Want to invest like Warren Buffett, but aren’t sure where to begin? One solid starting point may be the most undervalued names in Buffett's Berkshire Hathaway (NYSE:BRKa) (NYSE:BRKb) portfolio - those whose share prices are far lower than what their financial metrics would indicate.

InvestingPro has you covered there with powerful tools that produce undervalued Buffett gems with one click. This week, our VIP Pro Picks highlights 4 stocks with plenty of upside potential and which take up a significant chunk of Buffett’s portfolio. And among these, Kraft Heinz (NASDAQ:KHC) looks particularly tempting at current levels.

Kraft Heinz is among the 10 most undervalued publicly traded stocks in Buffett’s portfolio based on InvestingPro’s fair value calculations, which blend multiple valuation models and several other metrics to size up where a company really should be priced. And Kraft Heinz - a longtime Buffett holding - still occupies a significant 3.9% of his portfolio, per the most recent disclosures, with the massive stake amounting to 34.5% of Kraft Heinz.

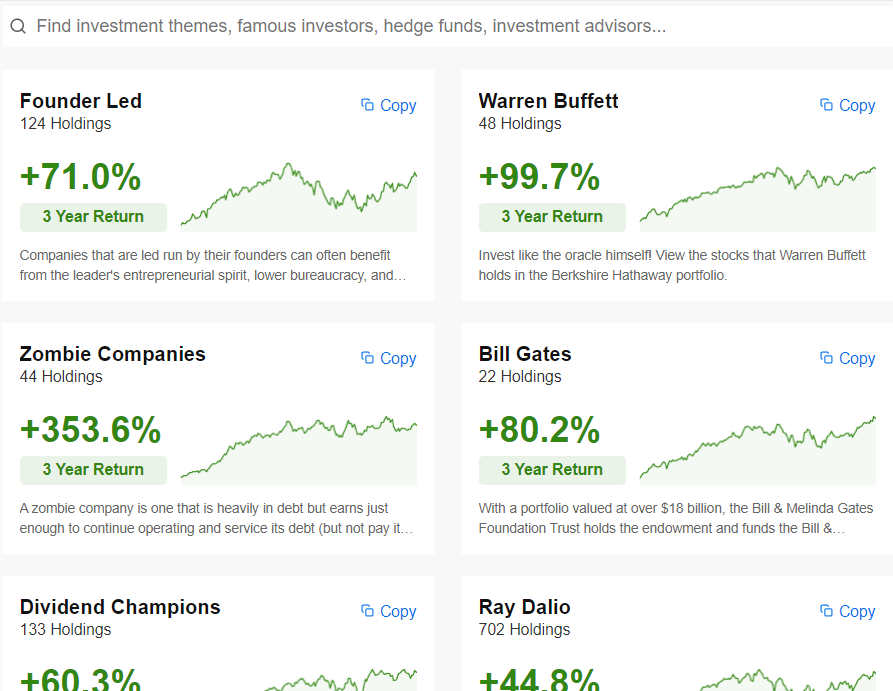

If you're an InvestingPro subscriber, you can click into the Ideas tab on your desktop and not only narrow things down by sector and theme, but also peer into the publicly traded holdings of a vast directory of portfolios: those of billionaires, hedge funds, activist traders, and other institutional investors.

Source: InvestingPro

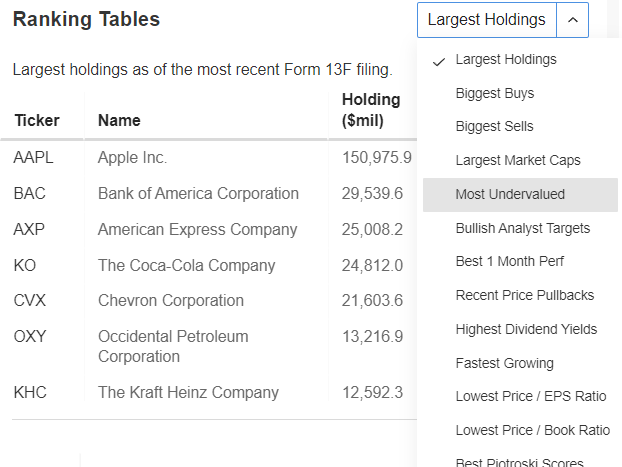

And once you’ve clicked into, say, Warren Buffett’s portfolio, you can use InvestingPro's tools to instantly pull up a wide variety of rankings (including a list of the largest holdings, as seen below).

Source: InvestingPro

And as far as those undervalued Buffett picks go, the Oracle of Omaha has firmly indicated that he’s in Kraft Heinz for the long haul. While the stock has lost ground so far for the year, its relative strength index (RSI) suggests it has actually been oversold. And at the same time, revenue growth has been accelerating as the company has maintained very healthy profit margins. Most impressively, Kraft Heinz has - like clockwork - surpassed analyst earnings estimates for the past 17 quarters straight.

Perhaps it comes as no surprise, then, that InvestingPro’s fair value calculations put Kraft Heinz upside at some 30% higher than where the stock is currently trading. The company’s forward price-to-earnings ratio currently comes to 12x, far cheaper than the average for its sector.

The food-and-beverage purveyor even pays a generous 4.6% dividend, so if you have the patience that Buffett is famous for, you’ll get paid while you wait for the shares to catch up with the company’s rich intrinsic value.

Want to see the full list of this week’s undervalued Buffett Pro Picks? Jump on the InvestingPro Summer Sale to unlock must-have insights and data. And while you’re here, dig into InvestingPro’s wealth of tools and screeners to begin building a lucrative portfolio.

If you're already an InvestingPro subscriber, this week's full Pro Picks list is available here.

Data as of June 29, 2023.