Nanoco (LON:NANON) has expanded its product and customer portfolio of nanomaterials for use in infrared-sensing applications from a single customer and one material-development programme in 2018 to five customers and eight different materials. Applications potentially include facial recognition and augmented reality (AR) in mobile phone, machine vision and anti-collision systems for autonomous vehicles. The most advanced of these could potentially lead to volume production in calendar year 2023.

Share price performance

Business description

Nanoco Group is a global leader in the development and manufacture of cadmium-free quantum dots and other nanomaterials. Its platform includes c 740 patents and specialist manufacturing lines. Focus applications are advanced electronics, displays, lighting and bio-imaging.

Developments potentially lead to volume production

The most advanced of Nanoco’s projects developing nanomaterials for sensing applications is with a major European customer, which we have previously inferred is STMicroelectronics (ST). As discussed in a previous note, Nanoco has successfully developed a new generation of nanomaterials for potential use in infrared sensing applications for ST which it is now optimising. If the optimisation phase is successful, it could lead to production scale-up and eventual volume production in calendar 2023. This would use Nanoco’s existing nanomaterials facility in Runcorn which has capacity to output materials worth £100m per year. In addition, Nanoco has recently signed a development agreement for an infrared sensing materials project with a very significant Asian chemical company.

A range of opportunities in sensing

Nanoco’s nanomaterials represent a cost-effective, proven way of improving the sensitivity of sensors used for facial recognition and AR applications in smart phones. The ability to use the nanomaterials for infrared sensing opens up opportunities in machine vision, collision avoidance systems, non-invasive glucose monitoring and compact night-vision goggles.

Valuation: Resolution of patent infringement key

The ongoing development and optimisation programmes confirm that there remains significant potential for generating revenues from the supply of quantum dots (QDs) for sensing applications. However, ahead of these definitely moving to commercial production, we believe that Nanoco’s value lies in a satisfactory resolution of the patent infringement dispute with Samsung (LON:0593xq). Although the value of a potential payout has not been disclosed, we calculate that lost revenue in the US attributable to the patent infringement to date could be in the region of US$200–250m or more. Any damages awarded could also make an additional allowance for future sales of infringing TVs and a possible uplift for wilfulness. Samsung would also be likely to seek a global negotiated settlement covering sales in other territories.

Progressing development opportunities

Pursuing near-term opportunities in sensing

Nanoco has expanded its product and customer portfolio of nanomaterials for use in infrared sensing applications from a single customer and one material development programme in 2018 to five customers and eight different materials. Of these, the projects with ST and a very significant, undisclosed Asian chemical company are the most advanced.

Development with STMicroelectronics (NYSE:STM) potentially leads to volume production in calendar 2023

Nanoco and ST have been working together for around three years. Originally this was as part of a supply chain for a major US customer, with Nanoco manufacturing nanomaterials that ST used to improve the sensitivity of its silicon infrared sensors. In June 2019 the US customer advised Nanoco that the joint programme would not be extended beyond December 2019 when the contract covering a range of stress tests and commissioning services at the Runcorn facility concluded. This decision was for reasons wholly unconnected to the performance of Nanoco’s materials and service delivery. The nanomaterials production facility in Runcorn had been successfully commissioned, with Nanoco delivering the final milestones for the US customer during FY20 and earning the contracted milestone payments in full.

With the US customer having withdrawn from the scene and the exclusivity agreement with it having lapsed, ST is able to offer the enhanced, proven, near infrared (NIR) sensors developed for the US customer across its extensive, global customer base. In May 2020 ST signed a framework agreement with Nanoco covering both development work and commercial supply of nanomaterials for use in multiple infrared sensing applications over a five-year period. The agreement covers the supply of small-scale volumes of nanomaterials for NIR sensors. It also covered a development project, which initially extended from April to December 2020, on a new generation of nanomaterials for potential use in other infrared sensing applications, which we infer from a recent paper given by ST (see below) are in the short-wave infrared (SWIR) range. This development activity was not impaired by the coronavirus pandemic. During H121 Nanoco successfully delivered all of the technical and commercial milestones on the first phase of this project, which contributed £0.8m of the total £1.0m revenues for the period. In May 2021 Nanoco announced that it was working on the second phase, which is the optimisation of the new materials. This phase is scheduled to complete in Q122. If successful, this phase could lead to production scale-up and eventual volume production in calendar 2023.

The agreement also commits ST to taking a specified minimum volume of nanomaterials from Nanoco if the enhanced sensors gain market traction and commercial volumes are required. These materials would be produced at the existing facility dedicated to sensing applications in Runcorn, which has already demonstrated that it can deliver material in commercial volumes and has the capacity to manufacture c £100m of materials each year. The volume production facility for sensor materials in Runcorn was closed temporarily during the first lockdown and has since been reopened.

Development agreement with Asian chemical company addresses different supply chains

In July 2021 Nanoco announced that it had signed a development agreement for a project with a very significant Asian chemical company. Nanoco had previously supplied this Asian customer with nanomaterial for infrared sensing applications and has recently completed feasibility work on a potential new nanomaterial operating at a different wavelength which will be suitable for use in electronic devices across a number of sensing applications and end-markets. The Asian customer intends to incorporate Nanoco’s nanomaterials in its own materials, which it will sell globally to companies making electronic devices (ie companies at a similar level in the supply chain to ST). The first phase of the development project with the Asian customer is scheduled to complete in calendar H221 (ie first half of FY22). If successful, there will be a further two development phases extending to the end of FY22 (July 2022). There would then need to be a scale-up phase, suggesting that any volume production for the customer would not commence until FY24 (ie one year to 18 months after any potential volume ramp-up for ST).

The value of this project is modest at present. The total value of work for the Asian customer during FY21, including the preliminary feasibility studies that have already taken place, is c £0.2m. Assuming that the first phase is successful and Nanoco proceeds with the two subsequent development phases, this could represent c £0.2m in revenue in FY22. However, Nanoco’s engagement with this Asian customer demonstrates that interest in the use of Nanoco’s quantum dots for infrared sensing applications continues to grow and that Nanoco is succeeding in expanding its customer base.

Using quantum dots for sensing applications

There is interest from ST, the significant Asian chemical company and others in using Nanoco’s HEATWAVE QD nanomaterials to extend the range of existing CMOS image sensors, which are made from silicon, out into the NIR and SWIR parts of the spectrum, that is the section from 900nm out to 1,800nm. This is because silicon sensors have adequate sensitivity in the visible part of the spectrum, but not in the infrared part. NIR sensors are used for facial recognition and AR applications in mobile phones, and for collision avoidance systems in autonomous vehicles. Silicon-based sensors are not as sensitive as sensors based on the compound semiconductor indium gallium arsenide (InGaAs) but are much less expensive to manufacture. Moreover, unlike the compound semiconductor option, a silicon sensor can readily be integrated with a silicon-based read-out circuit, further reducing cost. Depositing a layer of QDs tuned to the IR frequency of interest on the sensor potentially provides a cost-effective route for improving the range and sensitivity of sensors. Enhanced sensitivity results in lower power consumption, which for a mobile phone user means longer time between charges.

In May 2021, ST presented a paper at the Society for Information Display’s annual symposium. This announced that ST was ready to commercialise its QD photodetector platform technology and intended to have 940nm engineering samples ready for release to early adopters during calendar H221 and short-wave infrared (SWIR,

Biometric facial recognition: 940nm wavelength

Biometric facial recognition typically uses a structured light approach where a fixed pattern of light such as parallel stripes are projected onto the face and the camera analyses the distortion of the reflected image to construct a 3D reconstruction of the face. A safe, non-visible light wavelength is used so as not to be intrusive for the user. Typically 940nm is used because suitable emission sources are readily available. Common silicon image sensors have poor sensitivity at the required 940nm wavelength unless a costly process modifying the wavelength of all light incident on the sensor by a specific amount is used. Treating the sensors with HEATWAVE QDs improves their efficiency in the NIR region, reducing the amount of power required, and improves the speed at which facial recognition takes place. In addition, the sensors still work efficiently at visible wavelengths, so the same camera module can provide multiple functions in the same device, saving both space and cost.

Optical diagnostics: 400–1,650nm wavelength

Optical diagnostic systems are a way of monitoring a patient’s condition without having to take samples of blood. The systems send pulses of light through a patient’s skin and measure the amount of absorption and scattering that has occurred. The light can be tuned to a specific wavelength for detecting the levels of different molecules in the patient’s blood: 575nm for haemoglobin, which indicates the amount of oxygen in the blood; 455nm for bilirubin, which indicates liver function; and 1,650nm for glucose, which helps diabetics monitor the amount of insulin required. For a specific molecule at a specific wavelength, the level of absorption and scattering can be used to determine the levels of the target molecule in a patient’s blood, proving a non-invasive diagnostic path. Using a QD sensor improves efficiency compared with a silicon-based sensor, thus reducing power consumption, which extends usage time between charges for a user who is wearing the device all the time, for example for managing diabetes. The QDs also mean that sensors with small pixel size can be used. (ST cite pixel pitches of 2.2 µm and 1.6 µm.) This is beneficial for devices implanted in the hypodermis for analysis of interstitial fluid, where comfort for the patient also needs to be considered.

Range finding (LiDAR): 1,450nm and 1,550nm wavelengths

LiDAR works by measuring the amount of time it takes for an emitted beam of light to bounce off a target and be picked up by a detector and using that time to calculate the target distance. The round-trip takes less time for objects that are nearer. This is referred to as time of flight (ToF) detection. An array of emitters and detectors can be used to construct a 3D image of objects within the sensor’s field of view. LiDAR technology is being adopted in a range of fields including machine vision, autonomous vehicles, geographical mapping, incoming wind detection for wind turbines and military targeting. Significantly, the new iPhone 12 Pro includes a world-facing LiDAR scanner to improve AR experiences. The ability to integrate more accurate information about a handset user’s physical environment into the AR world could potentially catalyse the launch of ‘must-have’ AR apps. Emergence of such apps would not only be beneficial for iPhone 12 Pro sales but also encourage Android handset manufacturers to add LiDAR to their devices.

Sensors for range finding and LiDAR applications need to ensure that sunlight reflected from the general surroundings does not swamp the emitted or reflected light beams, so the wavelengths are chosen outside the visible part of the spectrum where the intensity of the sunlight will already have been reduced by natural effects such as water vapour. The 940nm wavelength used for facial recognition in mobile phones is not suitable because the longer distances involved require the use of more powerful beams of light, posing safety issues if people look into the beam of light. This potentially limits the use of LiDAR in autonomous vehicles, where higher power beams are required, holding back vehicle deployment. The power issue is being addressed by using longer wavelengths of light, which are eye-safe. Nanoco’s HEATWAVE QDs have demonstrated high efficiencies at these wavelengths. This helps improve LiDAR range without having to turn up the power and results in fast response times, which is useful for detecting rapidly moving objects.

Night vision: 700–1,100nm wavelength

Night vision applications typically use NIR light from the moon or an external illumination source to obtain images in low light situations. Current CMOS technology has relatively low pixel resolution at these wavelengths, forcing a choice between low final image resolution or over-sized sensor arrays. Nanoco’s HEATWAVE QDs enable high resolution CMOS sensors designed for visible light to operate efficiently at these longer wavelengths, enabling viewers to obtain highly detailed images for target identification.

Display: Small-scale activity at present

Display remains an important market for Nanoco. While its activities in this area reduced following the end of the long-term collaboration with Merck in June 2020, the group has formed relationships with new customers, a number of which are evaluating existing materials for use in TV displays. This activity is modest at present. Samsung currently dominates the market for TV displays containing cadmium-free QDs with, according to Nanoco’s estimates, around a 90% market share. If competitors such as Hisense, Huawei, TCL or Vizio were to capture material market share, this could represent an opportunity for Nanoco to reactivate its mothballed production facility dedicated to display applications, which has the capacity to manufacture c £30m of materials each year.

Grant underpins the future of Nanoco’s life sciences activity

In November 2020 Nanoco announced that it had secured grant funding from Innovate UK of just under £1m for a life sciences project to develop a heavy metal-free QD testing kit to detect COVID-19. The project lasts 18 months and represents a potential third segment for generating future revenues. The project is an extension of Nanoco’s earlier work using its VIVODOT QDs conjugated with antibodies as a diagnostic tool in the detection of cancer, which completed the proof-of-concept stage. The new project focuses specifically on COVID-19 antibodies and, if successful, the technology developed could be used to detect other viruses found in saliva, potentially including flu and future COVID-19 variants. Part of the funds are allocated for the development of a delivery system for the test, which will be done by a partner selected by Nanoco. The goal is to create an accurate and rapid self-administered test with results produced in situ.

Patent infringement lawsuit against Samsung

In February 2020 Nanoco announced that it had filed a patent infringement lawsuit against Samsung. The lawsuit alleges that Samsung has wilfully infringed the patents relating to Nanoco’s unique synthesis and resin capabilities for QDs. Nanoco is seeking a permanent injunction from further acts of infringement and unspecified but significant monetary damages. Nanoco and Samsung initially worked together to develop cadmium-free QDs based on Nanoco’s IP. However, Samsung ended the collaboration and launched its QD-based televisions without entering into a supply or licensing agreement with Nanoco.

Markman hearing appears positive

Prior to the trial itself, which is set for October 2021, there was a ‘Markman’ hearing in March 2021, which established the court’s interpretation of five key words or terms used in the patents that Nanoco alleges Samsung has infringed. These definitions may be important to either side’s arguments. The court has now issued its final report on the Markman hearing. This states that the judge rejected four of the five constructions proposed by Samsung and rejected one of the constructions proposed by Nanoco. In four of the five patents in the case, Nanoco's constructions were upheld and in the fifth patent Nanoco and Samsung each had one construction upheld.

Separate patent review extends litigation timescales

It is very common for a company defending a patent infringement claim to contest the validity of the patents both in the court case and also through a parallel process with the US Patent Trial and Appeal Board (PTAB), which Samsung is doing. The PTAB agreed to Samsung’s request to review the validity of the five patents in the case. In our view the PTAB’s decision to instigate an inter partes review (IPR) does not significantly swing the likely outcome of the court case one way or the other. This is because each of the five patents being contested contains a number, in some cases more than 20, of ‘claims’ that can be challenged. While the PTAB’s initial assessment showed that there was a ‘reasonable likelihood’ that Samsung would prevail with one or more of the claims challenged in its petition, which was key to the PTAB agreeing to the formal review, a patent remains valid and can be used as the basis of an infringement case as long as at least one of the claims relating to that patent stand up to the challenges. Moreover, during the process of deciding whether to proceed with the IPRs, Samsung had submitted a number of grounds for challenging each claim and the PTAB dismissed many of Samsung’s individual grounds of challenge (against Nanoco’s claims).

The PTAB’s decision to proceed with a formal IPR, which can take up to 12 months to reach a conclusion followed by appeals, has delayed the trial process. This is because Nanoco and Samsung independently petitioned the judge in Texas to delay the court trial until after the PTAB had completed the IPRs. The petitions were successful. In our view the change in sequence improves the likelihood of a positive outcome for Nanoco. There are three main reasons for this. (1) Since the IPRs will settle the majority of issues of patent validity, these matters will not have to be addressed in court, allowing Nanoco to focus at that point on the issues of infringement and damages. This is significant because it is likely that only one week will be allocated for the trial, giving each side only a limited time to present their own case and respond to the other side. (2) As Nanoco has more claims in this litigation suit than could be argued in a trial, going to trial after the IPRs will enable Nanoco to bring to court those claims already confirmed as valid by the PTAB. (3) If the trial takes place at a later date, Samsung will have sold more displays containing quantum dots which Nanoco alleges have been manufactured using its patents, potentially increasing the damages that would result from a favourable trial verdict. We note that to succeed in the overall case, Nanoco needs to win both the IPRs and the trial.

Scale of potential settlement significant

Nanoco has not revealed its estimates of the potential payout if the litigation is successful but has stated that between April 2015 and the present Samsung had sold more than 14 million TVs deploying QDs based on Nanoco IP in the US. These TVs had an average sales price of US$2,200–2,500 compared with the average price of a top of the range TV without QDs of c US$1,000. The value of the lost revenue to Nanoco this represents has not been disclosed. Had the alleged patent infringement not taken place, we believe Nanoco would have collected royalties from its partners, primarily Dow Chemical (NYSE:DOW), which would potentially be supplying QDs to Samsung in volumes higher than Nanoco could produce itself in Runcorn. If we assume that the cost of the QDs in each TV is equivalent to 10% of the uplift in price between QD and non-QD TV displays, and that Nanoco would have received a 12% royalty (as per our May 2017 initiation note) on these QDs, this represents US$14.4–18.0 in lost revenue per TV display or US$200–250m between April 2015 and the present in the United States alone. Any damages awarded could also make an additional allowance for future sales of infringing TVs and a possible uplift for wilfulness. Samsung would also be likely to seek a global negotiated settlement covering sales in other territories.

Separate funding secured to support litigation process

Nanoco has engaged US-based international IP law firm Mintz, Levin, Cohn, Ferris, Glovsky and Popeo to represent it in patent enforcement and litigation. The company has also signed a litigation funding agreement with a very large, undisclosed US litigation finance specialist with extensive experience in financing technology-based IP patent litigation matters. The finance specialist is funding the costs of the litigation against Samsung, which is likely to cost many millions of dollars to prosecute. The finance specialist undertook extensive due diligence, including the use of independent experts, before signing the agreement, giving management greater confidence in the likelihood of winning the case. The agreement means that Nanoco is able to actively progress the lawsuit without adversely affecting its cash runway (see below).

Cash runway extended past calendar H222

Management has taken a series of steps that have collectively reduced cash consumption from £0.8m/month in October 2019 to c £0.2m/month when contracted revenues and receipt of R&D tax credits are taken into account. This cost base should enable Nanoco to achieve cash break-even on annual revenues of c £6m, which could be reached as early as calendar 2023 if the ST programme moves to production at that point. Management’s target is to progress nanomaterial development and scale-up programmes, of which the programme with ST is the most advanced, so the company reaches break-even within three years.

While delaying the trial in the patent litigation against Samsung until after the IPR has improved the likelihood of a positive outcome for Nanoco, it has potentially extended the timescales for receiving the initial IPR judgement and trial verdict by around six months to late calendar 2022. In July 2021 Nanoco raised £3.15m (gross) through a non-dilutive loan note facility being provided by major shareholders (see our July update for details). The facility supports the cash runway for organic business activities past calendar H222, at which point there should be good visibility of potential production orders. The initial IPR judgement and verdict from the trial in the patent litigation against Samsung are both expected during calendar 2022, so the loan notes preserve both potential sources of value for shareholders.

The loan notes fall due in July 2024, potentially giving Nanoco time either to repay them using cash from commercial production income or from the litigation settlement. In the event of a successful outcome to the litigation with Samsung or a change of control of Nanoco, the note holders will also be entitled to a success bonus of 105% of the nominal value of the notes in addition to a repayment of the loan notes themselves. Management believes that the cost of servicing the potential premium for winning the litigation would not materially affect the economic impact of the award for shareholders.

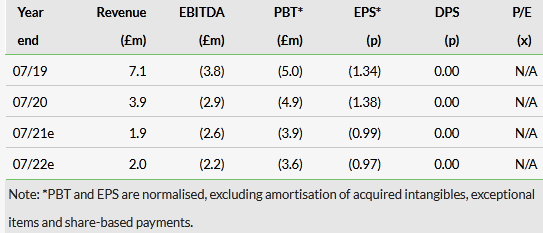

Our estimates, which are unchanged from our July update, assume that at least one of the development programmes currently under way starts to scale up during FY22. If they do not, management has the option to remove the group’s R&D, production and scale-up capabilities to focus on pursuing the lawsuit against Samsung. The cash runway extends past calendar H222 in this scenario as well.

Click on the PDF below to read the full report