Early buying momentum from pre-market through to morning trading had the potential to stamp bulls' authority on markets.

But by the close, we are again looking at bearish 'black' candlesticks for the Nasdaq and S&P 500, with a bearish 'cloud cover' for the Russell 2000 (IWM).

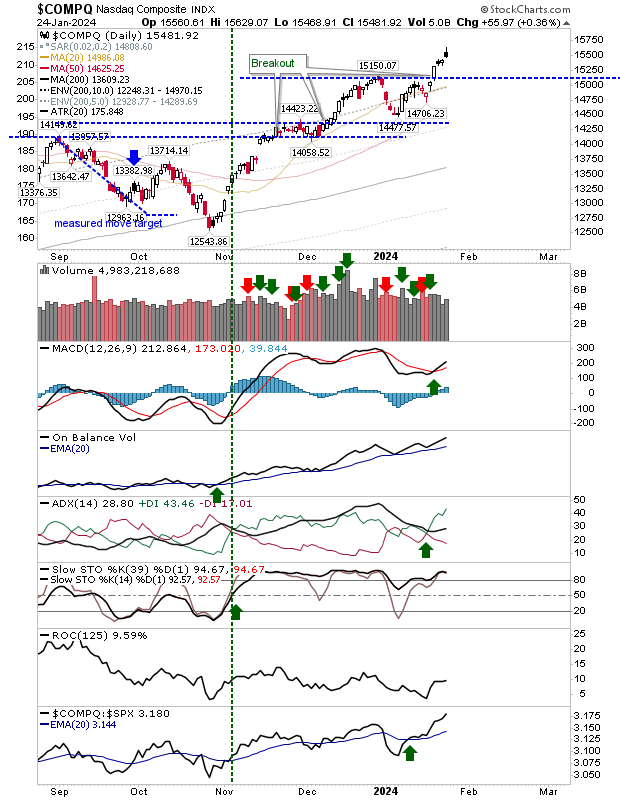

For the Nasdaq, we are perhaps looking at an opportunity to test breakout support of 15,150 although this process will likely take 2-3 days of selling to achieve.

Today is a logical place for this selling to start. Technical strength is bullish with little in the way of bearish divergences to indicate pending weakness, so it will be down to pre-market to determine if there will be a gap down.

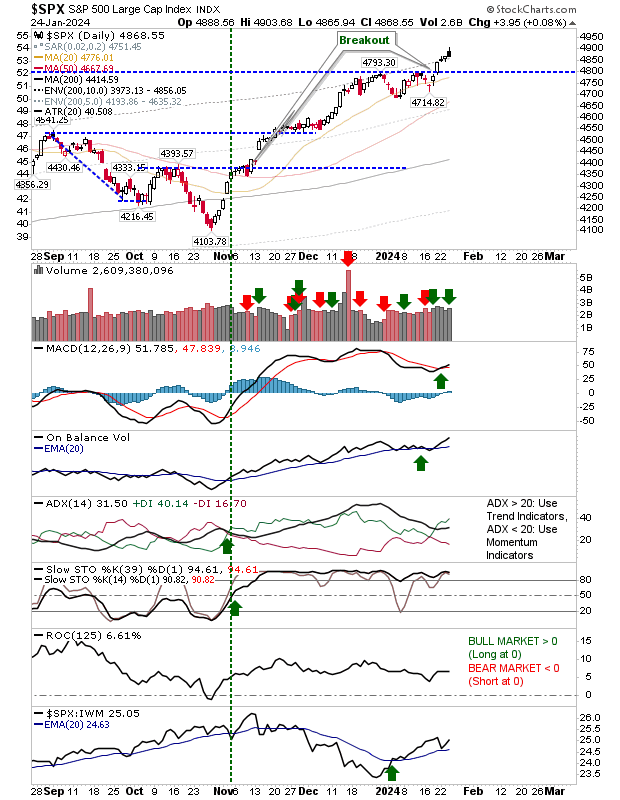

The S&P 500 is another index staring at a support test. This support test may come a little quicker than the Nasdaq and today could be the day.

There was a recent 'buy' trigger in the MACD and On-Balance-Volume is working off new all-time highs (yesterday's buying ranked as accumulation). The S&P 500 is strongly outperforming the Russell 2000 after struggling at the end of 2023.

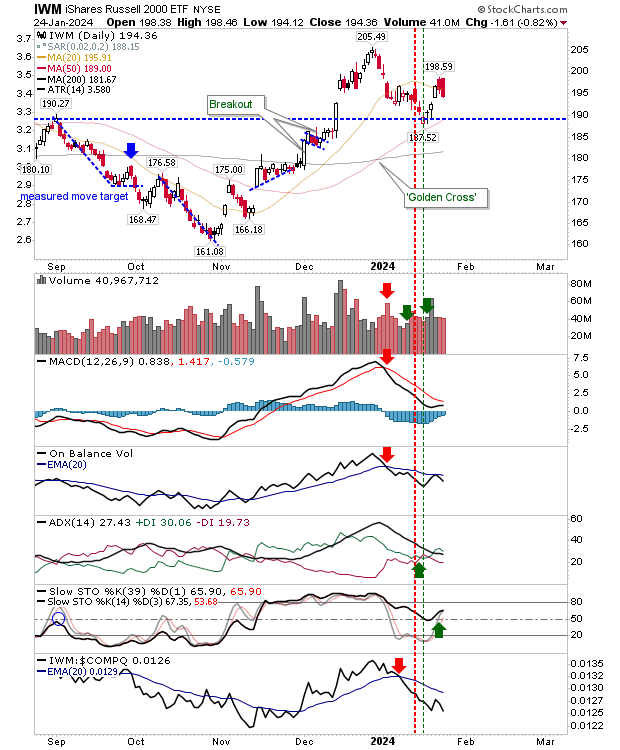

The Russell 2000 ($IWM) doubled up on the bearishness. However, a move back to $189, which is also the 50-day MA for this index could provide a good launch point for the continuation of the October-December rally.

Long term, I'm more bullish for the Russell 2000, but we need a support confirmation test.

For today, we have an easier downward path, but there is solid support across all indices not far below. At this stage, as we come close to the end-of-week I will be curious as to the impact this will have on the weekly charts.