This article was written exclusively for Investing.com.

The stock market has seen a change in the tides. It is now pricing in the possibility of the tapering process ending sooner and interest rates rising faster.

The NASDAQ Composite has been wobbling as the equity market starts to consider the implications of a more hawkish Fed. As a result, the NASDAQ is showing severe cracks beneath the surface, which suggests the bottom may be ready to fall out.

It is tough to see the cracks forming if you are staring at only the S&P 500 and the NASDAQ 100. But the NASDAQ Composite has seen the number of stocks making new lows rising, while the percentage of stocks trading below their 200-day moving average drifting lower as the index makes new highs.

Changes in the Fed’s stance from ultra-dovish to a less dovish posture may also significantly impact the index's performance. Even the release of the FOMC minutes late on Wednesday indicated that the Fed is thinking about tapering its asset purchases at a faster pace.

Additionally, the Fed fund futures are now forecasting the first-rate hike possibly as early as May. This is helping to send the dollar index and yields on the 2-year Treasury note rocketing higher, suggesting the market is also beginning to price in the chance that the Fed tapers faster than planned.

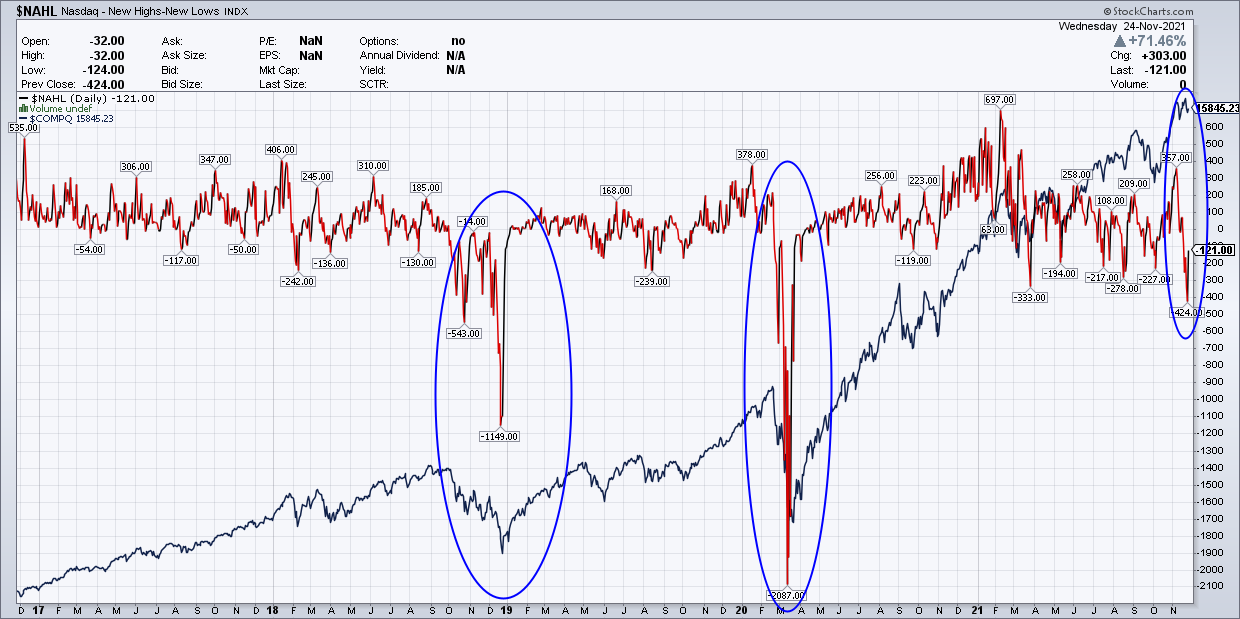

New Lows Outpacing New Highs

This has led to some uninspiring performance in the NASDAQ Composite over the last few weeks. The most notable is that the number of stocks making new lows exceeds those making new highs.

On Nov. 23, there were 424 more new lows made than new highs. That difference was the lowest since the March 2020 Covid crash, and before that, all the way back into the winter of 2018. But at those points, the NASDAQ Composite was well off its highs, not still trading at it.

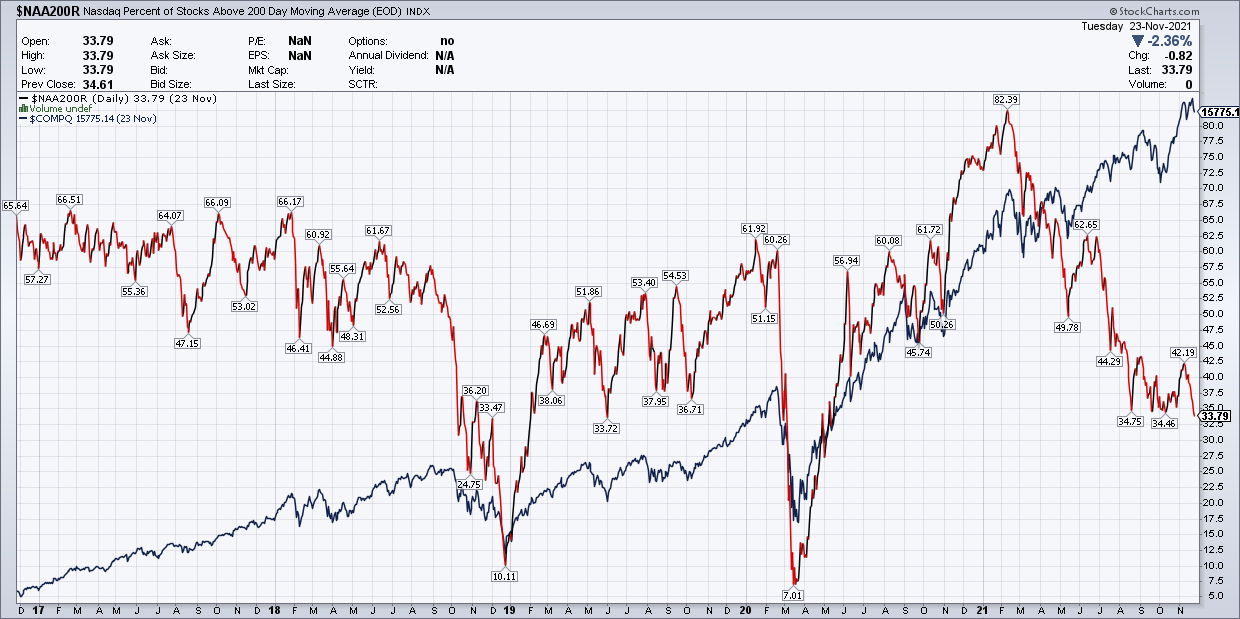

Percentage of Stocks Below Their 200-Day Moving Average

Meanwhile, the percentage of stocks trading below their 200-day moving average on the NASDAQ Composite sits around 34%, a low level. This would suggest that most stocks in the NASDAQ are no longer trading in a long-term uptrend. This very low value is not typically associated with a composite sitting right around its all-time highs.

A Divergent Advance-Decline Line

It gets worse because the advance-decline line of the NASDAQ has been steadily drifting lower. Historically a divergent advance-decline line from the broader index is a bearish reversal signal.

However, there is one positive for the bulls. The current advance-decline line mimicked that of 2014 when it took until the summer of 2015 for the NASDAQ to turn lower. So, an advance-decline line peaking in early 2021 doesn’t have to indicate that the NASDAQ rally is over.

However, it does tell us that the underlying wellbeing of most members of the NASDAQ Composite is not healthy. Most stocks in the NASDAQ Composite appear to be struggling, and fewer stocks seem to be lifting the index higher.

While this pattern can indeed persist, it would suggest that this current rally is likely running on fumes or, at best, in the very late innings of its life cycle. A decline of some degree is likely needed to reset the bull market and a resumption of the longer-term uptrend.