Over the last 30 days, Bitcoin delivered 34% gains, going from $27.6k to $37k. The impressive rally recovered the losses in the aftermath of the Terra (LUNA), Celsius, Blockfi, 3AC and FTX crashes. It bears noticing these Ponzi-like schemes became vulnerable after the Federal Reserve started its rapid interest rate hiking cycle in March 2022.

Then, the Bitcoin price was holding at $47.5k. Yet, in the new high-interest rate environment, the narrative around Bitcoin’s fourth halving in April 2024, combined with near-certain Bitcoin ETF approvals, seems to counter the market’s liquidity retraction.

As institutional capital gateways are expected to open, pioneers in the field have already gained massive Bitcoin gains. The most publicly exposed institutional investor is Michael Saylor’s MicroStrategy.

How has the company fared so far, and will Saylor’s enthusiasm infect other entities once the results are on the table?

MicroStrategy’s Bitcoin Gambit Already Paid Off

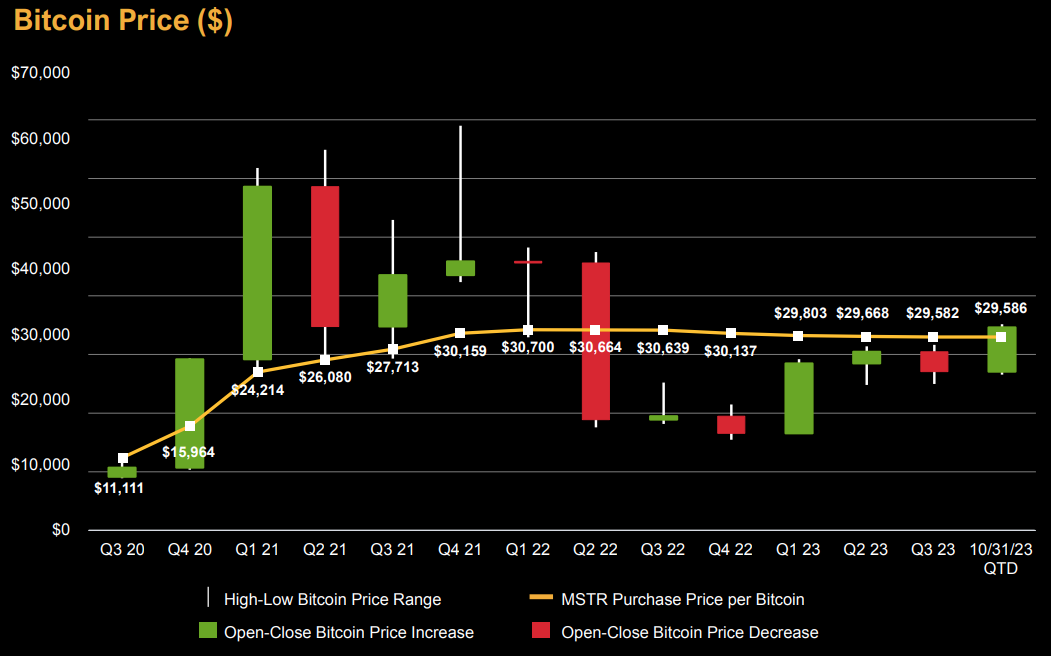

As MicroStrategy’s CEO in August 2020, Michael Saylor started the Bitcoin gambit with 21,454 BTC purchased, worth $250 million at the time. Although Saylor resigned as CEO in August 2022, turning to Executive Chairman duties, the BTC acquisition strategy continued.

Until November 1st, 2023, the company accumulated 158,400 bitcoins at an average purchase price of $29,609.65. The bet yielded $1.2 billion in unrealized profits. This “hodling” strategy aligns with the previous report that it is still the best bet for crypto investors.

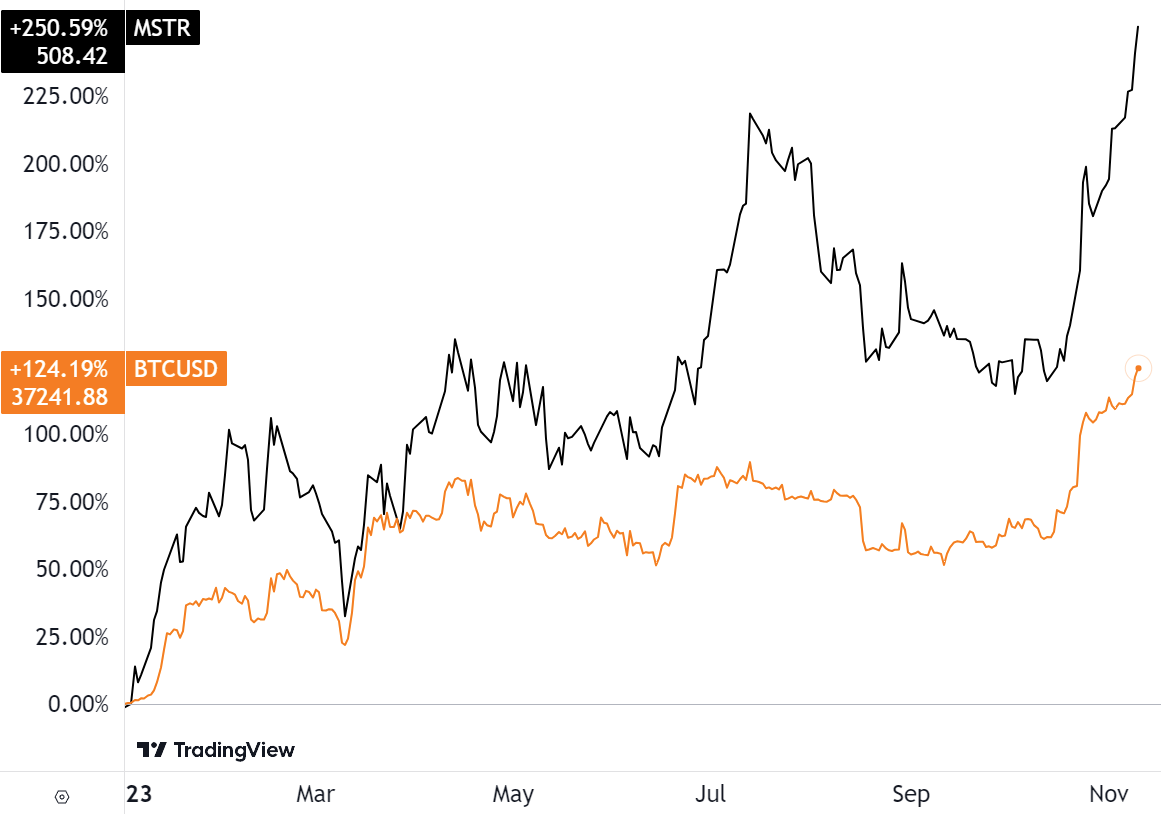

Over the three years, the investment amounted to $4.69 billion. The current BTC price of $37,082 means that MicroStrategy is sitting on 25.2% gains. More importantly, this had a multiplier effect on MSTR stock, having gained +250% value year-to-date.

The company’s main revenue comes from subscriptions for its enterprise analytics software. In Q3, this revenue increased 28% year-over-year to $21 million, while the software license revenue brought in $45 million, a 16$ year-over-year uptick.

Yet, MicroStrategy has effectively served as a Bitcoin exposure proxy without holding BTC in a self-custodial wallet. This concept is behind much-hyped Bitcoin ETFs, as even more direct spot exposure.

As BTC Price Goes Up, Greater Danger of Selloffs?

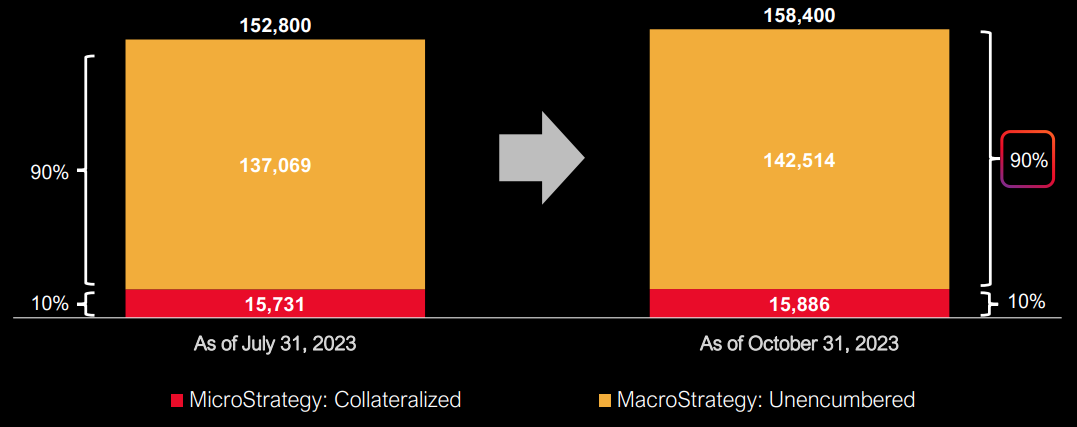

The company leveraged debt to get to this level of BTC exposure via the MacroStrategy division. Through outstanding debt and convertible notes, the resulting annualized interest expense sits at $35.5 million. For comparison, MicroStrategy reported an operating loss (non-GAAP) of $8 million in Q3.

However, the quarter’s non-cash digital asset impairment charge sits at $34 million in the positive. This accounts for Bitcoin’s price moves in MicroStrategy’s balance sheets. This leads to 90% of Saylor’s BTC holdings as “unencumbered.”

In other words, Saylor is far more likely to sell boosted MSTR shares, courtesy of BTC, to keep servicing debt obligations and cover operating losses.

Michael Saylor’s Expectations

On November 2nd, Michael Saylor appeared on CNBC’s Squawk on the Street. Remaining true to Bitcoin maximalism, he noted that we are leaving the era of altcoins which have “distracted and demolished shareholder value.”

Referring to the critical Bitcoin supply and demand dynamic moving forward, Saylor leans on the higher demand side.

“You’re going to see $12 billion of natural selling per year converted into $6 billion of natural selling a year, at the same time as things like spot bitcoin ETFs increase the demand for bitcoin,”

With the Sam Bankman-Fried trial finalized, it seems that the guilty verdict on all fraud counts marks the depletion of Bitcoin’s FUD supply. However, it also considers that the New York Fed recession indicator is at 56% in the next 12 months.

If a recession materializes, it is not clear how Bitcoin investors would react. This largely depends on its intensity and longevity.

***

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.