- Netflix is set to report earnings later today.

- Consensus expectations are high, and the company has no room for error.

- Ahead of earnings, the stock appears to be fairly valued with a slight downside in the offing.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Tech stocks, the engine of the recent bull market, are now in the spotlight as Q2 earnings season heats up. All eyes are on Netflix (NASDAQ:NFLX), the dominant streaming giant, reporting its results after the closing bell today.

This report will be crucial for gauging the health of the streaming industry and could impact the broader market sentiment.

Netflix boasts impressive year-to-date gains, with its stock surging 33%, while competitors like Paramount Global (NASDAQ:PARA) and Warner Bros Discovery (NASDAQ:WBD) have fallen 19% and 26%, respectively.

However, the streaming giant faces a critical test as its stock has pulled back over 7% since reaching a more than 2-year high of $697.23 earlier this month.

In this article, we will analyze what investors can expect from the high-stakes earnings release later on today.

What can we expect from Netflix's quarterly results?

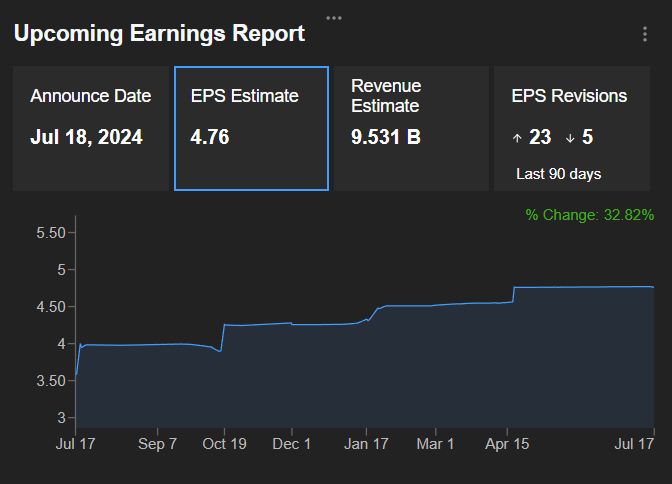

In terms of key data, analysts are forecasting an average EPS of $4.76, almost 10% down on the first quarter, but up 44.6% year-on-year.

Source: InvestingPro

Sales are expected to reach $9.531 billion, compared with $9.37 billion in the previous quarter and $8.187 billion a year earlier, representing an annual growth of 14.4%.

Beyond these main figures, investors will also be interested in some specific details of Netflix's results, starting with the number of new subscribers, which is expected to be 4.7 million, compared with 5.9 million last year.

More specifically, we'll be looking at subscriber growth for the discounted, ad-supported plan, bearing in mind that the company has raised the prices of its other subscriptions to steer more subscribers towards the ad-supported version, deemed more profitable.

Of course, the company's forecasts for the coming quarters could largely mitigate or accentuate the impact of Q2 results, given that optimistic forecasts could offset disappointing results, and vice versa. It's worth remembering that Netflix shares plummeted following the publication of a Q1 EPS that was 16% higher than expected, precisely because of cautious forecasts.

Analysts skeptical about the earnings outcome

It's also worth noting that some analysts are wary of Netflix's upcoming results. Goldman's Eric Sheridan, who has a neutral rating on the stock, warned last week that "based on Sensor Tower data, in the US and globally, Netflix experienced a decline in app downloads during the quarter".

For their part, analysts at Citi, who are also neutral on Netflix, estimated that the company "will report net additions slightly ahead of estimates, but slightly below expectations from investors", who "will likely continue to focus on the company's advertising, sports content and capital allocation strategy."

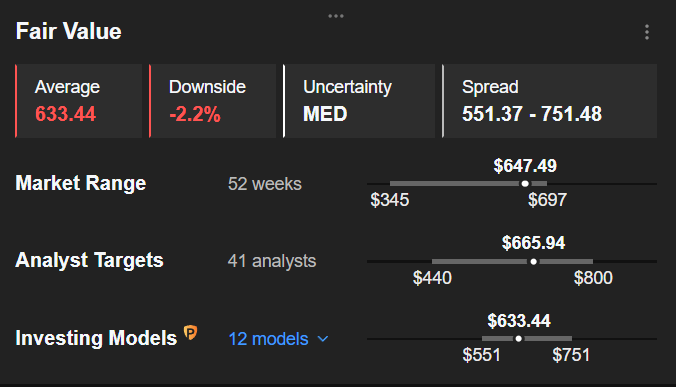

As for targets for Netflix's share price, analysts also show a mixed view, with an average target of $665.94, which translates into a very limited upside potential of +2.8% from Wednesday's closing price.

Source: InvestingPro

Valuation models are also sending out a message of caution, with InvestingPro Fair Value (an intelligent synthesis of several recognized models) coming in at $633.44, or 2.2% below the current price.

Conclusion

Netflix is therefore approaching its earnings release at fairly high levels, and analysts' expectations in terms of profits and revenues are also high, implying that the balance of risks is tilted to the downside.

What's more, beyond the influence of the results on Netflix's share price, this publication could also have an impact on the technology sector in general, given that optimism is already starting to wane, with Nasdaq falling by almost 3% yesterday on its worst day since December 2022.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Are you tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is for information purposes only; it does not constitute a solicitation, offer, opinion, advice or investment recommendation, and is not intended to induce the purchase of assets in any way.I would like to remind you that any type of asset is evaluated from multiple angles and presents a high risk. Consequently, any investment decision and the associated risk rests with the investor.