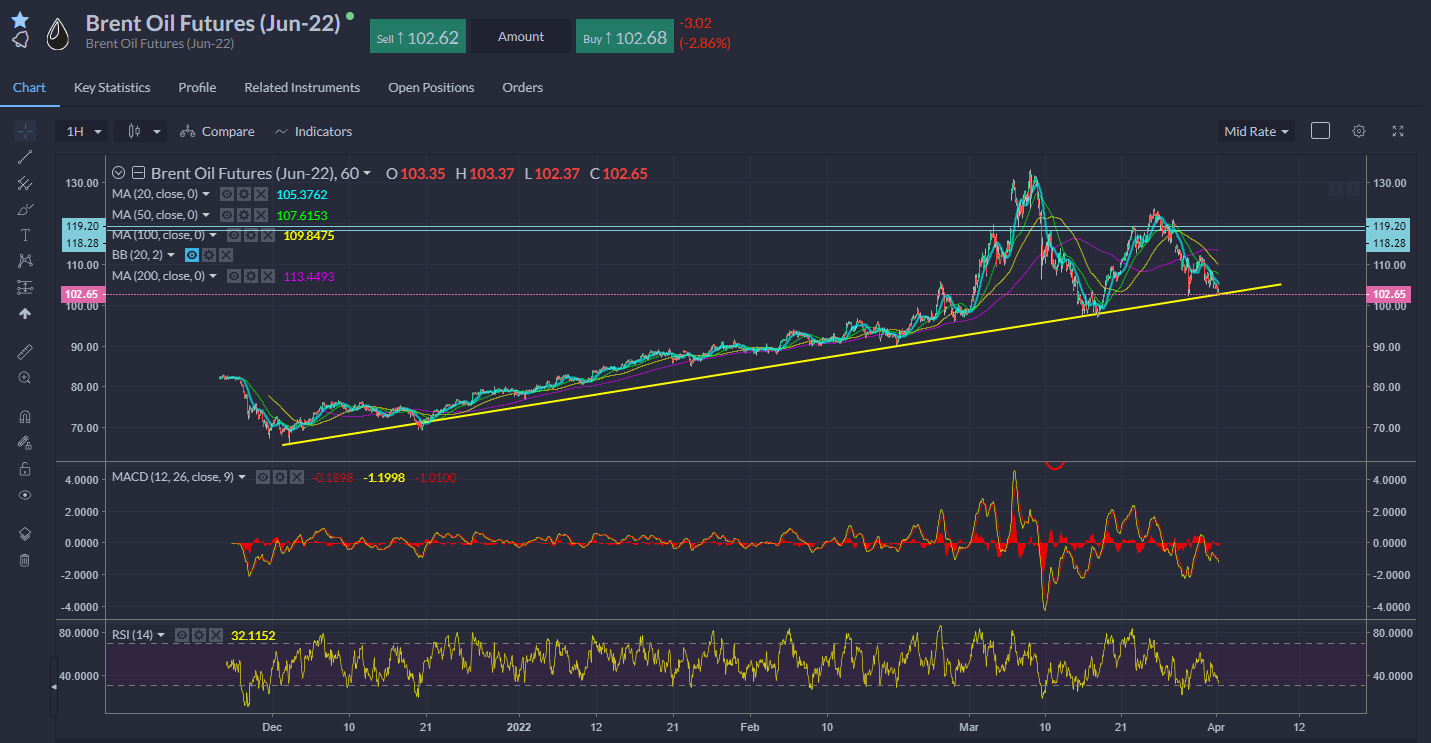

Oil prices are lower, with Brent futures around $102, testing key trend support after US president Joe Biden ordered the release of 1m barrels of oil per day from strategic reserve for 6 months to bring down prices, in line with the 180m that had been mentioned. OPEC stuck to its guns, agreeing to ease oil cuts by 432,000 bpd in May, whilst reiterating that “current volatility is not caused by fundamentals, but by ongoing geopolitical developments”. International Energy Agency member countries are set to meet later today and could release more.

It’s not just the SPR release – ultimately that is never going to affect the longer-term fundamentals, albeit it’s a huge release that will reduce pressure for physical barrels. Slowing growth in China, where lockdowns are an ongoing threat, are a factor too. The Russian invasion of Ukraine looms over the entire market. China Caixin Manufacturing PMI fell at the fastest pace since the pandemic first hit, down to 48.1 from 50.4. The SPR release won’t change the fact that global inventories are incredibly tight, but does ease some immediate physical worries. Meanwhile, US natural gas prices rose to their highest since November as the Kremlin doubled down on its threat to cancel gas sales if they were not paid in rubles. The ruble trades where it was before the invasion now.

US core PCE rose to 5.4% from 5.2%, which wasn’t quite as high as feared but still heading up and was the highest since 1983. The headline PCE measure rose 6.4%, the fastest pace since January 1982. Consumption meanwhile fell –0.4% from +1.5% the prior month. Consumption down, prices keep rising...make of that what you will but the demand destruction argument doesn’t hold up in my opinion. Jobless claims still basically at the lowest level in half a century, so combined with the JOLTS figures only underscores how tight the labour market is...wage price spiral fears are real.

Eurozone manufacturing PMI fell to 56.5, a 14-month low, while the output index slid to a 21-month low. S&P Global (NYSE:SPGI) says: “A rise in geopolitical tensions was mentioned as a factor weighing on demand, and had a noticeable impact on business confidence, which fell to its weakest level since May 2020. The weaker upturn was accompanied by an intensification of supply chain pressures over the month as rising COVID-19 infections in China and Russia's invasion of Ukraine reportedly led to longer lead times. Meanwhile, amid surging commodity, fuel and energy costs, input price inflation re-accelerated in March and hit a four-month high. To offset margin pressures, eurozone manufacturers raised their charges to the greatest extent in the series history”.

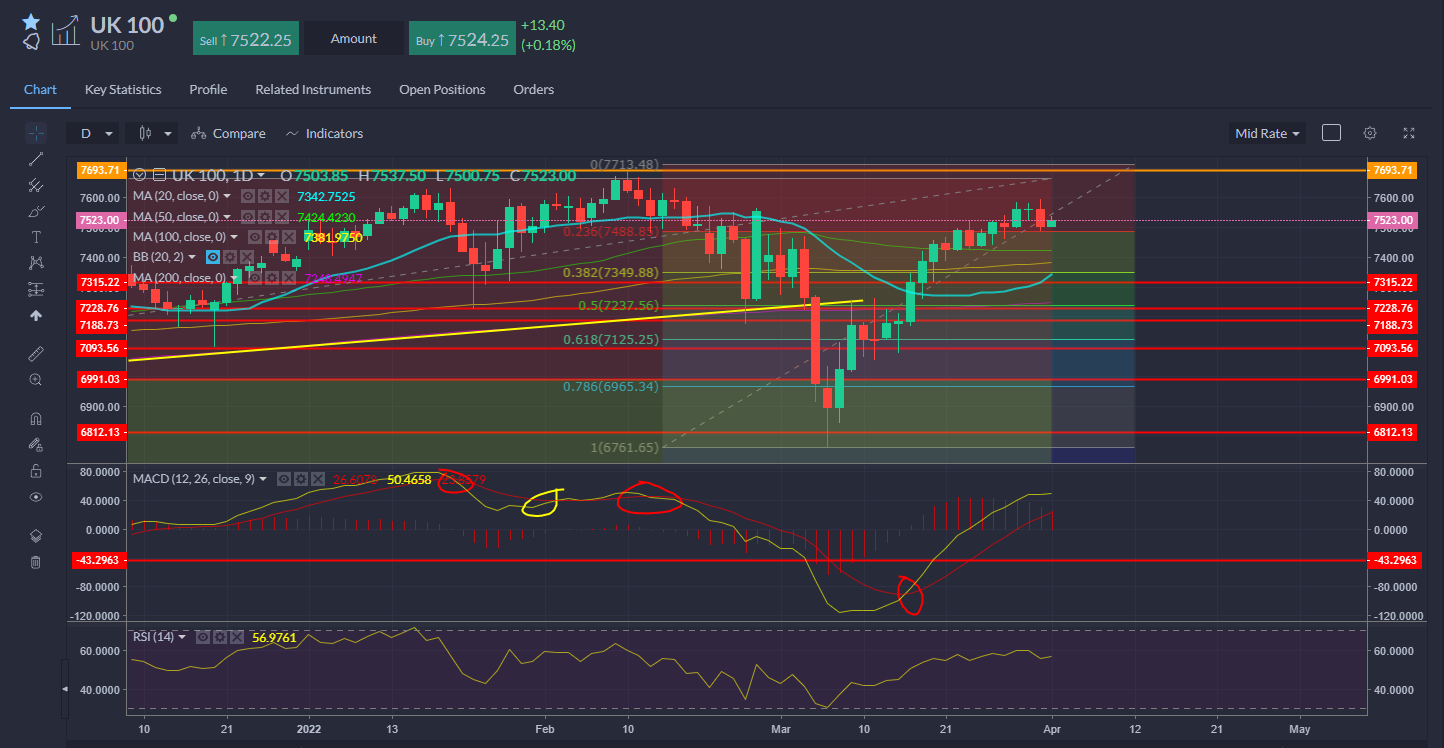

European stock markets are flat at the start of trading, following on from a weak US session and a mixed bag in Asia overnight. The S&P 500 finished down 1.5%, with similar moves for the Nasdaq and Dow Jones. GameStop (NYSE:GME) surged 14% in after-hours trading after announcing a stock split…ridiculous. The Nikkei in Japan was down around half of one percent after some weak data The closely watched Tankan survey showed a decline in business sentiment for first time in seven quarters, with the headline at +14 from +17, although +12 had been expected. The FTSE 100 tests the 23.6% retracement for now having shed 0.83% yesterday.