Nanoco Group (LON:NANON) has signed an agreement for a fifth work package from its major European customer. This covers the final phase of a scale-up of a longer wavelength material and development of a third material. It has also completed a placing and subscription raising £2.0m (net) at 37p/share, which extends the cash runway into CY24, and announced a broker option at 37p/share potentially raising up to an additional £3.7m.

Work package provides stable revenue base

This fifth work package gives a monthly revenue rate similar to that delivered in H122, so we have raised our FY22 revenue estimate by £0.2m to £2.4m. Importantly, while the four previous work packages have lasted one or two quarters, this fifth work package extends for one year starting May 2022, giving Nanoco a more stable environment for business planning. The working capital arrangements in the contract enable Nanoco to set up a robust raw material supply chain ahead of commercial production orders, which it expects to have visibility of during H2 CY22. The inclusion of development work on a third material emphasises the long-term nature of the relationship with the customer, which we have previously inferred is STMicroelectronics (LON:0INB) .

Cash runway potentially extended into CY24

The fifth work package, together with the placing and subscription, extends Nanoco’s cash runway from H1 CY23, by which point management expects to have visibility of both potential production orders and the outcome of the patent litigation trial with Samsung (LON:0593xq), into CY24. It means Nanoco has sufficient cash if the litigation process is prolonged by appeals because if the initial application for sensing materials is relatively low volume, Nanoco will not reach cash break-even until FY25.

Valuation: Dependent on patent litigation outcome

Ahead of the programme with ST moving to commercial production, we believe much of Nanoco’s value still lies in a satisfactory resolution of the patent infringement dispute with Samsung, an event which is much more likely given the positive verdict from the US Patent Trial and Appeal Board (PTAB) in May. Although the value of a potential payout has not been disclosed, we calculate that lost revenue in the United States attributable to the patent infringement to date could be in the region of US$200–250m or more. Any damages awarded could also make an additional allowance for future sales of infringing TVs and a possible uplift for wilfulness.

Share price performance

Business description

Nanoco Group is a global leader in the development and manufacture of cadmium-free quantum dots and other nanomaterials, with c 560 patents. Focus applications are advanced electronics, displays, bio-imaging and horticulture.

Revisions to estimates

Minor upgrades to FY22 estimates

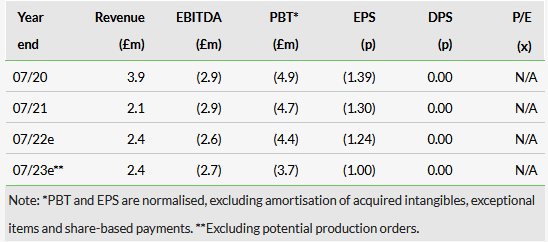

We have made the following changes to our FY22 estimates:

Revenues: management notes that the new work package delivers a monthly run-rate equivalent to that delivered in H122, when revenues, most of which were attributable to ST, totalled £1.1m. Since Nanoco received new orders from its major Asian customer in Q322 and is at an advanced stage of discussion regarding additional development work packages with the customer, we expect H222 revenues to be higher than H122 and therefore raise our revenue estimate slightly, by £0.2m to £2.4m. This follows another minor upgrade in March.

Administrative costs: we reduce administrative costs by £0.2m to reflect tight cost management.

EPS: we modify our estimates to include the new shares issues following the placing and subscription but exclude any potential shares attributable to the broker option. We note that the Broker Option is not materially dilutive because the total fundraise including the placing and subscription will not exceed 5% of the company’s issued share capital immediately prior to the fundraise.

Cash flow: we modify our cash flow to include the £2.0m (net) from the placing and subscription but exclude any potential cash from the broker option. The broker option closes at 5.00pm on 7 June 2022. We note that long-term shareholder Lombard Odier Asset Management remains supportive but did not participate in the current fund-raising because it did not want to risk exceeding a 30% stake.

Introducing FY23 estimates

Since the fifth work-package from ST extends to end April 2023, there is sufficient visibility to introduce estimates for FY23. These do not include any revenues attributable to the commercial production of nano-materials for sensing or other applications. We note that, if inflationary effects were excluded, the cost savings arising from exiting the surplus facility in Manchester and other actions would reduce the annualised cost base by around 15% by January 2023 compared with management’s expectations for FY22.

Click on the PDF below to read the full report: