Fed is still hiking.

The other key Fed rates have also been raised by the same amount, the full 25bp. That goes for the reverse repo facility (4.55%), the permanent repo facility (4.75%), and the rate on excess reserves (4.65%). This is all broadly as expected. And no special mention of the bond roll-off, which continues as was. There was no reference to outright bond selling either, but hard to believe this is not ever discussed; it’s just that it tends not to make the Fed minutes.

US Curve Inversion Means Negative Carry for Holders of Long-End Bonds

Source: Refinitiv, ING

ECB Meeting: A 50BP Hike and Guidance for More Plus QT Parameters

While headline inflation coming down is encouraging, the ECB has expressed a focus on core inflation as a measure of underlying price pressures. That remains stubbornly high, implying the ECB is not done with its job yet. Obviously, markets are thinking beyond the next meeting(s) and have already started to price in rate cuts for 2024. ECB officials have pushed back against this notion ahead of today’s policy decision, but with modest success. By the end of 2024, the market still sees the ECB bringing down rates by 90bp from their prospective peak this year. What we will be watching today in brief (full preview here):

- 50bp rate hike: Markets are firmly priced for a hike of the depo rate to 2.5% today, which is also our expectation.

- Rates guidance: The ECB decides on a meeting-by-meeting basis, but still provides a perspective for rates given prevailing conditions. This guidance should be the main focus today. In December the ECB signaled “rates will still have to rise significantly at a steady pace”, with President Christine Lagarde specifying in the press conference that one should expect rate increases “at a 50bp pace for a period of time”. The market largely agrees with our view of another 50bp in March, pricing in 94bp in total by then. Thereafter the pace slows, with a total of 153bp delivered by the July meeting, i.e. depo rate peaking at 3.5%.

- Quantitative tightening parameters: President Lagarde promised “detailed parameters for reducing APP holdings”. We would expect the ECB to follow a proportionate reduction across the different asset portfolios, and – with regards to the public sector – stick with the capital key split across jurisdictions. The ECB may think of shifting exposure towards supranational issuers in the context of “greening” the portfolio.

The ECB has no reason to dial down its hawkishness

We think that the ECB has no reason to dial down its hawkishness. Market rates are correctly set for the next few meetings, but we think the notion of rate cuts starting in 2024 could receive more pushback given the ECB's awareness that financial conditions are not just dictated by setting their key rate, but by rates along the entire curve. The risk is that any signs of dissent – which have been notably absent from official communication but surfaced in a “sources” story – could erode the impact of the ECB’s guidance on rates. That dissent may only show over the next couple of days, though.

BoE Meeting: 50bp Hike With a Dovish Feel

Our economists note that while the minutes of the December meeting appeared to open the door to a potential downshift to a 25bp move today, the reality is that the recent data has looked hawkish. Wage growth is still persistently high, and especially services inflation has come in above expectations. What we are watching in brief (for a full preview here):

- 50bp hike: We expect a 50bp hike today, but we think the decision is a closer call than the market pricing of 45bp suggests.

- Vote split: Our economist base case is that six of the nine policymakers will vote for a 50bp hike, one for 25bp, and two for no change.

- New forecasts: The growth outlook looks likely to be upgraded given calmer markets and scaled-back rate hike expectations since the mini-Budget crisis. For the medium-term story, one should keep an eye on the so-called ‘constant rate’ inflation forecasts. If these show inflation at, or very close to, 2% in a couple of years' time it would signal that the Bank Rate is close to its peak.

- Guidance: The BoE is more likely to keep its options open. Our economist expects the Bank to reiterate being prepared to act ‘forcefully’ in the future if required, but shy away from signaling a slowing of the pace in March.

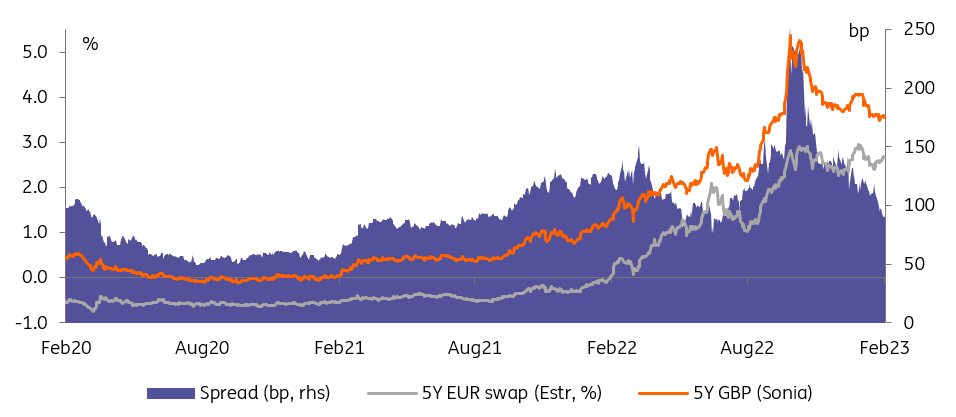

Markets still have a relatively hawkish take on the BoE

Markets have come around to our more benign view on the terminal rate in this cycle, now implying hikes will stop around 4.25%. Though relative to what we see in other currencies, markets still have a relatively hawkish take on the BoE further out the curve, pricing more elevated rates for longer. Even if the BoE hikes 50bp today, that persistence could be challenged given the overall relatively dovish spin we expect surrounding the hike, for example in the voting split or new forecast, but also given the more general dissent voiced by some BoE officials thus far.

We Expect More Convergence of Sterling and Euro Swap Rates After Today’s Central Bank Meetings

Today’s Events and Market View

The main highlights today are the ECB and BoE policy decisions. And while both central banks are expected to hike by 50bp, the undertones could be quite different. The ECB should continue to push a concerted hawkish line, while at the BoE we should see more signals of the peak in rates being close. We expect more convergence between EUR and Sterling rates, especially in the 5Y area pertaining more to the medium-term outlook. With regards to eurozone sovereign spreads we think the risks are still tilted towards wider spreads as the impact of quantitative tightening and potential shifts today are underappreciated.

Among the data releases, we will see the US initial jobless claims, though they are outweighed by tomorrow's jobs data for January. In the supply space, we will get bond auctions in Spain and France.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more