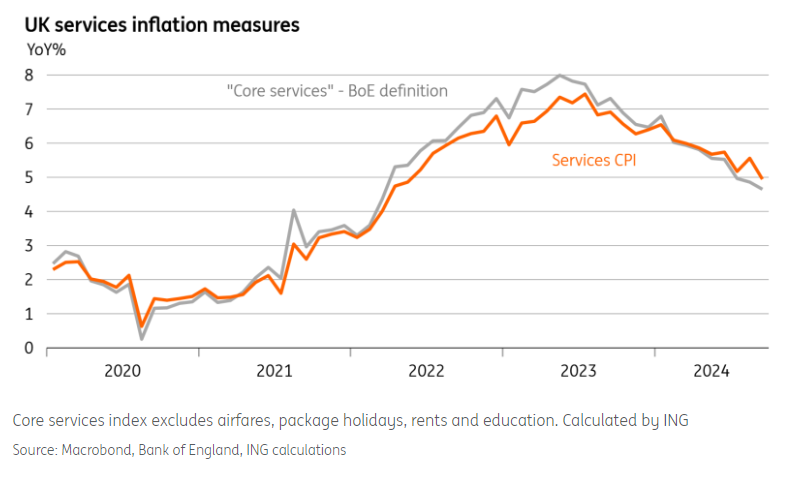

UK services inflation has fallen below 5% for the first time since May 2022 and that’s potentially big news for the Bank of England.

Remember this is, by some distance, the most important input into the BoE’s decision-making process, as it tries to gauge the level of inflation “persistence” in the economy. Service sector price trends are slower moving and tend to be more reflective of domestic economic conditions, like wage growth.

The important thing here is that the BoE had been forecasting September services inflation up at 5.5%, so the fact that it’s down at 4.9% marks a sizable undershoot. August’s figure was 5.6%.

It is worth saying that a fair chunk of this latest slide is down to a steep fall in air fares, which are notoriously volatile. But we’ve calculated a “core services” index, which the BoE has used recently and excludes items less relevant to monetary policy (including air fares, but also things like rents). That core services index has also fallen back further, as the chart below shows.

In other words, this latest fall looks genuine, and the BoE will be taking note.

Whether it has any bearing on the Bank’s November decision is questionable. It’s hard to see officials voting through anything other than a 25bp rate cut. But we expect this latest undershoot on services inflation to continue. We’ve argued for some time that it can end the year around 4.5%, rather than the 5.3% forecasted by the Bank of England. Survey indicators show companies are raising prices less aggressively, even if headline wage growth has stayed relatively sticky.

If we’re right, then we think the Bank of England can pick up the pace of cuts beyond November. We expect a cut in December and at every meeting until rates reach 3.25% next summer. Governor Andrew Bailey hinted at this in a recent newspaper interview, and we might see further signals at next week’s public appearances in Washington.

It’s worth saying that this can happen even if headline inflation ticks higher again, which looks likely. Headline CPI fell further than expected to 1.7% in September, but is likely to climb back to the 2.5-2.7% area around the turn of the year. That’s almost entirely because the drag from falling natural gas prices is fading.