US: Upcoming data will indicate the likelihood of one more rate rise

The Federal Reserve's Jackson Hole conference indicated that the September FOMC meeting is likely to see the Fed funds policy rate range held at 5.25-5.5%. We've also seen signalling that the Fed could have to hike again later this year, given that the strength in the economy is leading to doubt that inflation will sustainably return to the 2% target with the stance of monetary policy as it currently is. The upcoming data will be important in gauging the likelihood of one more rate rise, which markets currently peg at a 50-50 call.

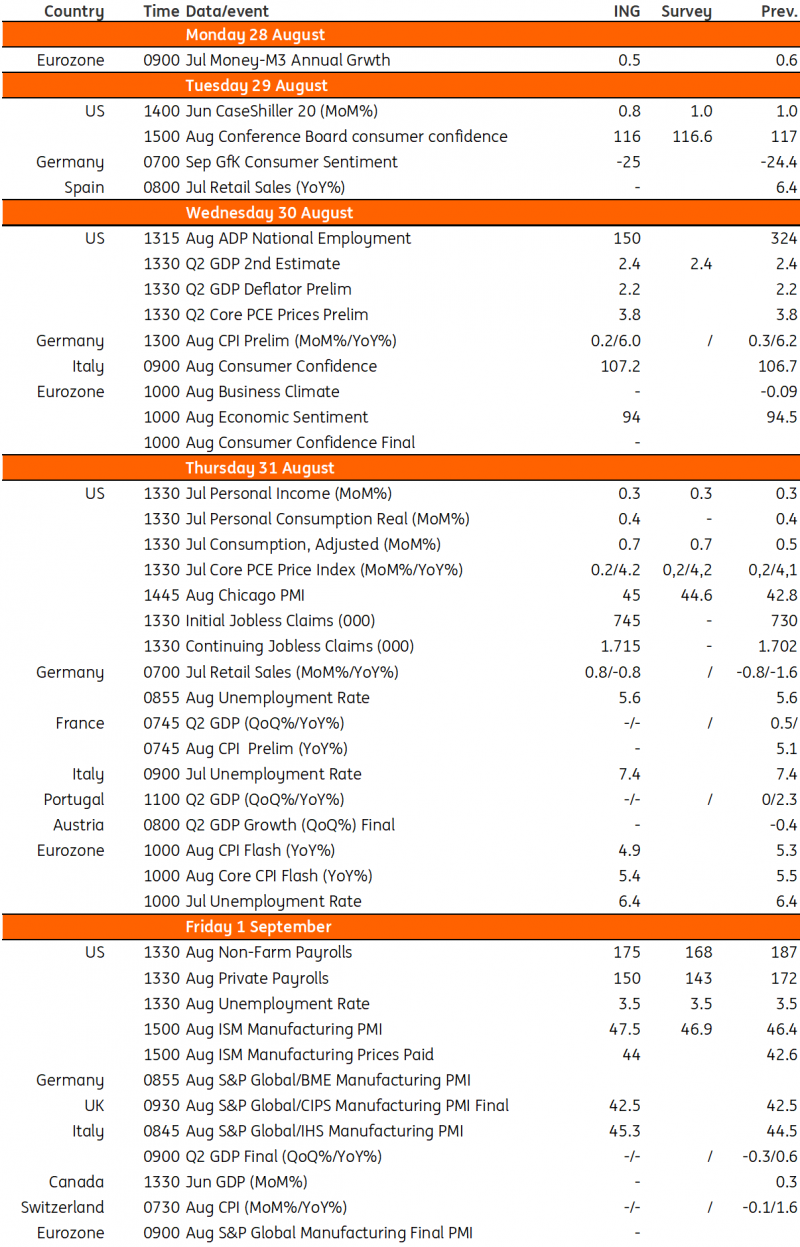

The jobs report and the personal income and spending numbers will be the key data points for markets, with the consensus being for a further slowing in the rate of payroll increases but the unemployment rate remaining very low at just 3.5%. Meanwhile, the income and spending numbers are likely to show that spending continues to outstrip income growth, with households continuing to rely on credit and the running down of savings to fund their lifestyle spending habits.

We suspect that this means we could see GDP expand at more than a 3% annualised rate in the third quarter – but with student loan repayments restarting in September and pandemic-era savings being run down quickly, the fourth quarter number is likely to be substantially slower. Core inflation is also looking more favourable. We expect the core personal consumer expenditure deflator to come in at a relatively benign 0.2% month-on-month, and we don't believe that the Fed will carry through with the oft-threatened final rate hike.

Eurozone: Next week will be all about inflation

For the eurozone, next week will be all about inflation. After August last year saw a huge spike in energy prices, we expect base effects to cause a drop. The most important reading to look out for will be core inflation, which remained stubbornly high at 5.5% in July and is currently being pushed higher by the effects of government subsidies. The question now is whether or not we'll begin to see some relief here. We expect the largest deceleration of core inflation to happen later in the year, but the August number will be a key factor in determining the European Central Bank's decision in September.