- AIG shares have posted a powerful rally of over 75% from a multi-year low.

- What tool could have predicted such a rise?

- In this piece, we'll see how to find out which stocks could soar before they take off.

- Take advantage of professional tools to help you find the next stocks to take off with InvestingPro - A special limited-time discount of -10%!

-

Click here to take advantage of the special Pro+ rate for a one-year subscription.

-

Click here to take advantage of the special Pro+ rate for a two-year subscription.

- Click here to take advantage of the special Pro rate for a one-year subscription

- Click here to take advantage of the special Pro rate for a two-year subscription

American International Group (NYSE:AIG) stock is on a tear, reaching its highest point since October 2008 at $80.74 on Tuesday. This caps a remarkable 13% rally in just the past month, but the good news goes back even further.

Since March 2023, AIG has been on a long-term upward climb, surging over 75% from a multi-year low of $45.66. As we'll explore later, savvy investors with access to the right tools could have profited handsomely from this impressive rise.

As we'll explain later in this article, InvestingPro subscribers had all the information they needed to profit from AIG's sharp rise over the past year.

Several factors have fueled AIG's recent surge, including consistent earnings outperformance. The company has consistently exceeded analyst expectations for quarterly earnings throughout this period.

This article delves deeper into the factors driving AIG's success and explores strategies to help you identify the next potential high-flier stock to buy.

How do you spot stocks that are going to take off BEFORE they take off?

As the world's best investor Warren Buffett has pointed out on many occasions, the most important thing when investing for the long term is to focus on the intrinsic value of companies, i.e. their real value based on tangible elements such as balance sheets and income statements.

The aim is to take advantage of market inefficiencies, by identifying stocks whose value is lower than it should be, i.e. stocks that are undervalued. To determine this, professional investors generally use valuation models.

Valuation models are mathematical tools used to estimate the value of a company's shares by analyzing various factors such as future cash flows, expected growth rates, and the associated level of risk. However, there are many models to choose from, and not all of them are necessarily relevant to the stock being analyzed, making the task more difficult for investors.

Fortunately, technological advances mean that there are now tools available to make this task easier, even for investors with little financial knowledge.

One such tool is Fair Value, an exclusive indicator from the InvestingPro fundamental analysis and stock-market strategy platform, which proposes a precise target for each stock on the market, based on the synthesis of several recognized valuation models.

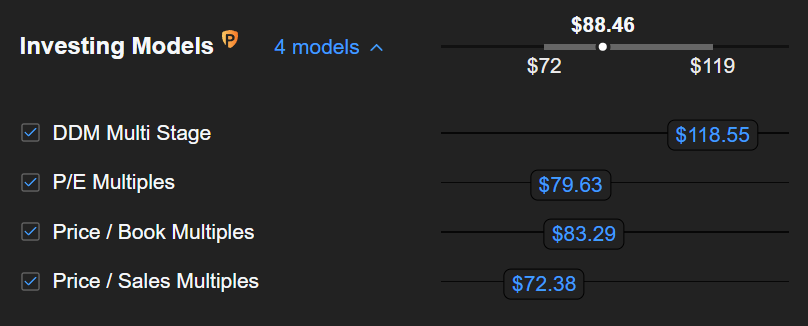

Here's how it looks on the InvestingPro platform (using the example of the AIG share mentioned above):

Source: InvestingPro

Advanced users can also customize the Fair Value calculation by choosing which models are taken into account and which are not.

And in practice, Fair Value has already enabled InvestingPro users to benefit from several particularly lucrative opportunities.

InvestingPro subscribers bagged a +75% gain thanks to the 'Fair Value' feature

A good example is AIG, which showed a potential upside of over 73% according to Fair Value on its low point last year, just before the current uptrend got underway.

As we saw above, the Fair Value of AIG shares is now $88.46, suggesting an additional upside potential of just over 10%.

While this may justify investors who already have the stock in their portfolios holding on to it for a while longer, it's by no means enough to justify opening a new position, as other stocks are showing much stronger bullish potential according to Fair Value.

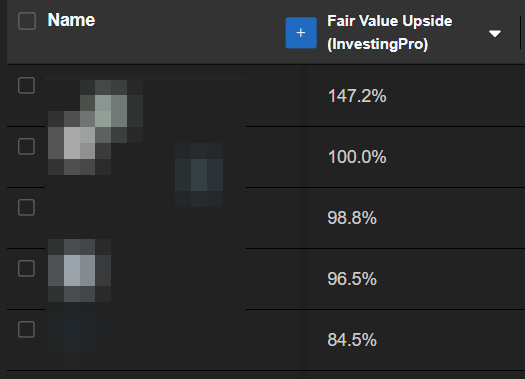

23 US financial stocks could explode by over 50% according to InvestingPro Fair Value

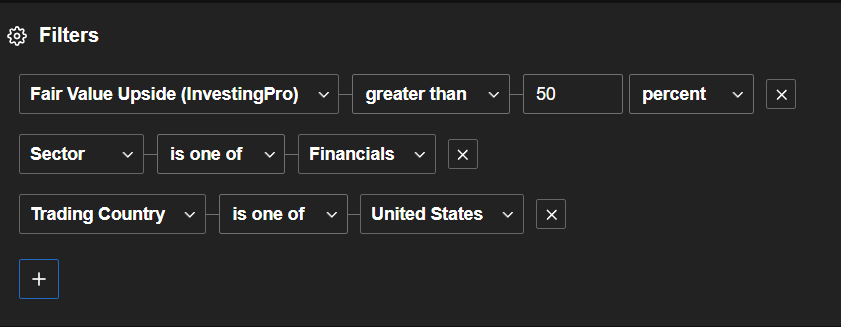

A search on the InvestingPro+ advanced screener has enabled us to identify 23 US-listed financial sector stocks, such as AIG, with a bullish potential of over 50% according to InvestingPro Fair Value.

Five of them could explode by more than 80% according to Fair Value:

To find out which stocks these are, InvestingPro+ subscribers can reproduce the following search on the screener in their member area:

Source: InvestingPro

If you haven't already subscribed to InvestingPro, now's the perfect time to do so: for a limited time, we're offering a -10% discount to our readers!

We are also offering a -10% discount on 1 and 2-year Pro subscriptions, but please note that some of the features mentioned in this article, such as stock searches by country or index, are reserved for Pro+ subscribers. With a Pro subscription, however, you'll be able to view the Fair Value, Health Score and ProTips of all stocks, use basic screener functions, access IA-managed outperforming ProPicks strategies, and much more!

You can also click here to learn more about InvestingPro and compare the Pro and Pro+ subscriptions in more detail. You'll also be able to take advantage of a -10% discount, but you'll need to manually enter the promo code "ACTUPRO" in the dedicated area at the last stage before payment.

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.