US: Dovish shift in the Fed's policy stance has seen Treasury yields fall sharply

The dovish shift in the Federal Reserve's policy stance has seen Treasury yields fall sharply and the dollar sell off quite significantly. This has raised the question, does the Fed know something that we don’t or is this shift more down to the argument that real interest rates are already high and will rise further as inflation falls? This de facto tightening of the policy stance could in itself offer scope for interest rate cuts, as suggested by Fed Governor Chris Waller. Nonetheless, the recent data remains strong with a tight jobs market, and core inflation still running double its target at 4% while retail sales activity remained firm in November. Consequently, we don’t expect an imminent interest rate cut and continue to believe that a second-quarter move is more likely than one in the first quarter.

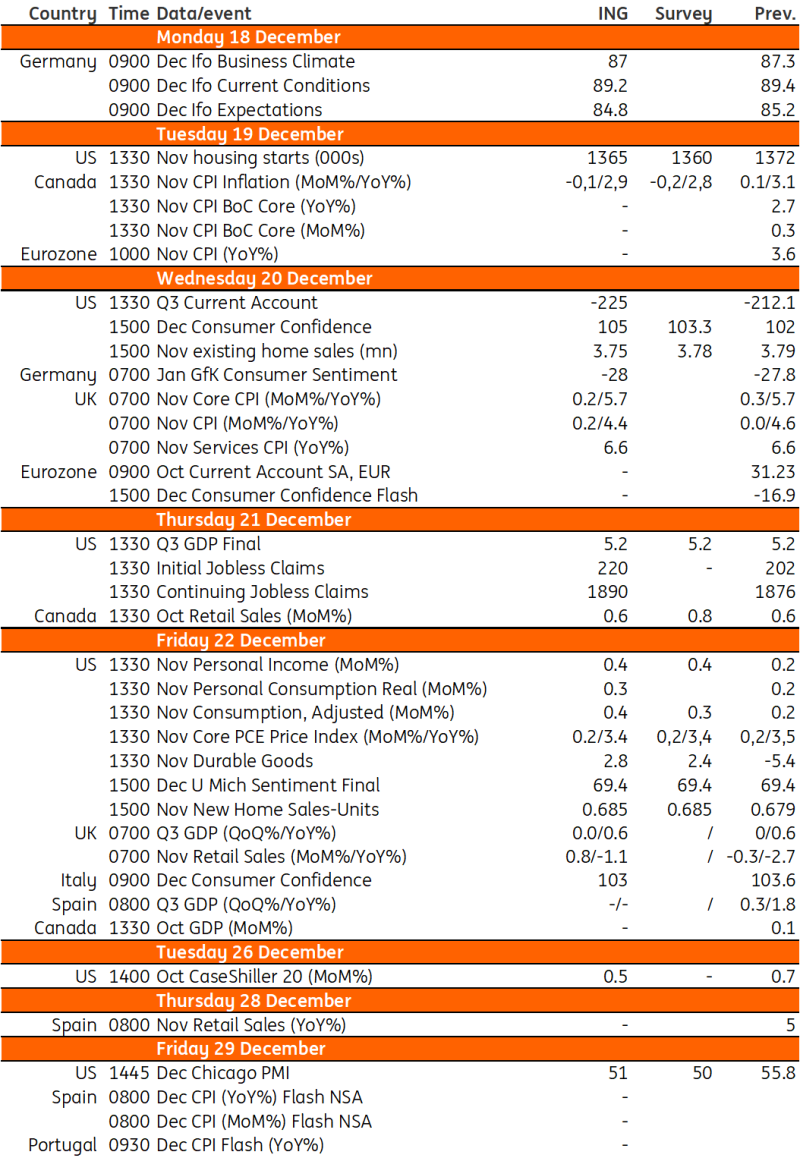

The data over the next couple of weeks includes housing transactions, which are likely to remain subdued due to a general lack of affordability that has translated into very weak mortgage application activity for home purchases. Durable goods orders should rebound partially after a big aircraft order-related drop last month while the November personal spending and income report will provide an update on the Fed’s favoured measure of inflation – the core personal consumer expenditure deflator – which is expected to be more benign than the core CPI print, coming in at 0.2% month-on-month rather than 0.3%.

UK: Services inflation to remain sticky as markets eye several 2024 rate cuts

The Bank of England set a different narrative to the Federal Reserve at its final meeting of the year and offered another rebuff against 2024 rate cuts. The fact is that markets aren’t taking much notice, and investors are pricing four rate cuts next year. We agree with that conclusion, though we’ll have to wait for further progress on domestically-generated inflation before the Bank pulls the trigger. The Bank said in its latest statement that the recent fall in services inflation isn’t totally down to factors that are relevant for monetary policy. Certainly, it looks like services inflation will remain sticky in the near term and we expect it to stay at 6.6% next week and around these levels into early next year. But by next summer, we expect services inflation to be back to the 4% area and headline CPI should be pretty close to target. That’s likely to be a catalyst for rate cuts, and our base case is August for the first move – though if markets are ultimately right that the ECB/Fed hike early in the spring, then the BoE could feasibly move earlier too.