- Upcoming earnings could make or break the market

- US dollar rebounded

- Oil price rallies on supply concerns

- US pending home sales figures are published on Wednesday.

- On Wednesday crude oil inventories are printed.

- Australian retail sales for June are released on Thursday.

On Tuesday, futures on Dow, S&P, NASDAQ, and Russell 2000 slipped into negative territory ahead of this week's much-anticipated interest rates decision from the US Federal Open Market Committee.

Retailers declined after global retail behemoth, Walmart (NYSE:WMT) announced its earnings would not meet expectations after the US close yesterday, but the slide was offset by a rally in oil stocks.

The European oil & gas sector popped 1.86%, rallying for the third day straight and adding 3.75% to its value, as Russia prepared to reduce its gas supplies to the continent.

The euro was little changed for the third day in a row, as traders maintained a holding pattern ahead of the much anticipated US Federal Reserve decision.

While the single currency seems to have reached equilibrium, having rebounded slightly from parity, the chart suggests another leg down.

The euro completed an H&S Continuation pattern and slowed its rebound upon nearing the neckline. It is worth noting that it has been trading within a Falling Channel.

The market has been trying to figure out how aggressive this week's US interest rate increase will be. For now, traders are pricing in another 75 basis point increase.

However, some market analysts are arguing that softening economic growth may convince US policymakers to shift focus away from inflation figures, which could see them easing their foot off the rate accelerator pedal. Traders are currently betting that rate hikes will peak in January 2023, a month sooner than was forecast last week.

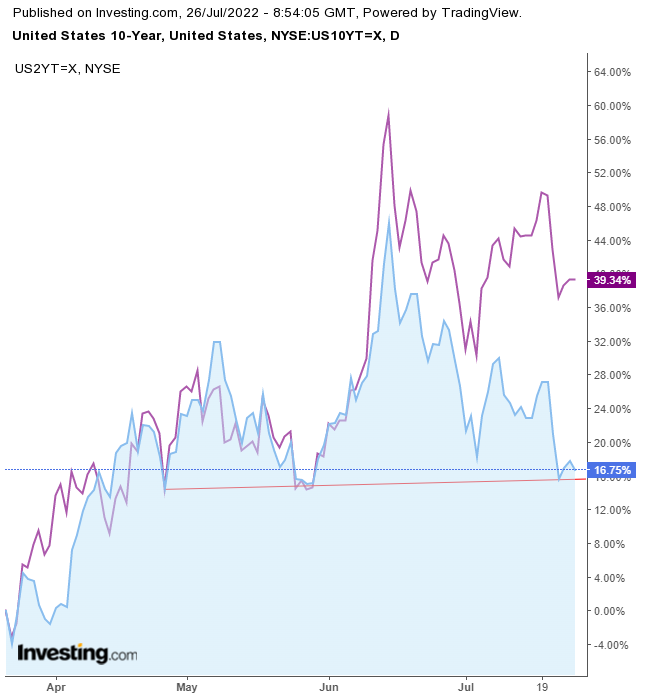

As well, the 10-year yield is expected to move lower.

The most observed yield is on the brink of an H&S top. Perhaps more importantly, the inverted yield is once again widening. While the 10-year yield is falling, the 2-year yield is rising.

It's topsy turvy for investors to continue buying a more extended commitment that pays less interest as it is a sign that they are losing faith in the economy's future. But that is what is happening which is why an inverted yield curve is a leading indicator of a recession.

Investors are keenly focused on upcoming earnings reports from mega-cap corporates including Apple (NASDAQ:AAPL) and Alphabet (NASDAQ:GOOGL). Today, Swiss banking giant, UBS (SIX:UBSG) slumped over 6% after missing earnings forecasts, with the CEO characterizing the quarter as one of the "most challenging" in a decade.

And, let's not forget the European energy crisis and China's ongoing battle with coronavirus as well as the continued woes in the Chinese property sector.

Stocks were volatile in yesterday's US session as traders attempted to get in quick trades ahead of corporate results.

There is definitely less enthusiasm in markets compared to last week. So far this week the S&P 500, Dow, and Russell 2000 are slightly higher, while the NASDAQ 100 is lower.

With so many potential risks it is difficult to forecast but I suspect corporate earnings will have a more lasting effect than the US Fed, as results could help investors decide whether companies can still thrive in the current economic climate or not.

Meanwhile, investors do not seem to be overly optimistic about upcoming figures from Amazon (NASDAQ:AMZN)—which are expected to show the slowest growth in decades as the strong dollar has likely hurt the company's exports—as the stock declined after Walmart's earnings warning.

The dollar rebounded today, ending a three-day slide,

The price bounced above the 106 peaks of June 15.

Gold fell slightly on a strengthening dollar.

The price has struggled at these levels, the lowest weekly level since April 2020.

Bitcoin resumed its decline for the sixth out of seven sessions.

The cryptocurrency is being squeezed by different forces: the Rising Channel since the June low versus the Falling Chanel since its November 2021 all-time high. A longer term, not to mention a broader channel, has more interest and is therefore stronger. Moreover, the digital coin topped out in May, which meant I maintained my bearish view.

Oil is rising for a second day due to supply tightness,

I believe a recession will cause the price to fall much lower.

Up Ahead

Disclaimer: The author currently does not own any of the securities mentioned in this article.