Premier African Minerals Ltd (LON:PREM), a key player in the mining sector, has had an eventful 2024. The company, which focuses on the exploration and development of mineral resources in Africa, has seen significant developments and faced various challenges this year. This analysis will provide an overview of the company's performance in 2024, including recent updates on its stock, and offer insights into what investors might expect moving forward.

Performance in 2024

Throughout 2024, Premier African Minerals Ltd has been actively involved in several promising projects. The company's flagship project, the Zulu Lithium and Tantalum Project in Zimbabwe, has been a focal point of its activities. This project holds substantial potential, with the company reporting positive drilling results earlier this year. On 15th March 2024, Mining Weekly highlighted that "the Zulu project is progressing well with promising drilling results, indicating a strong future for Premier African Minerals Ltd."

Despite these positive developments, the company has faced some hurdles. Market conditions and regulatory challenges in various African countries have impacted its operations. In April 2024, the Financial Times noted, "Regulatory and political challenges continue to pose significant risks for Premier African Minerals, potentially delaying project timelines."

Stock Performance

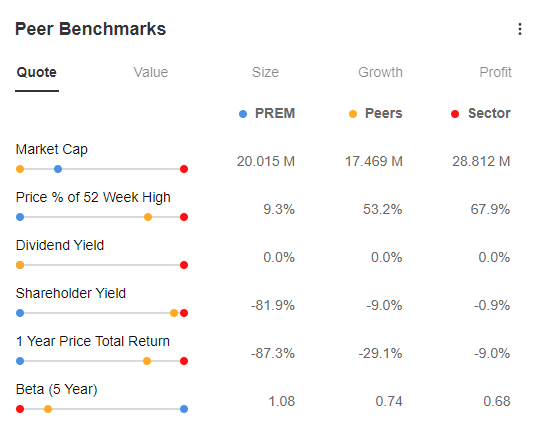

The stock of Premier African Minerals Ltd has experienced volatility in 2024. Starting the year at a modest price, it saw fluctuations due to market conditions and company-specific news. In July 2024, the stock experienced a notable increase following a series of positive announcements regarding the Zulu project. On 20th July 2024, Reuters reported, "Premier African Minerals Ltd saw a surge in its stock price by 15% after announcing significant progress in its Zulu project."

However, the overall market sentiment and external economic factors have also influenced the stock's performance. The ongoing global economic uncertainties have caused fluctuations, but analysts remain cautiously optimistic about the company's prospects.

Future Outlook

Looking ahead, Premier African Minerals Ltd has several factors that could drive its growth. The continued development of the Zulu Lithium and Tantalum Project remains a key priority. Successful advancement in this project could significantly enhance the company's value. Additionally, the company's efforts to diversify its portfolio by exploring other mineral resources in Africa could provide further growth opportunities.

Analysts have mixed views on the company's future. While some are optimistic about the potential returns from its projects, others caution about the risks associated with operating in politically unstable regions. The Guardian commented, "Premier African Minerals Ltd holds substantial potential, but investors should remain aware of the inherent risks in the mining sector, particularly in Africa."

Conclusion

Premier African Minerals Ltd has navigated a challenging yet promising 2024. With key projects showing potential and the stock responding positively to progress updates, the company is positioned for growth. However, regulatory challenges and market volatility remain significant factors to watch. Investors should keep a close eye on project developments and broader economic conditions as they consider the future prospects of Premier African Minerals Ltd.

Feel ready to dive into details and start finding interesting stocks to invest? Try our AI supported solution InvestingPro today!