The Centrist Emmanuel Macron leading by 23.87% of the votes could underpin the common currency in the beginning of the week driving it to 1.0908 which is its highest level since last Nov. 11, before setting back for trading currently near 1.0850.

It has been widely expected to watch Macron and Marine Le Pen in the final but Macron leading in this preliminary phase could give the single currency momentum.

What is widely expected now is to see on May 7 runoff a repeated case of what has happened in 2002 to drop down the far-right nationalist radical candidate Marine Le Pen for keeping France core country in EU.

The French presidential results could drive the investors to load risky assets in the beginning of the new week driving the low yielding currencies down such as the Japanese yen to watch USDJPY trading close to 110.50 supporting the Japanese exporters shares in the first Asian session of this week.

The demand for gold as a safe haven has eased down driving it to be traded around $1270 per ounce having its first existence since Apr. 10 above daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 1295.46.

The yields in the US money market rose also in the beginning of this week giving support to the greenback to watch now US 10yr yield near 2.31%, after it had fallen last week to 2.17% amid risk aversion sentiment.

The market eyes will be closely next on the fiscal situation US which can face a new governmental shutdown, in the case of congress refusing of the Governmental bill by the end of this week.

This is not far away from happening, after the failure of passing Trump's health care bill, while the US government efforts to reach acceptable plans to reform taxes are still on.

U.S. Treasury Secretary Steven Mnuchin has said last week that these plans have progressed supporting the risk appetite.

Mnuchin 's comments could prop S&P 500 up to get back 19.74 points last week, after it had been depressed by energy companies shares slide, as EIA data has shown U.S. gasoline supplies increasing for the first time since February with continued crude output rising.

WTI is still unchanged trading well below $50 per barrel near $49.80, after reaching $49.18 by the end of last week.

Baker Hughes weekly report came by the end of last week to say that US Oil Rigs rose for the 14th consecutive week adding this time 5 rigs to reach 68 which is the highest level since April 2015.

The Markets will be waiting by the end of this week for the flash release of US GDP which is expected show annual growth by 1.5%.

After the Fed's Beige book has underscored last week that "The economy continued to grow across the U.S. at a modest-to-moderate pace in recent weeks without a rapid pickup, as a tight labor market helped broaden wage gains, though consumer spending was mixed.

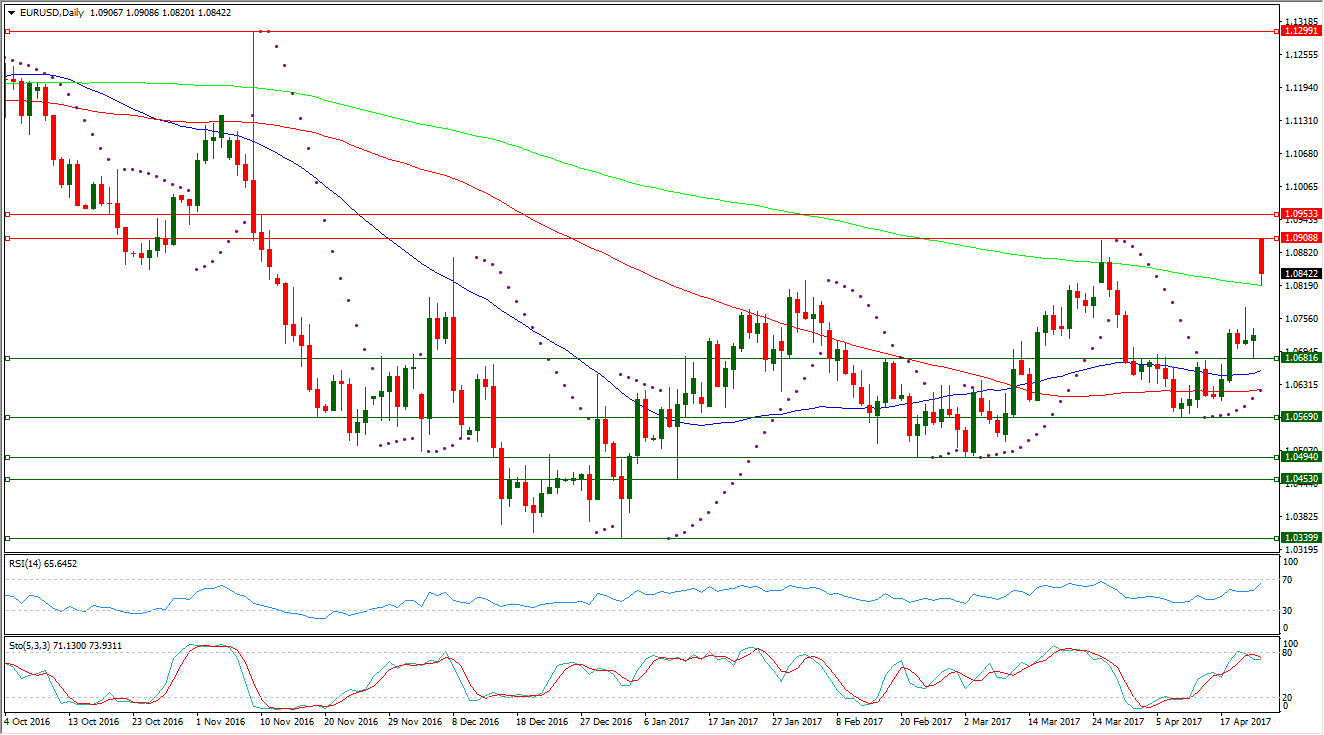

After forming series of higher lows above 1.0339 which has been reached on the third day of this year to be the lowest level since December 2002, EURUSD could form a second bottom at 1.0681 last Friday.

EURUSD could form an upside gap in the beginning this new week to reach 1.0908 surpassing its previous resistance at 1.0905 which has been formed on last Mar. 27, before diminishing to for currently near 1.0850.

Despite retreating to 1.0850, The pair is still keeping the place it gained above its daily SMA200

EURUSD daily RSI-14 is referring now to existence inside the neutral region reading 65.645.

EURUSD daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the neutral region at 71.130 leading to the downside its signal line which is at 73.931, after sliding from 1.0908.

EURUSD is in its eighth day of existence above its daily Parabolic SAR (step 0.02, maximum 0.2) which is reading today 1.0619.

Important levels: Daily SMA50 @ 1.0658, Daily SMA100 @ 1.0622 and Daily SMA200 @ 1.0818

S&R:

S1: 1.0681

S2: 1.0569

S3: 1.0494

R1: 1.0908

R2: 1.0953

R3: 1.0000