The start of the new month brings fresh global manufacturing data in the form of the PMIs. The surveys will provide an important update on broader factory sector performance in June after the flash PMIs painted a downbeat picture for the major developed economies.

The preliminary June PMI data showed factory orders falling for the first time in two years in the US with renewed declines also seen in the UK and Japan. The eurozone - closest to the war in Ukraine - saw orders fall for a second successive month. The deteriorating manufacturing demand picture, alongside a worsening trend in services growth, led to an immediate recalibration of market pricing for interest rate paths in the US and Europe, and also saw commodity prices come under pressure.

The final manufacturing PMI will provide an all-important missing piece of the June picture via updated production numbers for mainland China. In particular, analysts will be assessing whether the relaxation of some COVID-19 containment measures will have helped global supply chains improve further, especially across Asia.

CPI data is meanwhile expected for the Eurozone and Indonesia, with inflation expected to remain elevated at record levels in the former. At the same time, policymakers will be keeping a close eye on Eurozone unemployment figures, which has fallen continuously over the year to signal a tightening labour market.

Since its invasion of Ukraine and the subsequent stringent sanctions, Russia's economic conditions have deteriorated sharply. Latest Russian GDP, unemployment, and retail sales data will detail how the country has fared in May.

Updated first-quarter GDP figures for the US and UK will also come to light this week and will reveal more details and granularity into the economic trends in the first quarter of the year, partly reflecting the impact of the war.

Elsewhere, Brazil, Japan, and South Korea industrial production data will be updated and be gleaned for the impact of global supply constraints and price pressures.

Central bank policy enters uncharted territory

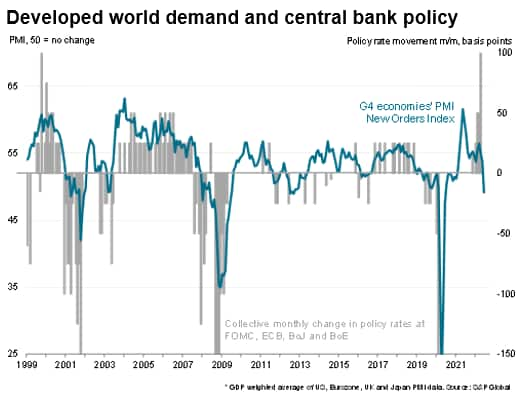

We are in unchartered territory as far as central bank policy is concerned, according to S&P Global's PMI survey data. The provisional flash PMI data for June (see special report) covering the US, Eurozone, UK, and Japan showed business activity growth slowing sharply as a result of a severe worsening of demand conditions.

New orders, in fact, fell on aggregate across these major developed economies for the first time since the initial pandemic lockdowns in the second quarter of 2020. However, demand is now falling not because of COVID-19 containment measures, but because the soaring cost of living is hitting just as the economic boost from the reopening of economies from the Omicron wave is starting to fade.

Historical analysis of the surveys' leading indicators, such as manufacturing orders-to-inventory ratios and companies' future output expectations, are now consistent with economic contractions in the US and Europe in the third quarter, absent a sudden revival in demand. This, as our chart shows, would be an unprecedented demand environment in which to be hiking interest rates.

However, a welcome side-effect of the downturn in demand has been an easing of price pressures. Although still elevated, the PMI survey gauges of inflationary pressures in both manufacturing and services have generally fallen from recent peaks. It, therefore, seems that slowing demand is already doing so of the job of tighter monetary policy.

Key diary events

Monday 27 Jun

Bank of Japan Summary of Opinions (Jun)

United States Durable Goods (May)

Tuesday 28 Jun

Germany GfK Consumer Confidence (Jul)

Italy Industrial Sales (Apr)

Mexico Unemployment (May)

South Africa Consumer Confidence (Q2)

South Korea Consumer Confidence (June)

United States CB Consumer Confidence (Jun)

United States Goods Trade Balance (May)

United States House Price Index (April)

Wednesday 29 Jun

Australia Retail Sales (May)

Eurozone Consumer Confidence (Jun)

Japan Retail Sales (May)

Russia GDP (May)

Russia Industrial Production (May)

Russia Retail Sales (May)

Russia Unemployment (May)

Spain CPI (Jun)

Spain Retail Sales (May)

United States GDP (Q1)

Thursday 30 Jun

Brazil Unemployment (May)

Canada GDP (April)

China NBS Manufacturing/Non-Manufacturing PMI (Jun)

Eurozone Unemployment (May)

France CPI (May)

Germany CPI (Jun)

Germany Retail Sales (May)

Germany Unemployment (Jun)

Japan Industrial Production (May)

South Korea Industrial Production (May)

United Kingdom GDP (Q1)

Friday 01 Jul

Hong Kong, Canada Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Jun)

Brazil Industrial Production (May)

Eurozone CPI (Jun)

India Balance of Trade (Jun)

Indonesia CPI (Jun) Italy CPI (Jun)

Japan Tankan Survey (Q2)

Japan Unemployment (May)

Mexico Business Confidence (Jun)

South Korea Balance of Trade (Jun)

United Kingdom Nationwide House Price Index (Jun)

United States ISM Manufacturing PMI (Jun)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

June Global Manufacturing PMIs

After June's flash PMIs pointed to a weakening factory sector, attention will shift to final global manufacturing PMI data for June, notably for Asia and especially in terms of the signals for supply chains and prices.

Americas: US and Canada GDP, Brazil and Mexico unemployment, Mexico consumer confidence

Final US GDP estimates for Q1 as well as estimates for GDP growth for Canada in May are expected. Prior data showed the US economy contracting at a 1.4% annualised rate in the first quarter, but inventories and trade were seen as major drags, meaning the headline understated the underlying health of the economy. Current estimates suggest a rebound to 0.8% growth in the second quarter, averting recession. But recent PMI data have suggested a new downturn in the third quarter is a rising possibility. US durable goods orders, Conference Board consumer confidence, trade numbers, and house price data are also all updated.

Europe: Eurozone unemployment, Consumer confidence, and CPI, UK GDP

Labour market data for the Eurozone are pending, with country-level data for France and Germany scheduled. Alongside these two, Italy will see the release of inflation data as well as Eurozone level inflation data. Russia will see the release of a plethora of data covering industrial production, retail sales, and the labour market.

Revised UK first-quarter GDP data are also issued, providing fresh granularity on spending and investment trends.

Asia-Pacific: Japan Tankan Survey, industrial production, employment, and retail sales plus retail sales for South Korea and Australia

The impact of changing COVID-19 restrictions in mainland China - as well as the sustained impact of its zero COVID policy on supply chains - will be eagerly assessed through updated PMI numbers. Meanwhile, the closely watched Tankan survey of manufacturers for Q2 is scheduled for Japan, which PMI data have suggested will have improved yet remain constrained by supply conditions. Japan also sees official statistical updates for industrial production, retail sales, and employment.

South Korea and Australia will also see consumer spending on retail figures released, while India will release figures on imports and exports for June.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."