Oil has found a little support over the last 24 hours, thanks to a stronger than expected draw on inventories. This has only led to a rejection off the trend line and lower lows look to be the target.

The American Petroleum Institute released their weekly Crude Oil inventories report at the end of yesterday’s New York session which gave crude a nice little boost. The report showed a draw on reserves of -2.3Million barrels and was a little higher than the market was expecting, as seen by the pop on the release. That only lasted a short while though, with Oil pulling back from the day’s high after a touch on the trend line. This is quite a bearish sign if Oil can’t capitalise on such a large draw-down and it shows the strength of this bearish trend.

It will pay to keep an eye on the official EIA report due out later today (1430 GMT) with the market expecting a draw of 800k barrels. Judging by the market’s reaction to the API result, it will need to take something spectacular to turn the sentiment around from the bearish bias that currently persists. The troubles in China are only likely to compound the problems in the Oil market with another solid fall in the stock market today likely to cause another yuan devaluation from the PBOC.

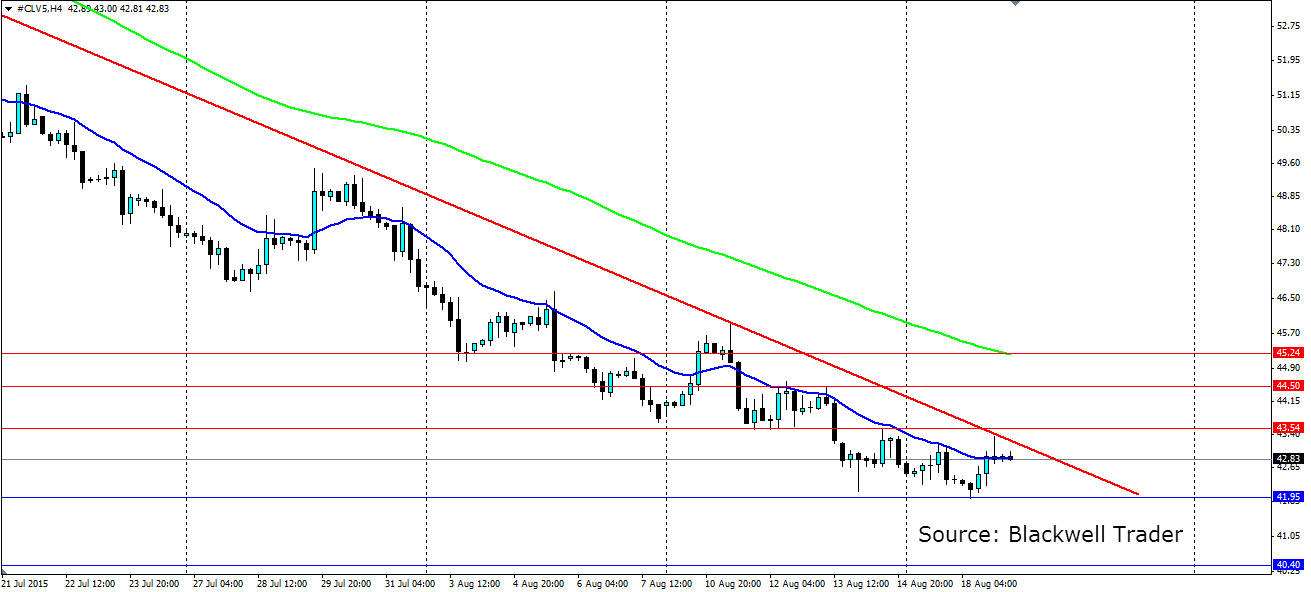

The doji that formed on the H4 chart, above, after the API report is a clear sign of the markets sentiment. Oil was bid up towards the trend line where it rejected strongly to close out below where it opened the candle. The trend line is firmly in control and provides an opportunity for traders to enter short with the bias.

From here we are likely to see the recent lows tested at $41.95. Below that we are into levels not seen in 6 years, so looking back we have support at 40.40, 39.48 and 37.43 which will all be points of interest for Oil. If we do see a breakout of the trend, look for resistance to be found at 43.54, 44.50 and 45.24.