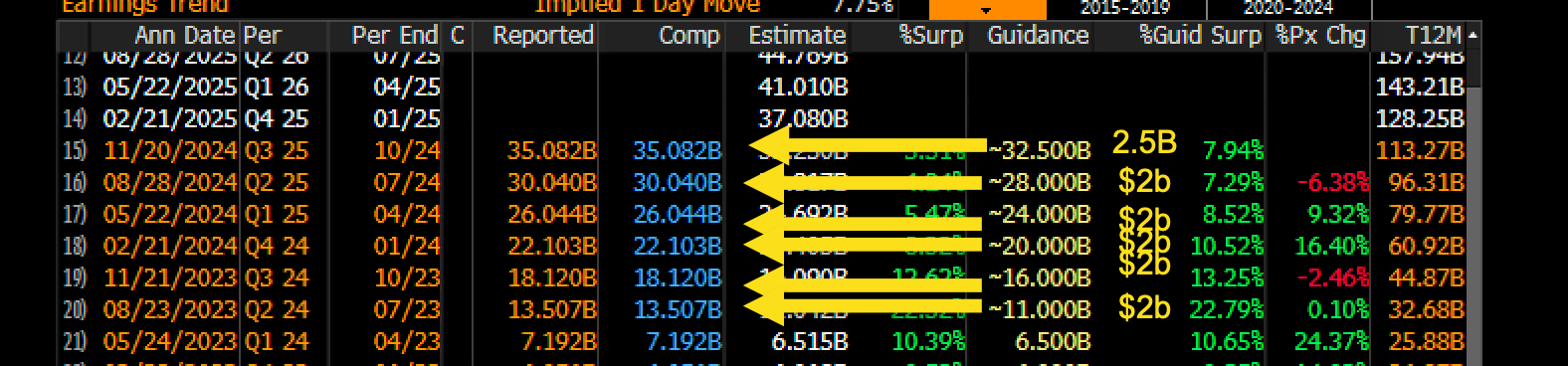

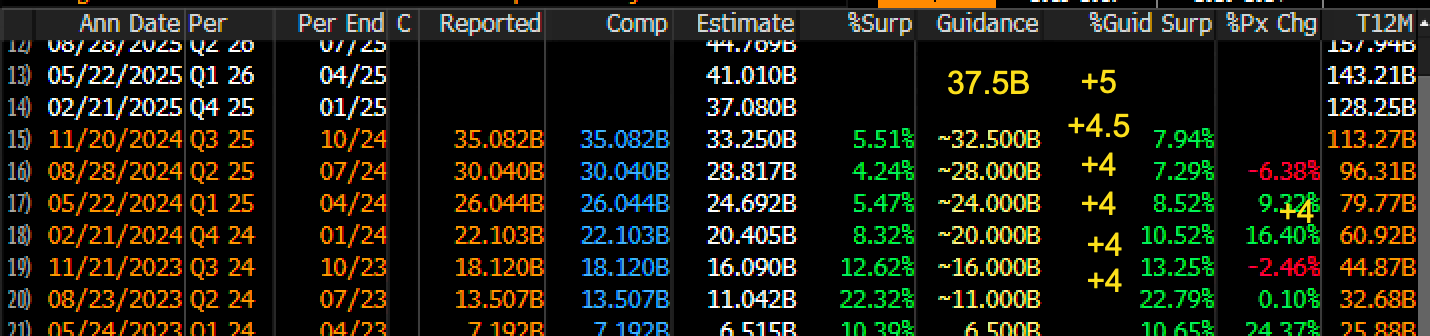

Nvidia (NASDAQ:NVDA) reported its results, and surprisingly, the company posted revenue of $35 billion and projected future revenue at $37.5 billion. They continue to follow the revenue and guidance pattern observed in the past. (Data From BLOOMBERG)

(Data From BLOOMBERG)

The one deviation this quarter was the guidance, which was $5 billion higher than usual, a slight increase from last quarter’s $4.5 billion. This also marks the first quarter with the Blackwell GPU included. My concern with this guidance is the apparent shift in revenue away from the Hopper segment. Given what we’ve observed, these results were unsurprising and somewhat predictably consistent. (Data From BLOOMBERG)

(Data From BLOOMBERG)

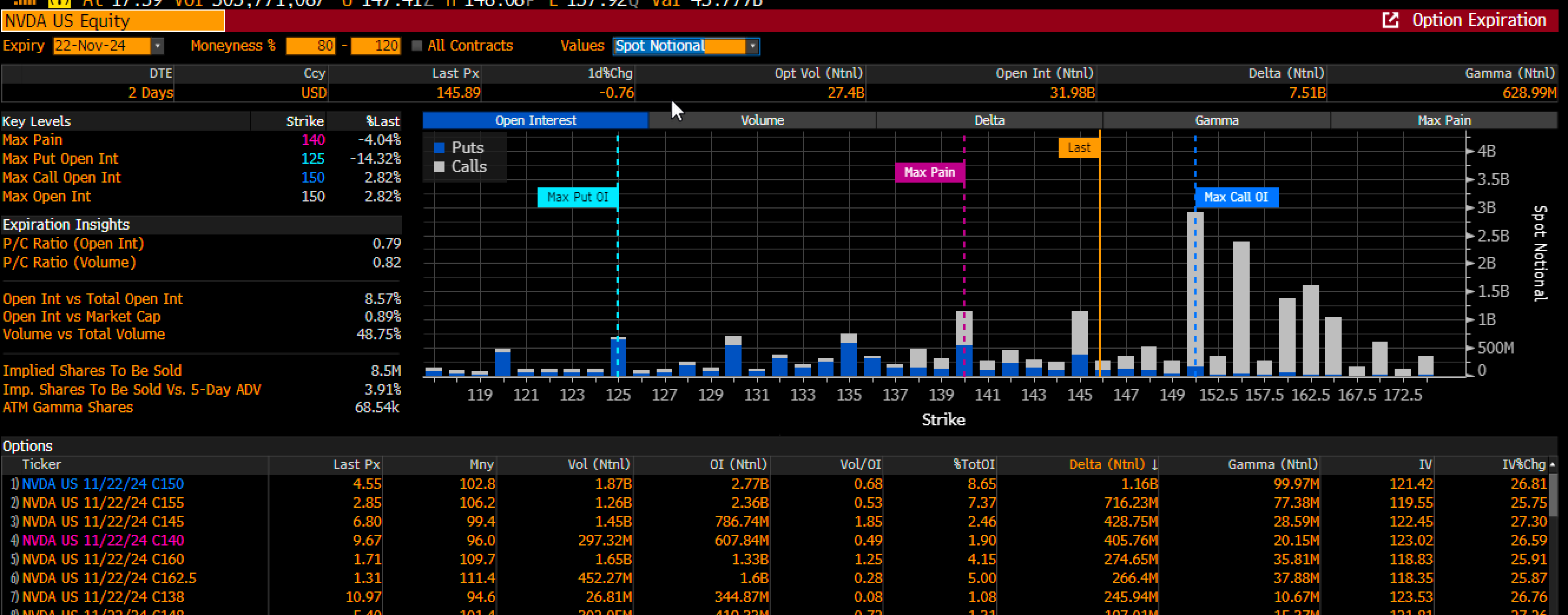

For now, the stock is trading at around $144, but if it fails to surpass $155 tomorrow, a significant amount of stock could be put up for sale. This is because all those calls at the $150 and $155 strike prices will lose much of their premium as implied volatility (IV) sharply decreases. The $150 calls, trading at $4.55, mean that anyone who bought these calls today for the earnings will need the stock to trade above $154.55 tomorrow to begin seeing a profit. (BLOOMBERG)

(BLOOMBERG)

So, at least at this point, the rising wedge pattern in Nvidia is still intact and could break lower tomorrow based on how the options market flows.

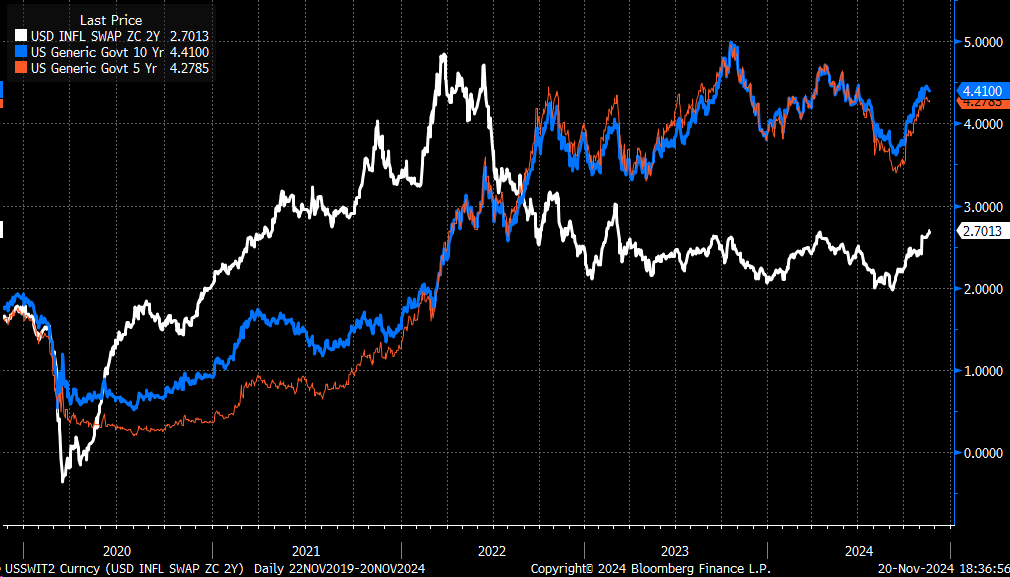

Finally, the 2-year inflation swap reached a breakout, rising to 2.7%—its highest level since March 2023. With the swap moving upward out of its range, I expect bond yields to follow suit. (BLOOMBERG)

(BLOOMBERG)