- Amazon stock has been in a correction ahead of earnings.

- However, the e-commerce giant maintains a strong position in the sector.

- Ahead of a key Q2 report, investors are expecting AWS and ad business to keep driving sales.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Amazon (NASDAQ:AMZN), the e-commerce behemoth, is gearing up to report its second-quarter earnings in the week ahead. While the stock has experienced a modest pullback in recent weeks alongside other big tech names, investor optimism remains high.

The company's market capitalization surged past $2 trillion earlier this year, fueled by expectations of continued growth driven by its core e-commerce business and emerging ventures like Amazon Ads and Amazon Web Services (AWS).

Amazon Ads has demonstrated impressive growth, with first-quarter revenue soaring 24% year-over-year. The introduction of ads on Prime Video is expected to further fuel this expansion.

AWS, Amazon's cloud computing arm, also continues to be a major growth driver, with analysts at Morgan Stanley (NYSE:MS) projecting 18% year-over-year growth fueled by the adoption of generative AI.

The recent Prime Day event, which generated $14.2 billion in sales, has added to the positive sentiment surrounding Amazon. However, with such high expectations, investors will be closely watching for any signs of weakness in the company's performance.

High Expectations for Continued Growth

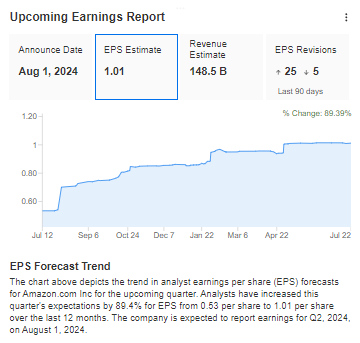

Forecasts project significant year-on-year growth in Amazon's earnings per share (EPS). If Amazon meets or exceeds the expected EPS of $1.01 and revenues of $148.5 billion, it will extend the impressive upward trend that began in the first quarter of 2023.

Source: InvestingPro

Analysts' optimism is evident, with upward revisions outnumbering downward revisions by five times.

Source: InvestingPro

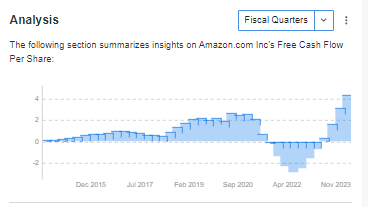

This confidence is bolstered by Amazon's increasing free cash flow relative to its share price, which comfortably covers interest payments - a crucial factor in the current high-interest-rate environment.

Source: InvestingPro

Technical Analysis: A Correction Is Developing

The technical chart reveals a corrective phase, which currently supports bearish sentiment ahead of the results announcement. Sellers have room to drive declines further.

The initial test for sellers will be the demand zone around $176 per share, a critical level marked by the largest correction in the uptrend. If sellers breach this zone, the next target will be the support level at approximately $167.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.