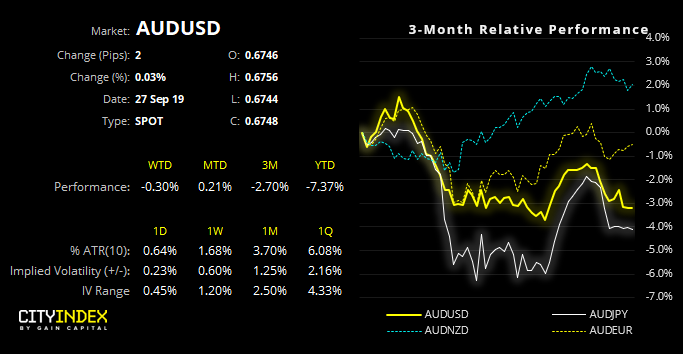

With several AUD pairs sitting at key levels, it could be approaching the time for a make or break for the Aussie.

AUD/USD remains within an established bearish channel on the daily chart. The September rally stalled around the 50% retracement level before rolling over, and prices are now interacting with the flash-crash low set early January. With the 20-day EMA capping the weekly high and Wednesday providing a bearish engulfing candle, the swing high could be in place at 0.6806. Yesterday’s inside bar shows compression is underway, which can be the prelude to range expansion.

AUD/JPY is consolidating above the June 2016 low and will likely track the direction of sentiment; so if indices and USD/JPY are to continue to rebound we could see USD/JPY rise in tandem, whereas if they turn lower, this FX barometer of risk could break through key support and bears take another crack at the year to date lows. Whilst a near-term bounce could be possible, and we’d favor an eventual break lower due to the dominant bearish trend.

AUD/NZD has broken out of its latest channel, although the downside break is yet to compel. Wednesday’s bullish hammer respected support around 1.0700 and spoiled the potential double top pattern previously highlighted. Still, yesterday’s bearish candle spanned most of the hammer’s range and closed near the lows, so bulls are not out of the woods yet. That said, we note a potential bullish wedge is forming on the four-hour chart with a small bullish divergence, so 1.0700 appears to be a key level going forward for bulls and bears.

"Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation, and needs of any particular recipient.

Any references to historical price movements or levels are informational based on our analysis, and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions."