Summary- Yellen and Draghi disappointed markets on Friday.

- The euro broke above technical resistance.

- Debt ceiling/unrest in D.C. is pushing up the euro to dangerous levels.

We are in a very weird time. Never has a new U.S. administration had to fight as much as Trump has had to in his first eight months in office. This fight, clearly being waged within Washington D.C. and not in the rest of the country, is creating turmoil that I feel will precipitate the next financial crisis.

The political narrative for the past six months has been the European Union surviving populist electoral challenges while the U.S. establishment fights back against a populist president. This is no different from the response in Europe in the wake of both Syriza’s victory in Greece and its response over the past fourteen months to Brexit.

It is clear the political establishment in both the EU and the U.S. have little regard for the wishes of their electorates. In Europe, the structure of the EU allows for this as policymakers are, for the most part, unelected.

In the U.S., on the other hand, we have degenerated into a kind of permanent political positioning for each election cycle. Campaigns never end; they just evolve tactically.

The convocation of central bankers in Jackson Hole, Wyo., this year produced nothing of note from the world’s two most powerful central bank heads. Neither ECB President Mario Draghi nor FOMC Chair Janet Yellen had anything to say on Friday that should have rocked the markets.

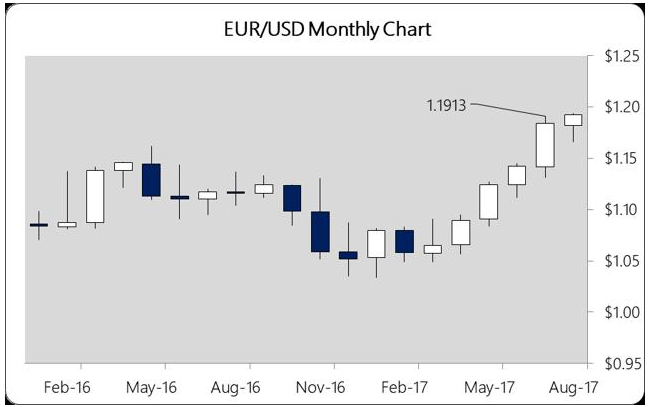

And yet, looking at the USDX (PowerShares DB US Dollar Bullish (NYSE:UUP)) and the euro (Guggenheim CurrencyShares Euro (NYSE:FXE)) we saw fireworks from a technical perspective. The close this past week at $1.1925 is significant across all major time frames – weekly, monthly, quarterly.

This close busted through the July high of $1.1913, ensuring a high probability setup of a further rally into September. Moreover, it did so after a three-week consolidation centered on $1.175, so, this isn’t any kind of blow-off move. In fact, it looks like the beginning of the next big up-leg in this counter-trend rally in the euro.

Relative Stability

And this is a further reflection of the political situation in Germany. For even though Chancellor Angela Merkel is encountering stronger opposition to her immigration policies, it hasn’t reached critical mass in the polls. Euroskeptic and anti-immigration Alternative for Germany (AfD), despite significant marginalization by the mainstream media in Germany, is polling at 10%.

Earlier in the year it secured local victories and out-polled Merkel’s CDU but since then AfD’s numbers have fallen off. While they will likely enter the German parliament for the first time, if the polls are accurate (which is never a good bet) Merkel will be able to rule with a relatively stable coalition as she’s done for the past three terms.

During times of political upheaval it is not uncommon for people to vote for the devil they know rather than register a protest vote. Merkel’s tough stance on Brexit negotiations, Poland’s intransigence on taking in refugees and, perversely, the slings and arrows the German Chancellor has taken from President Trump have all likely played a factor in her high poll numbers.

This, and marginally improving economic numbers, have put a bid under the euro that has become almost a panic buying situation.

By contrast, the situation in Washington D.C. continues to deteriorate, at least publicly. And now with the U.S. approaching the debt ceiling limit, the possibility is high for all manner of craziness. Zerohedge published a commentary from Deutsche Bank on the situation which spells out all manner of doomsday scenarios.

But aside from dollar selling/euro buying the market has been quiet about this. This is likely because no matter how bad things get during the negotiation stage the debt ceiling always gets raised.

The markets, however, are trading like it won’t and as we head into September it’s more than likely current trends will continue.

The Bigger Picture

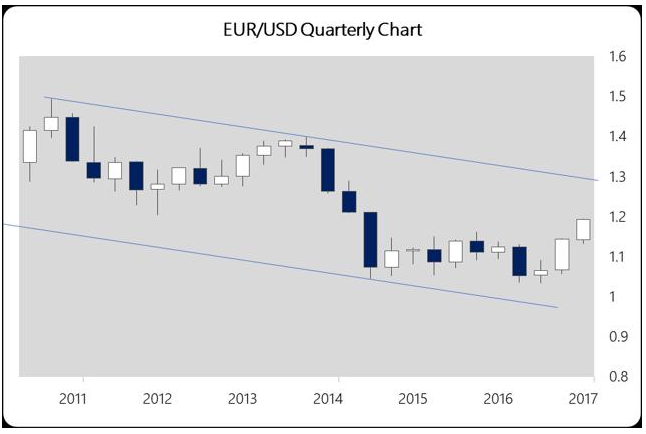

When I back out and look at things from the quarterly perspective the strength of this move becomes clearer.

If these levels hold through September’s close we’re definitely looking at a euro rally that could top out near $1.30 early in 2018. Having just cleared the two years of bottom bouncing after the Swiss de-pegged the franc (Guggenheim CurrencyShares Swiss Franc (NYSE:FXF)) back in 2014, this huge move in the euro should be concerning for all Europe bulls.

It was the overly strong euro that precipitated the previous rounds of sovereign debt problems. Today the financial conditions are far worse and this is why Draghi refuses to commit to ending his asset purchase programs. He knows the markets cannot sustain higher yields at this point and if he keeps signaling he’s a buyer, he’s hoping everyone else will continue to front-run him.

In effect, he is the buyer of last resort. And he’s not getting any help right now on the currency front. Bond prices will have to rise to keep investors happy. There’s room to the downside in yields on German bunds after a sell-off earlier in the year.

This means there is room for the euro to make that run to the $1.30 area over the rest of the year. Between now and then the situation in Washington will likely have come to a head, and either Trump will survive it or he won’t.

It is at that point that things get really interesting.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.