- NY/Eastern US temperatures soar while Texas/South heat wanes

- Gas prices return to mid-$2 to sub-$2.70 range on mixed heat/storage outlook

- With all things being equal, LNG helps gas bulls by propping up feed demand

Call it the yin and yang of natural gas.

As New York and Eastern U.S. temperatures soar into the 90s Fahrenheit in the first heatwave of the summer, scorching conditions in Texas and the Southern states are subsiding after increased cloud cover and showers over the July 4th holiday stretch.

That has left gas prices at a crossroads, with the path of least resistance looking lower in the immediate term, as the market loses its chutzpah of the past four weeks to head for its first weekly loss since.

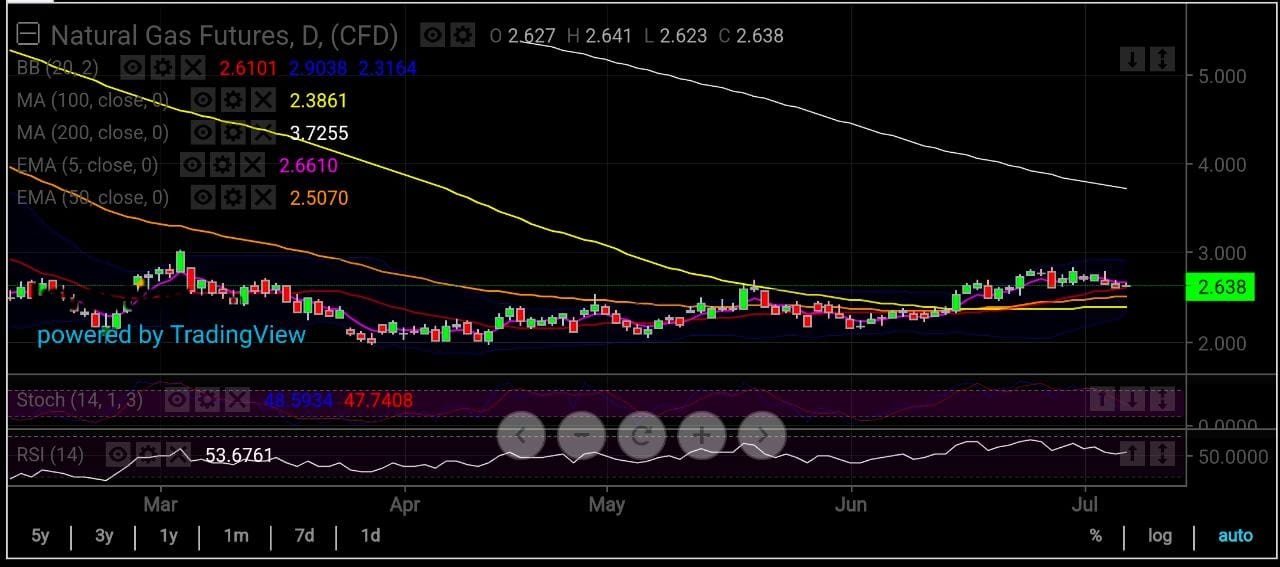

Most-active August gas on the New York Mercantile Exchange’s Henry Hub was exposed to a 6% loss on the week, after a near 30% rally over the past month. After last Monday’s three-month high of $2.936 per mmBtu, or million metric British thermal units, the front-month gas contract has been capped at a mid-$2 to sub-$2.70 range.

Said Sunil Kumar Dixit, chief technical strategist at SKCharting.com:

“If selling intensifies, expect some more losses towards 100 Day SMA, or Simple Moving Average of $2.38.

But in the event of a rebound, momentum accumulation from support areas should bring the front-month quickly back towards $2.66, with the next swing target of $2.839.”

Charts by SKCharting.com, with data powered by Investing.com

Charts by SKCharting.com, with data powered by Investing.com

Rhett Milne of NatGasWeather.com puts it in perspective as traders await the weekly gas storage report from the U.S. Energy Information Administration, or EIA, due this Friday instead of Thursday owing to the holiday.

U.S. utilities likely added a near-normal 64 bcf, or billion cubic feet, of gas to storage last week, according to industry analysts tracked by Investing.com. That was barely different from the 63-bcf injection during the same week a year ago and a five-year (2018-2022) average increase of 64 bcf. In the prior week, utilities added 76 bcf to storage.

Mixed Gas Storage Outlook

Says Milne of NatGasWeather:

“It’s quite telling [that] last week’s impressive Texas heat wave will only lead to slightly smaller-than-normal build for Friday's delayed [report} release.

And while this week has greater coverage of highs into the 90s, the Fourth of July holiday typically results in lighter demand due to many offices being closed. Essentially, surpluses will only improve modestly after the next three EIA reports are accounted for and [are] likely to remain over 335 bcf.”

Analyst Eli Rubin of EBW Analytics Group adds that on a seasonal basis, with the most likely gas storage trajectory on pace to exceed 3,900 bcf and the storage surplus set to gain throughout July, “natural gas may be reliant on further external bullish catalysts to lift NYMEX futures higher.”

Adds HFI Research:

“The market is finally turning a corner,” price-wise. “And looking at our projected storage injections over the next five reports, we see a deficit of 21-bcf versus the five-year average.”

John Sodergreen, who publishes a weekly note on gas under the heading of “The Desk”, also concurred, saying:

“Lately, the weekly gas storage report is reminding me of old-time boxes of Cracker Jacks – a surprise inside each one, every time.”

AccuWeather, in comments carried by naturalgasintel.com, said temperature highs in the East during the day would reach the 90s through Friday, with high humidity pushing toward almost 110 degrees in some areas. The surge in temperatures is expected to lead to increased cooling demand in areas that until this week had not yet experienced much heat this summer, the forecaster said.

Notably, it adds that heat and humidity have hit the East Coast, driving an uptick in energy demand as air-conditioning use kicks up a few notches. In Philadelphia, highs were forecast to reach the low 90s through the end of the week. New York City had a similar outlook, while slightly higher temperatures were forecast for Washington, DC.

“Because the 30-year average high temperature has crept upward in recent decades in the nation’s capital, the criteria for a heat wave should probably be more like the low to mid-90s for a heat wave, rather than the 90-degree threshold,” said AccuWeather senior meteorologist Dan Pydynowski. “But, hot is hot.”

The hot and humid conditions are following an unseasonably cool June for much of the East, according to AccuWeather. Several cities saw temperatures average 1-4 degrees below the historical average last month, which is a time when average temperatures are 3-8 degrees lower than that of early July, forecasters said.

Steve Silver, senior meteorologist at Maxar, says that above-normal temperatures are in the Northwest, Southwest, Texas, and New England in the 1- to 5-day period, while widespread belows extend from California to the Rockies and the Midwest. Highs are forecast to peak near 100 degrees in Dallas and mid-to-upper 90s in Houston early next week.

“Models suggest hotter risks in California, but models have been biased to warm here of late, and a large gradient is likely between the hotter inland areas and more moderate coastal areas.”

In the northern and central Plains, the weather is leaning on the cool side of normal in the Great Lakes region and near normal on the East Coast, Silver noted.

In Texas, storms may pose a cooler risk in areas of the southern Plains, northeast Texas, and the mid-South, he said, adding:

“Risks may be additionally hotter here, especially as models show a continued lack of monsoon activity. Models are also hotter in Texas, but the forecast takes recent warm biases into account. Wet conditions may pose some cooler risk in the Midwest and East.”

LNG Providing Gas Bulls The Little Edge

On the liquefied natural gas, or LNG, feed-gas demand appears to be steadying in the low 13 bcf/d range, said EBW Analytics, adding:

“While the return from the Sabine Pass outage has boosted exports, mid-summer exports running 2+ bcf/d below capacity may require bearish revisions to average Summer demand flows.”

HFI Research, meanwhile, says that although gas production in the Lower 48 U.S. states had surged back to 101+ bcf/d to start July, LNG gas exports have also returned, offsetting the output boost. With power burn demand now hitting its apex, the agency says it expects “tighter fundamentals to start giving prices a boost.”

LNG demand, meanwhile, continues to fluctuate amid maintenance outages, though intake volumes have trended higher overall over the past week or so.

NGI data on Wednesday showed feed gas deliveries to U.S. terminals a hair shy of 13 dekatherm per day, which is on the high end of volumes seen since late June when feed gas deliveries were below 12 dth/d.

“Essentially, there are several bullish elements or undercurrents in play or that can surprise,” NatGasWeather said.

***

Disclaimer: The content of this article is purely to educate and inform and does not in any way represent an inducement or recommendation to buy or sell any commodity or its related securities. The author Barani Krishnan does not hold a position in the commodities and securities he writes about. He typically uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables.