Invesco Asia Trust (LON:IAT) delivered a 12.4% NAV total return (TR) over the 12 months to end-December 2024, bolstered by the stock market rally in China and Hong Kong (to which IAT’s managers patiently maintained an overweight exposure) on the back of stimulus measures announced by the authorities in September 2024.

While IAT’s return is somewhat behind the 14.0% posted by its benchmark, IAT’s share price total return of 15.8% was ahead of it, and the trust maintains a strong mid- and long-term track record of outperforming the market and its peer average. IAT remains positioned to benefit from the consumption growth story of the region via a combination of internet companies, consumer-related businesses (including e-commerce) and financials stocks, among others.

The managers also see opportunities across tech and manufacturing, even if they are now cautiously underweight Taiwan on valuation grounds. Finally, their below-benchmark position in Indian equities (which also command high valuations relative to the broader region) is coupled with an overweight exposure to Indonesia, where the managers see an attractive combination of growth prospects and undemanding valuations.

IAT helps investors navigate Asian complexities

Asia should remain a key driver of global economic growth in the years to come, and IAT’s managers highlight the combination of undemanding average valuations across the region and a solid double-digit corporate earnings outlook for 2025. That said, there are multiple factors at play that may affect local economic prospects and in turn lead to a disparity in equity valuations. These include the AI boom (especially in the context of Taiwan and South Korea), China’s property crisis, South Korea’s ‘Corporate Value-Up’ programme, as well as the strong bull market in India. Expertise in the Asian region and stock-picking ability may prove critical to generating attractive returns. Therefore, we consider IAT, a high-quality vehicle pursuing a contrarian, bottom-up valuation-aware strategy, an appealing gateway to Asian equities.

Merger with Asia Dragon Trust offers many benefits

We believe that a successful merger with Asia Dragon Trust (DGN) to create Invesco Asia Dragon Trust would bring several benefits to the shareholders of both trusts. The greater size of the combined trust (with the possibility of inclusion into the UK 250 flagship index), coupled with the well-proven strategy of IAT’s managers, as well as the attractive proposed new fee structure, may put the trust on the radar of a wider investor audience. Moreover, investors would have a cash exit option in the form of an unconditional tender offer for up to 100% of the issued share capital conducted every three years, which would replace IAT’s existing performance-related conditional tender offer. The trust will retain the policy of paying an annualised dividend at 4% of opening NAV, but move from semi-annual to quarterly payments.

NOT INTENDED FOR PERSONS IN THE EEA

In search of underappreciated Asian stocks

We continue to view IAT as an attractive route to gain exposure to the emerging and developing Asia region and believe it is well positioned to become the ‘go-to’ Asian trust following the proposed merger with DGN. Launched in 1995, IAT aims to provide long-term capital growth through investing in a well-diversified portfolio of companies listed in Asia. Invesco has managed IAT since its first day of trading on 11 July 1995, as IAT became one of two successor companies to Drayton Far Eastern investment trust. IAT’s benchmark is the MSCI AC Asia ex-Japan Index (the MSCI Asia Pacific ex-Japan Index prior to 2015), reflecting the trust’s primary focus on Asia and persistently low exposure to Australasia (ie Australia, New Zealand and some neighbouring islands).

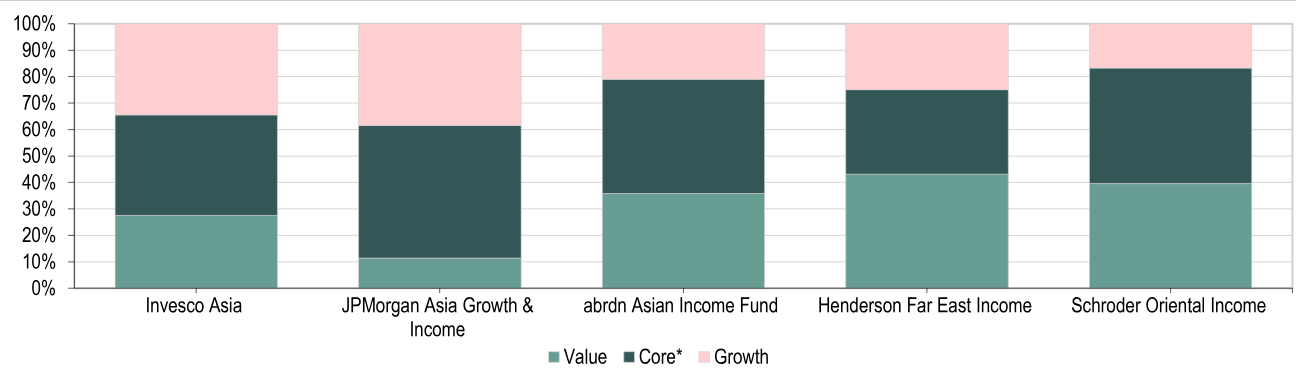

IAT may be described as an ‘all-weather’ trust with a balanced approach to growth and income, pursuing an enhanced dividend policy (see details below). This is illustrated by data from Morningstar (see Exhibit 1), which show that IAT has a higher positioning towards growth names than the more income-oriented abrdn Asian Income Fund (AAIF) and Schroder Oriental Income (SOI), as well as Henderson Far East Income (HFEL), which recently repositioned its portfolio towards structural growth opportunities, while still protecting income. IAT’s value tilt remains above that of JPMorgan (NYSE:JPM) Asian Growth & Income, which also provides a regular dividend to investors paid partially out of capital.

Exhibit 1: Portfolio breakdown by style, IAT versus peers

Source: Morningstar, Edison Investment Research. Note: *Core represents companies with value and growth scores that are not substantially different; see Morningstar's Style Box for details.

Unconstrained, high-conviction portfolio outperforming the broader market

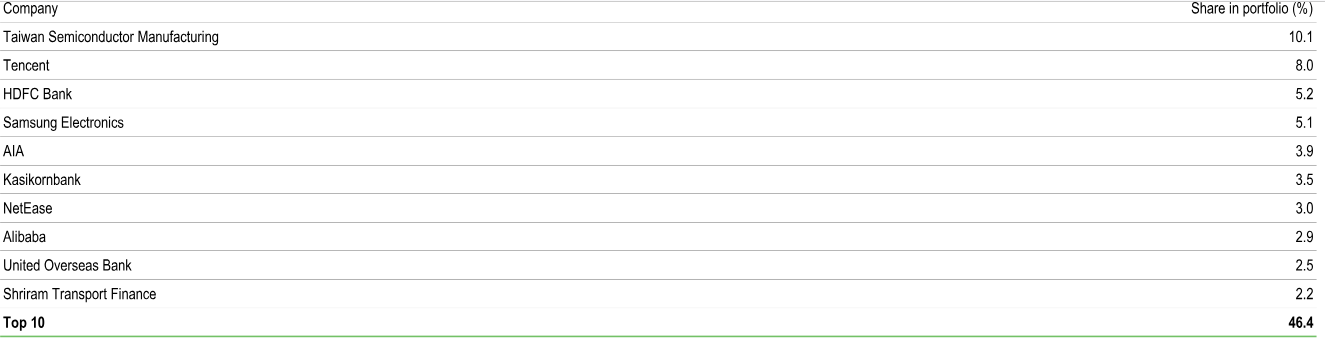

IAT runs a concentrated, high-conviction strategy and held 57 investments as of 16 December 2024, selected from an investable universe of around 1,000 stocks with a market cap above US$1bn and daily liquidity of more than US$5m. Its top 10 holdings make up close to half of the portfolio value, see Exhibit 2. IAT looks for ‘unloved’ investments with strong fundamentals trading at undemanding valuations. Its managers are also open to exploring emerging trends and turnaround stories. As a result, the trust pursues an unconstrained, bottom-up approach to stock-picking, allowing it to potentially benefit from attractively priced equities across the region. We consider this an important advantage over a plain vanilla exchange-traded fund with exposure to Asia ex-Japan. Around three-quarters of its portfolio is held in large-cap names (defined as those with a market cap above US$10bn), broadly in line with its benchmark. Therefore, we believe that the strategy has sufficient capacity to absorb DGN’s assets following the merger (DGN’s portfolio is also skewed towards large caps).

Exhibit 2: IAT’s top 10 holdings as at end-December 2024

Source: IAT data

Invesco’s Asian and Emerging Market (EM) Equities team is UK-based (headquartered in Henley), but it has contact with several hundred companies during each year, and its portfolio management team travels to the region three to four times a year. Moreover, Fiona Yang, IAT’s lead portfolio manager, is based in Singapore. She took over the lead from industry veteran Ian Hargreaves (LON:HRGV), who will remain closely involved in co-managing IAT for years to come, according to Invesco. Fiona joined Invesco in 2017 as an Asia and EM equity analyst and in January 2020 became the assistant fund manager within the team, and then fund manager in September 2021. For details on Ian Hargreaves, see our previous review note.

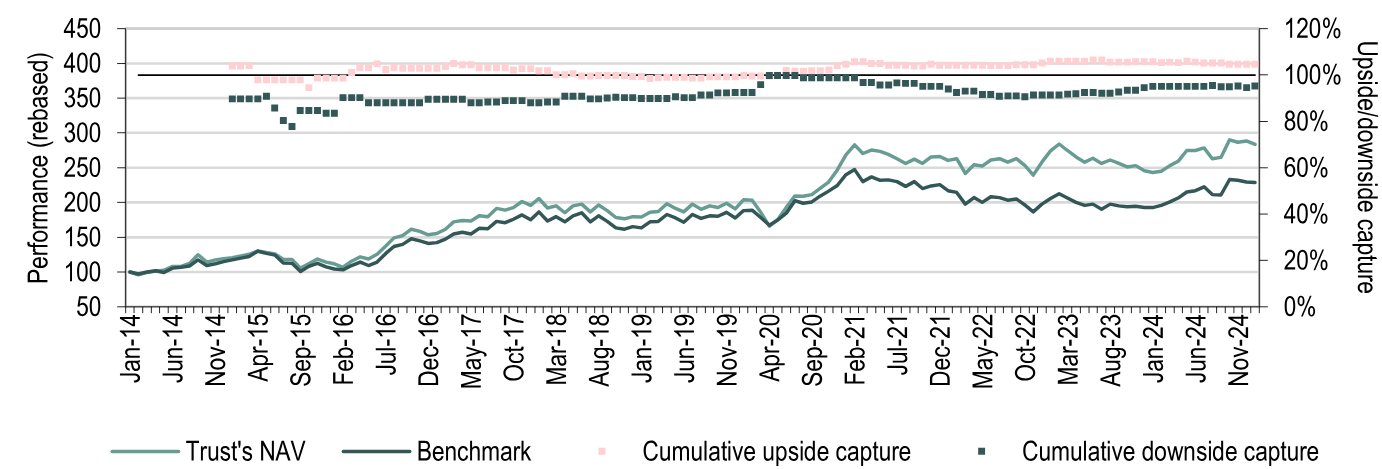

IAT has a quality bias and often holds a portfolio where most holdings have net cash on the balance sheet, which, together with its valuation-aware approach, assisted it in limiting capital losses during market weaknesses and in outperforming the benchmark on the upside. This is well documented by IAT’s cumulative upside and downside capture ratios over the last 10 years of 105% and 95%, respectively (see Exhibit 3). Even if this may partly be the result of the underweight to China during most of the period, we believe that good stock-picking has been an important contributor to IAT’s long-term performance. IAT’s solid risk-adjusted returns are also illustrated by its superior five-year annualised Sharpe ratio of 0.27 (versus c 0.12 and 0.10 for the benchmark and the average for its AIC Asia Pacific Income peers, respectively), according to Morningstar.

Exhibit 3: IAT’s cumulative upside/downside capture ratio over 10 years

Source: LSEG Data & Analytics, Edison Investment Research.

Note: Cumulative upside (or downside) capture is calculated as the geometric average NAV total return (TR) of the fund during months with positive (negative) benchmark TR, divided by the geometric average benchmark TR during these months. A 100% upside (downside) indicates that the fund’s TR was in line with the benchmark’s during months with positive (negative) returns. Data points for the initial 12 months are omitted in the exhibit due to the limited number of observations used to calculate the cumulative upside/downside capture ratio.

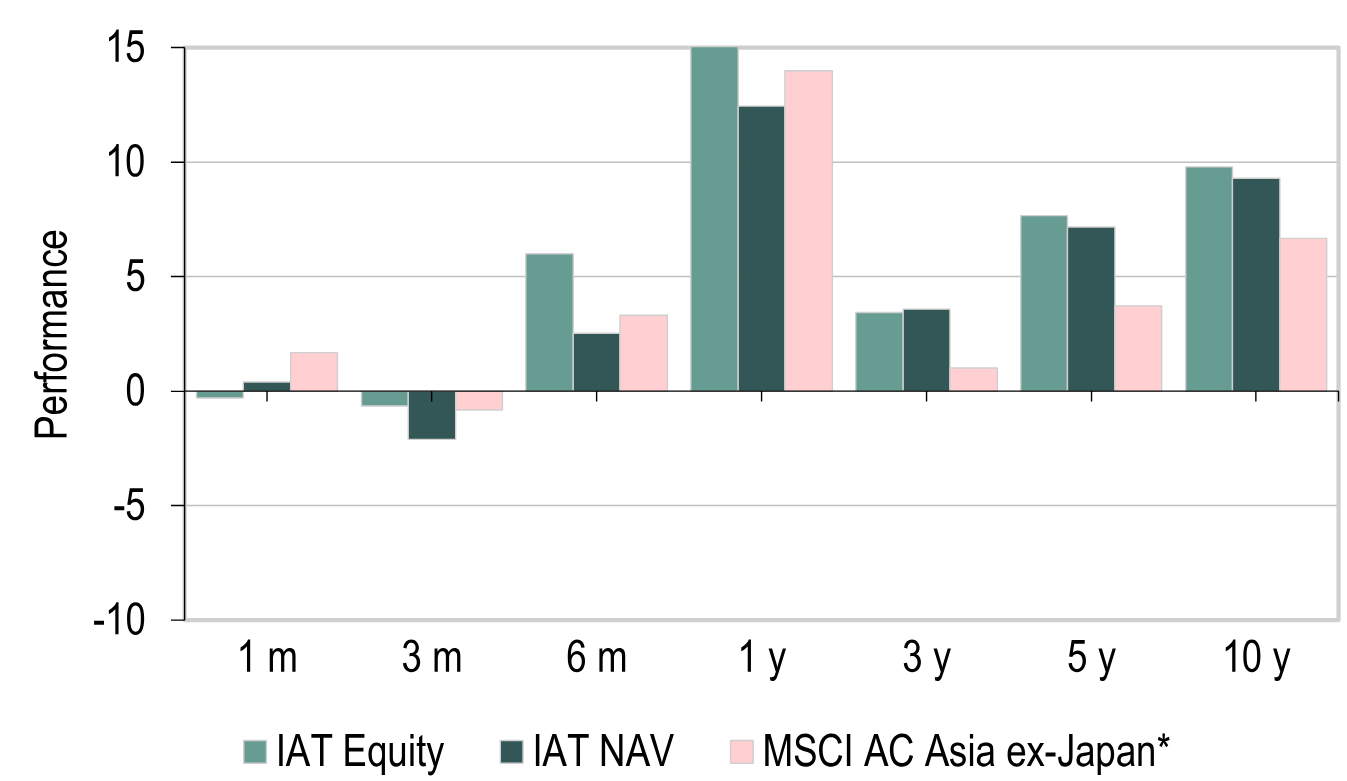

Ahead of market and peer average over the medium and long-term

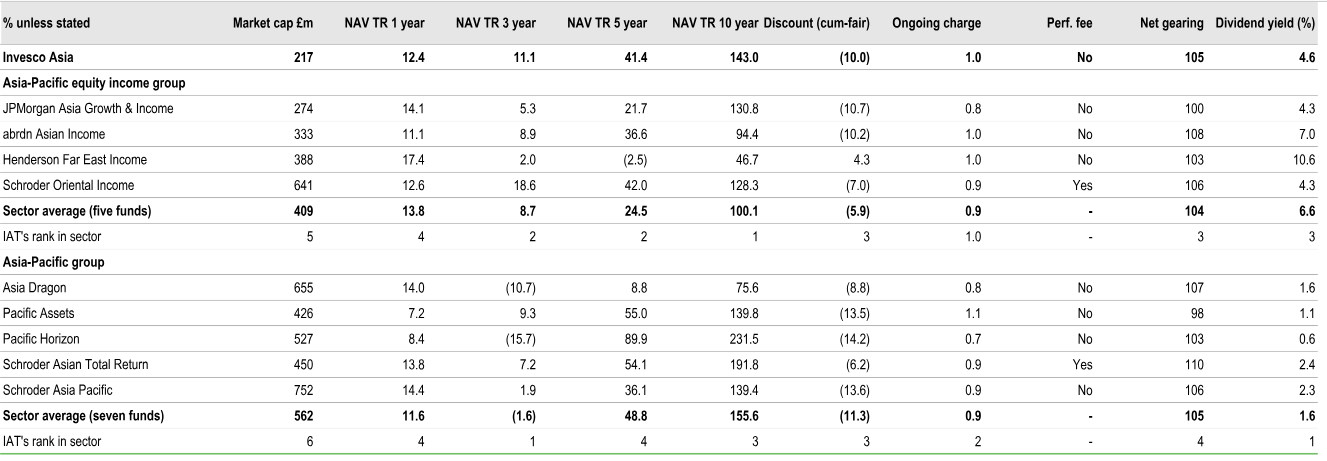

IAT’s strategy has proved successful as the trust has outperformed its benchmark with five-year and 10-year NAV TRs to end-December 2024 of 7.2% and 9.3% pa, respectively, compared to the benchmark’s returns of 3.7% and 6.7% pa, respectively (see Exhibit 5). IAT’s returns are also ahead of the average returns of its close peers (grouped in the AIC Asia Pacific Equity Income sector) of 4.5% and 7.2% pa, respectively, ranking first over 10 years and second over five years (behind Schroder Oriental Income by a slim margin), see Exhibit 7. The trust has also outperformed its benchmark and the average return of the above-mentioned equity income peer group over the last three years.

IAT’s five- and 10-year NAV return is somewhat below the AIC Asia Pacific peer group average, though we note that this is partly due to Pacific Assets and Pacific Horizon being more growth-oriented and having a greater proportion of small- and mid-cap companies in their portfolios. Therefore, they are not fully comparable with IAT. They also have a much higher allocation to India, which IAT’s managers have considered quite an expensive equity market for a while now. Finally, we note that IAT outperformed each of the AIC Asia Pacific peers over the last three years.

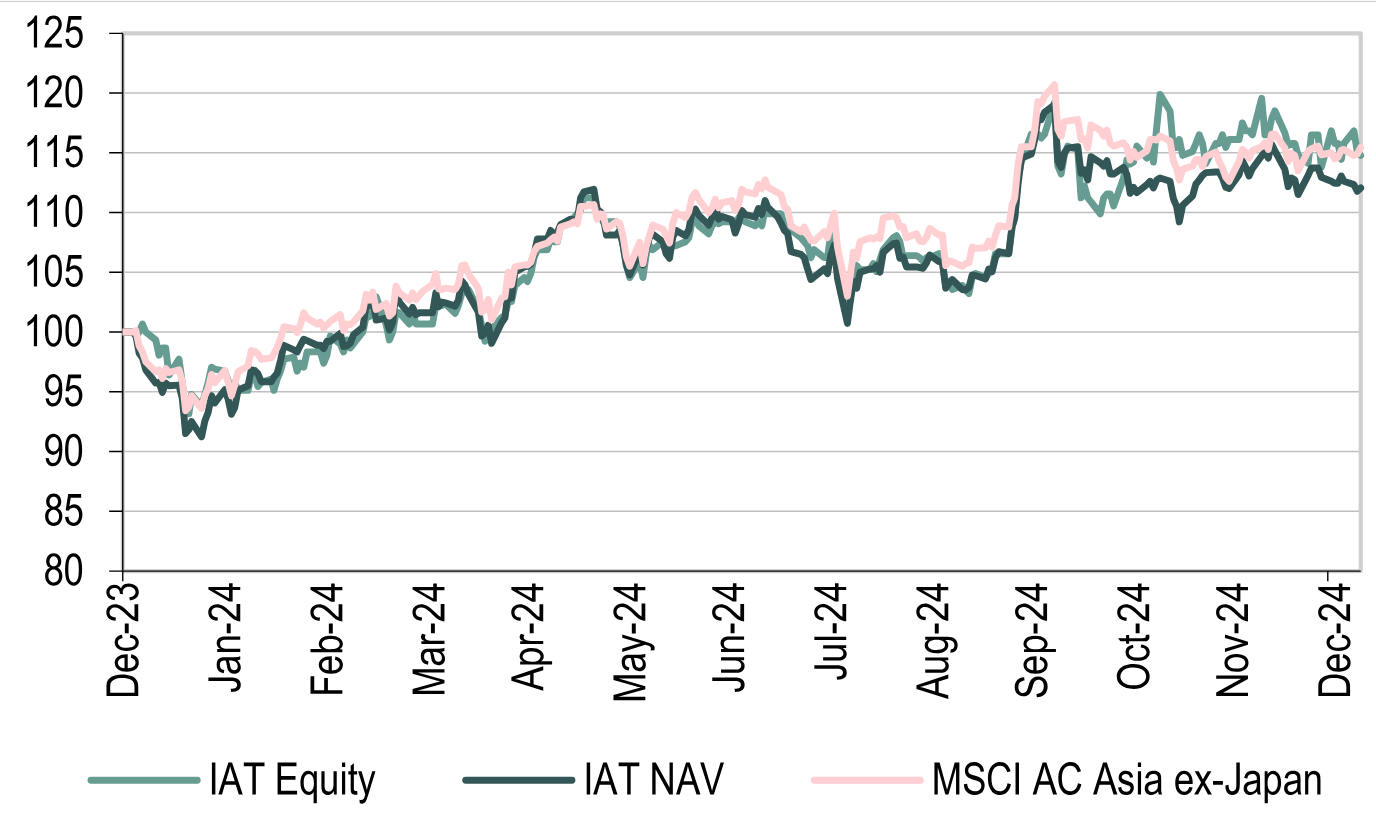

NAV TR in 2024 robust though below benchmark

IAT delivered a robust NAV TR of 12.4% over the 12 months to end-December 2024. Its performance in absolute terms was assisted by the Chinese equities rally in September 2024, as IAT’s managers patiently retained a slight overweight position to Hong Kong and mainland China. That said, IAT somewhat underperformed the 14.0% sterling return of its benchmark (the MSCI AC Asia ex-Japan Index) during this period, which its managers attribute to several factors.

Firstly, IAT had sold some previous solid performers. As a contrarian, valuation-aware investor, IAT has retained its underweight exposure to India (10.9% of the portfolio as of end-December 2024, c 11pp below the benchmark weight). It had sold some of its Indian positions that were performing well on valuation grounds (eg Larsen & Toubro (NSE:LART), an Indian construction and engineering business, which was trading at a high one-year forward P/E of more than 30x) and has not seen any attractively valued alternative opportunities in India to replace them. Secondly, IAT’s overweight positions in South Korea, Indonesia and Hong Kong/China underperformed the broader market. Thirdly, it was affected by a negative stock selection effect in Hong Kong/China and South Korea, most notably Chinese consumer and property-related stocks (though this was somewhat offset by holdings such as Tencent (HK:0700) and JD.com), as well as its overweight position in Samsung Electronics (LON:0593xq), which announced job cuts and admitted it is in a crisis following its Q324 results.

Samsung’s major recent issues include: 1) delays in AI chip supply, allowing market share gains by competitors such as SK Hynix (also held by IAT, but it is a smaller holding than Samsung); 2) weak demand for traditional chips used in smartphones and PCs; 3) losses in its contract chip manufacturing business; and 4) competitive pressure in its consumer electronics business (eg smartphones).

That said, we note that IAT’s investment horizon is three to five years and its average annual outperformance of its benchmark over five years of 3.4pp is comfortably ahead of its 0.5pp outperformance threshold for the five years to end-April 2025 included in its performance-conditional tender (see details below).

Exhibit 4: Price, NAV and benchmark TR performance, one-year rebased

Source: LSEG Data & Analytics, Edison Investment Research

Exhibit 5: Price, NAV and benchmark TR performance (%) to end-December 2024

Source: IAT data, LSEG Data & Analytics, Edison Investment Research. Note: *MSCI AC Asia Pacific-ex Japan prior to 1 May 2015. Three-, five- and 10-year performance figures annualised.

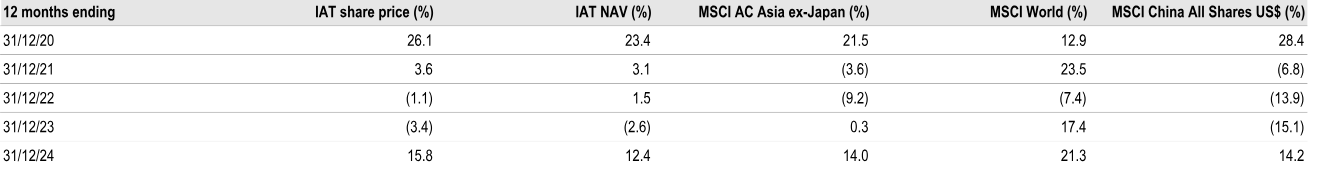

Exhibit 6: Five-year discrete performance data

Source: LSEG Data & Analytics. Note: All percentages on a TR basis in pounds sterling unless otherwise stated.

Exhibit 7: Peer comparison to end-December 2024

Source: Morningstar, Edison Investment Research. Note: Performance data to 31 December 2024 based on cum-fair NAV. TR, total return. Net gearing is total assets less cash and equivalents as a percentage of net assets.

Merger with Asia Dragon Trust to create the ‘go-to’ Asian trust

On 28 October 2024, IAT announced the combination with DGN, involving the transfer of certain assets of the latter to IAT in exchange for new IAT shares through a scheme of reconstruction and the wind-up of DGN, with the new entity renamed Invesco Asia Dragon Trust. DGN’s shareholders will have an option of a partial cash exit for up to 25% of DGN’s issued share capital at a 2% discount to the formula asset value per share. The enlarged entity will be managed by IAT’s current investment manager, pursuing the same successful contrarian, total return strategy.

We expect that this should be a clear benefit to DGN’s shareholders, given that IAT achieved roughly double the NAV TR of DGN over the 10 years to end-2024 (see Exhibit 7 above), even if past performance is not a guarantee of future results. DGN’s assets will be realigned at or around the effective date of the scheme to be in line with IAT’s existing investment policy. The larger trust’s size, with a combined portfolio of around £800m based on current asset values (assuming the cash option is taken in full), will also result in higher stock liquidity and the potential for inclusion in the UK flagship top 250 equity index. We believe this is a clear advantage for the shareholders of both trusts, most notably investors in IAT, which has been a well-performing, but somewhat subscale investment trust and therefore may have experienced less interest from some investor groups. IAT’s investors already approved the deal during the general shareholder meeting on 16 January 2025, while DGN’s shareholder meeting will be held on 4 February 2025, with admission to trading of the combined trust expected on 14 February 2025.

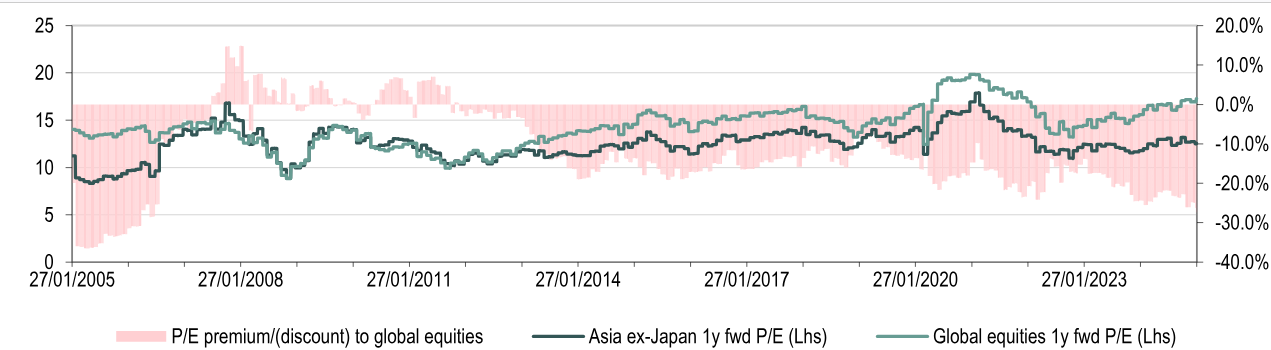

Portfolio positioning

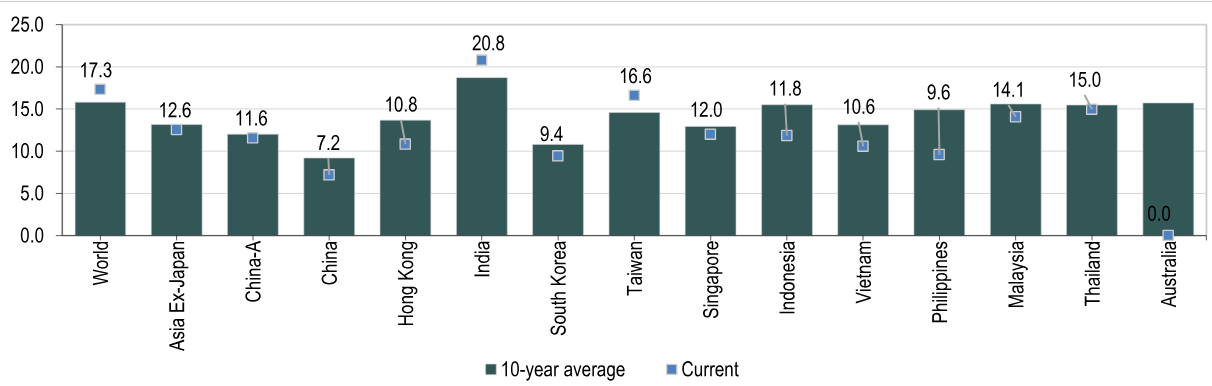

The strong performance of global equities in general (led by US equities) has resulted in a widening valuation gap to the Asia ex-Japan market (which at a one-year forward P/E ratio of 12.6x trades at a slight c 5% discount to its 10-year average) (see Exhibit 8). Based on LSEG Data & Analytics indices, the current discount of equities in the Asia ex-Japan region to global equities stands at 27% compared to a 10-year average of 17%. This is coupled with valuation disparities across Asian markets, which, according to IAT’s managers, require a selective approach to investments in the region, in line with IAT’s proven investment strategy. IAT’s managers recently highlighted that Asian businesses have solid balance sheets and competitive advantages that could make them more resilient than their current valuations may suggest.

Exhibit 8: One-year forward P/E ratio, Asia ex-Japan versus global equities

Source: LSEG Data & Analytics, Edison Investment Research

Exhibit 9: One-year forward P/E multiples by country at 14 January 2025

Source: LSEG Data & Analytics, Edison Investment Research

IAT’s managers believe that the widespread weakness in Chinese equities has allowed them to build a portfolio of high-quality names at attractive valuations. They recently trimmed the portfolio’s overweight position to Hong Kong and China versus its benchmark to c 4pp (with a combined exposure of c 40% as of end-December 2024), and its major current holdings include large internet companies, life insurers, as well as selected property and consumer stocks. The managers recently sold holdings in several companies to focus on higher-conviction names, with disposals including home appliances manufacturer Gree Electric, insurer Ping An, as well as residential and commercial property developer and commercial property operator China Overseas Land and Investment, in line with its intention to focus on holdings that are less dependent on a pick-up in property completions. A recent introduction to the portfolio is Sands China, a developer, owner and operator of resorts and casinos in Macao.

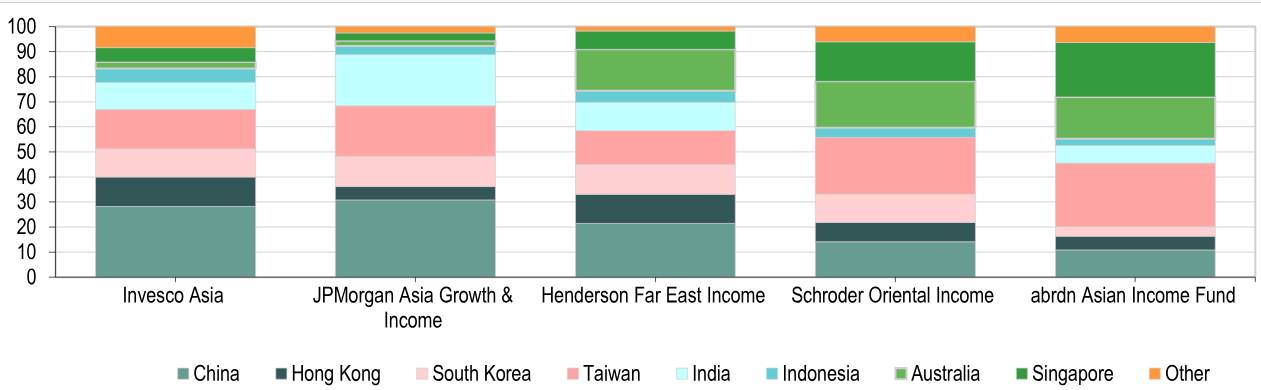

IAT remains the trust with the highest combined China/Hong Kong weight among the AIC Asia Pacific Equity Income peer group (see Exhibit 10), and therefore is well-positioned for a scenario in which good-quality Chinese equities re-rate from depressed levels. At the same time, it is less exposed to a possible retracement in Indian equity valuations following a period of strong investor sentiment. Despite the recent market correction in Indian equities and the September 2024 spike in Chinese equities, the valuation gap between the two markets remains wide, with one-year forward P/E ratios of 20.8x and 7.2x, respectively.

Exhibit 10: Regional exposures, IAT versus peers

Source: Company data, Edison Investment Research. Note: Last reported data rebased for cash/gearing.

IAT’s managers see signs of exuberance in parts of the Taiwanese tech industry, on the back of the AI boom, and Indian equities, fuelled by strong economic momentum, with the International Monetary Fund (IMF) forecasting GDP growth of 6.5% in 2025 after 7.0% in 2024. The above-average valuations can be seen in LSEG data indicating that the Indian and Taiwanese equity markets currently trade at premiums of 11% and 14%, respectively, to their 10-year averages based on the one-year forward P/E ratio (see Exhibit 9).

IAT’s underweight exposure to India is coupled with a c 4–5pp overweight position in Indonesia (5.5% of the portfolio as of end-December 2024), where the managers see a combination of undemanding valuations and a positive economic outlook. IAT also remains underweight Taiwan (15.6% of the portfolio as of end-December 2024, c 6–7pp below the benchmark), which, however, did not appear to negatively affect its recent performance as this was more than offset by a positive stock selection in this market. IAT now holds shares in Taiwanese tech names such as TSMC (a slight underweight versus the benchmark), Largan Precision (research and manufacturing of precision optical plastic lenses), semiconductor business MediaTek, as well as Yageo (a producer of passive electronic components), while it recently exited Chroma (a supplier of precision test and measurement instrumentation). Moreover, IAT’s managers see opportunities in tech and leading manufacturers more broadly across the region, given the importance of Asia in the supply chains of AI, renewable energy, batteries and commodities.

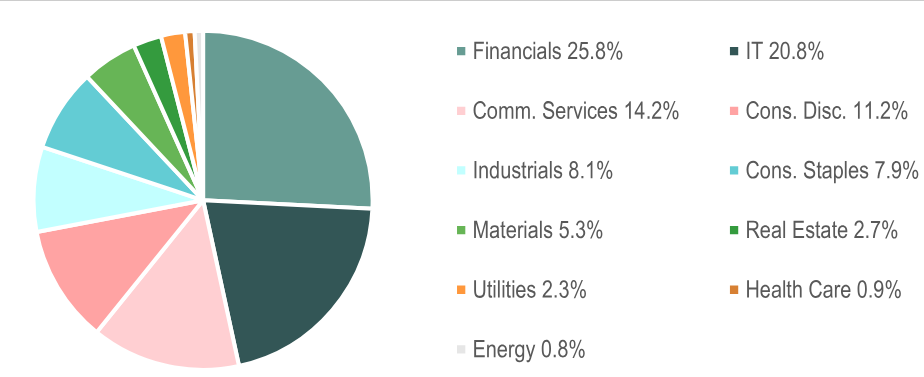

IAT’s portfolio is a play on the long-term potential of China, India and South-East Asia with respect to consumption growth on the back of rising income and an expanding middle class, to which IAT’s managers positioned their portfolio via consumer-related sectors (especially e-commerce/internet companies such as Tencent, Alibaba (NYSE:BABA), JD.com, NetEase (NASDAQ:NTES) and Sea Limited (NYSE:SE)). IAT’s managers also maintain their positive stance towards financials stocks as a route to gain exposure to the rising income and consumption theme through credit growth and demand for insurance products, and general economic growth (especially in countries with low household and non-financial corporate debt to GDP, such as India and Indonesia). IAT’s financials exposure is currently its largest overweight sector position, making up around a quarter of the portfolio, and is diversified geographically across countries such as India (HDFC Bank, Shriram Finance, ICICI Bank), Hong Kong (AIA), Thailand (Kasikorn Bank), Indonesia (Bank Negara, Bank Rakyat Indonesia), South Korea (KB Financial Group (KS:105560), Samsung Marine & Fire), Singapore (United Overseas Bank) and Australia (QBE Insurance). Bank Rakyat Indonesia, one of the largest banks in the country, was recently added to the portfolio, as IAT’s managers believe that a period underperformance by the bank due to asset quality is temporary. Finally, IAT reduced its underweight position to the energy sector with its recent investment in Woodside Energy, an Australian petroleum exploration and production company, underpinned by the business’s undemanding valuation, robust balance sheet and appealing dividend yield.

Exhibit 11: IAT’s portfolio by sector as of 16 December 2024

Source: IAT data

China: Expected to grow c 5% despite macro headwinds

China’s economy continues to face headwinds from a weak (though stabilising) property market and subdued consumer sentiment, resulting in deflationary pressures, with China’s CPI up a mere 0.1% year-on-year and the producer price index (PPI) down 2.3% year-on-year in December 2024. The country’s exports, one of the few stronger parts of its economy, may soon feel the strain of the looming trade tensions with the US and Europe, such as export controls on semiconductors and import tariffs, which are likely to intensify under Donald Trump’s US administration. Donald Trump recently declared that he is considering the introduction of 10% tariffs on imported Chinese products (though much less than the 60% tariffs he mentioned in the campaign trail).

Chinese companies seek to offset these headwinds, at least partly, via increased penetration of emerging markets, including the global south, as well as expanding their production footprints geographically. However, Chinese companies’ operations in countries such as Mexico could also suffer from new US tariffs and there is a risk that Chinese officials will curb the latter to retain the incremental fixed investments and employment domestically. The Chinese government also intends to introduce some countermeasures, such as export restrictions on certain technology used to make battery components and for processing critical minerals such as lithium and gallium. Further long-term risk factors are the demographic decline and China’s stance towards Taiwan. That said, Chinese officials claim that China’s GDP growth in 2024 was in line with its target of 5%, which will be maintained for 2025. The IMF expects China to narrowly miss this level, albeit with still robust 4.8% growth in 2025.

Significant fiscal and monetary measures to revive the economy

In September 2024, the People’s Bank of China (PBOC) cut its reserve requirement ratio by 50bp, which will release RMB1tn of liquidity into the banking system to improve the latter’s lending capacity. The PBOC also lowered interest rates on existing mortgage loans by an average 50bp and reduced the minimum down payment ratio for second homes from 25% to 15%. Finally, the central bank cut its benchmark interest rate on seven-day reverse repurchase agreements by 20bp to 1.50% in October 2024 and recently signalled further cuts in 2025, according to the Financial Times, citing comments from the central bank. The PBOC also introduced measures to directly support the local stock market, including a swap programme, which provides funds, insurers and brokers with easier access to funding for stock purchases, as well as loans to support buybacks of listed companies. These measures amounted to RMB800bn (or c 0.6% of China’s GDP) since September, according to The Economist.

The Chinese government also announced significant fiscal stimulus, as it pledged to significantly increase debt and widen the budget deficit to 4% of GDP to revive the economy. Reuters reported that China plans to issue long-term special sovereign bonds with a significant volume of around RMB3tn in 2025 for fresh fiscal stimulus, up from RMB1tn in 2024. The proceeds will be used to boost consumption through subsidy programmes for durable goods, which is a change from the government’s previous approach of not stimulating consumption directly (China has a relatively low level of household spending to GDP). The proceeds will also support large-scale equipment upgrades by businesses and fund investments in innovation-driven advanced sectors. We also note that in H124, the government announced measures to support the troubled property sector, which involve the purchase of unsold completed apartments from developers by local state-owned enterprises to convert them into social affordable housing (supported by RMB300bn in cheap central bank funding). Moreover, the government aims to address the debt burden of local governments.

Equity markets rallied initially, though have given away some gains so far in 2025

Chinese equities appreciated strongly on the back of the September announcements, with the CSI 300 Index up c 20% in September 2024 (translating into a similar return overall in 2024), though they have retraced partly in 2025 to date amid the inauguration of Donald Trump and investors’ disappointment in the government’s limited success in reviving the property sector and consumption. On the other hand, we note that, encouraged by Chinese authorities, there has been an increased focus on the shareholder returns of Chinese listed companies (both state-owned and private) this year, with prominent examples including Tencent and Alibaba (which are among IAT’s top 10 holdings).

China’s officials focus on driving ‘new quality productive forces’

Notwithstanding the near-term challenges, it is worth noting that the Chinese government aims to foster a more innovative economy in the long run, including green transition, advanced manufacturing (electric vehicles (EV), robotics, semiconductors, clean energy), biotech and digitalisation (which are at least partly filling in the gap left by China’s ‘old’ economy). For instance, its EV car-makers have been successful in their global expansion, as illustrated by BYD closing in on Tesla with 1.76m EVs sold in 2024 versus 1.79m by Tesla.

South Korea: Measures to foster corporate governance improvements yet to bear fruit

IAT maintains a moderate slight c 1pp overweight position to South Korea (which made up 11.4% of its portfolio as of end-December 2024). The managers positioned the trust’s portfolio to benefit from improvements to the corporate governance of local companies, which in their view have not been priced in, and they believe that South Korean companies’ dividend growth has been above the broader regional average for several years now. The government aims to support a greater appeal of local equities through reforms to corporate governance and enhanced distributions to shareholders via the ‘Corporate Value-Up’ programme (announced in early 2024), inspired by the recent success in Japan (see our June 2024 update note for details). As part of this programme, the Korean Stock Exchange recently launched the Korea Value-Up Index (tracked by exchange traded products) consisting of companies that satisfy several quantitative criteria related to profitability, shareholder return (dividend payout/treasury stock cancellation) and high P/BV and return on equity relative to industry, among others. We note that the majority of IAT’s current South Korean exposure consists of companies that are constituents of this index: Samsung Electronics, SK Hynix, Samsung Fire & Marine, KB Financial Group and Hyundai Motor (KS:005380).

That said, the recent efforts to bolster corporate governance are yet to bear tangible fruit, and South Korea’s KOSPI index posted a c 9% TR decline in 2024 (with the Korea Value-Up Index also down slightly since launch). The KOSPI index did not recover after the global equities sell-off in August 2024, which itself was triggered by US recession fears. The weak Chinese economy and uncertainty around US trade policy following Trump’s presidential victory may have been negative contributors to the export-oriented South Korean market. We also note the recent political turmoil arising from the president’s declaration of martial law (which was quickly withdrawn) and subsequent impeachment. According to the IMF’s forecasts included in its World Economic Outlook October 2024 report, South Korea’s GDP growth is expected to be 2.2% in 2025 (2.5% in 2024).

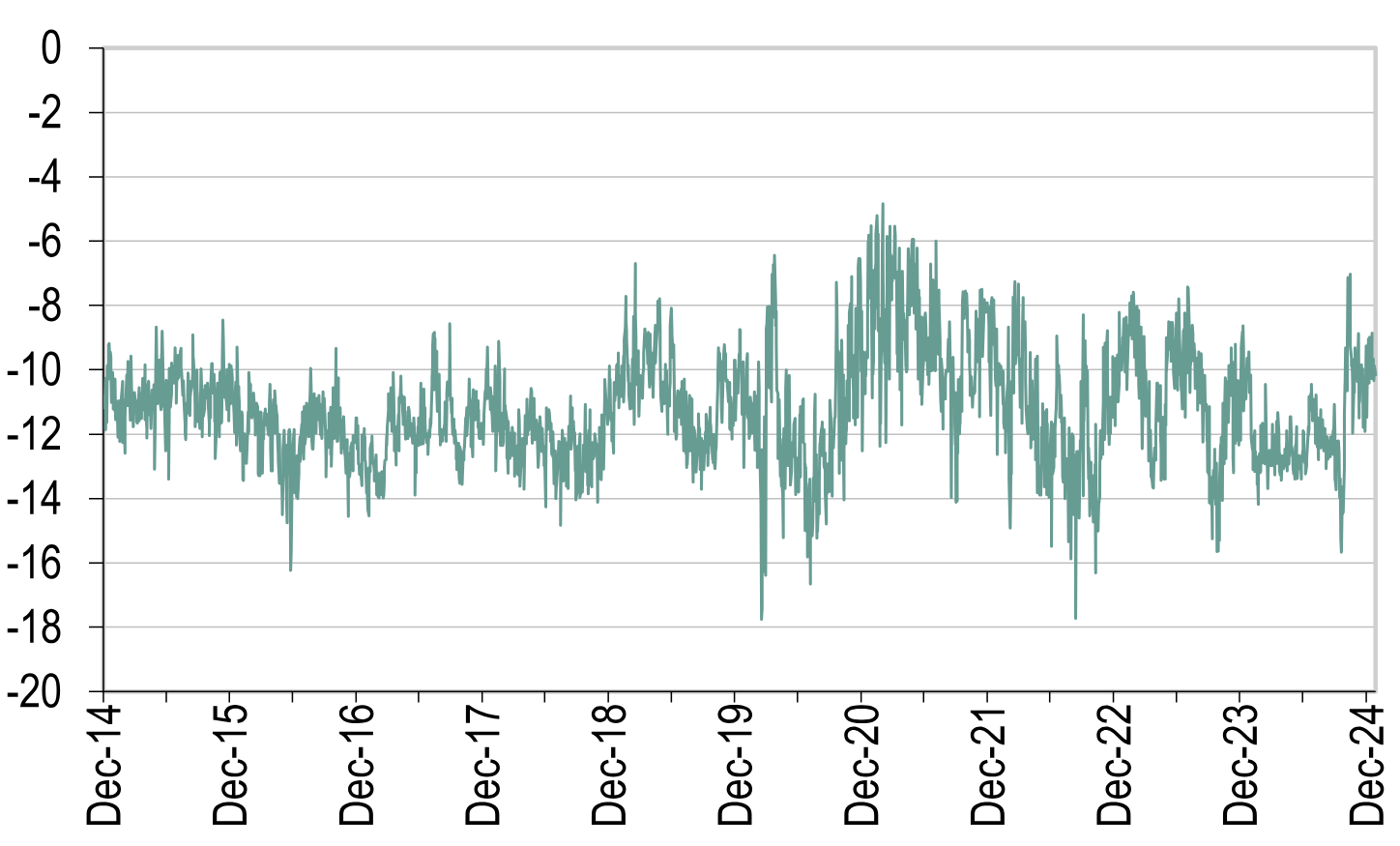

Discount

IAT’s shares trade at a 10.2% discount to cum income NAV (8.8% to NAV excluding income), which is broadly in line with its five- and 10-year averages (both at c 11%). We note that IAT’s board believes that, under normal conditions, the shares should trade at a discount of below 10% to the ex-income NAV. As IAT’s discount widened beyond this threshold, the trust initiated share buybacks in 2024 and since then has spent c £6.9m on repurchasing c 2.3m shares (or roughly 3.4% of opening outstanding shares).

Assuming the merger proceeds, Invesco Asia Dragon Trust will maintain IAT’s target of an average discount to cum-income NAV of below 10% over each financial year and conduct share buybacks accordingly. Moreover, it will be subject to a triennial unconditional tender offer for up to 100% of the issued share capital at a 4% discount to prevailing NAV (first tender expected in 2028), which we believe represents a strong commitment to narrowing the discount to NAV. This will replace IAT’s current triennial continuation vote, as well as its performance-related conditional tender offer of up to 25% of IAT’s issued share capital in the event IAT fails to outperform its benchmark by 0.5pp over the five years to end-April 2025.

Exhibit 12: Discount to NAV over 10 years

Source: LSEG Data & Analytics, Edison Investment Research

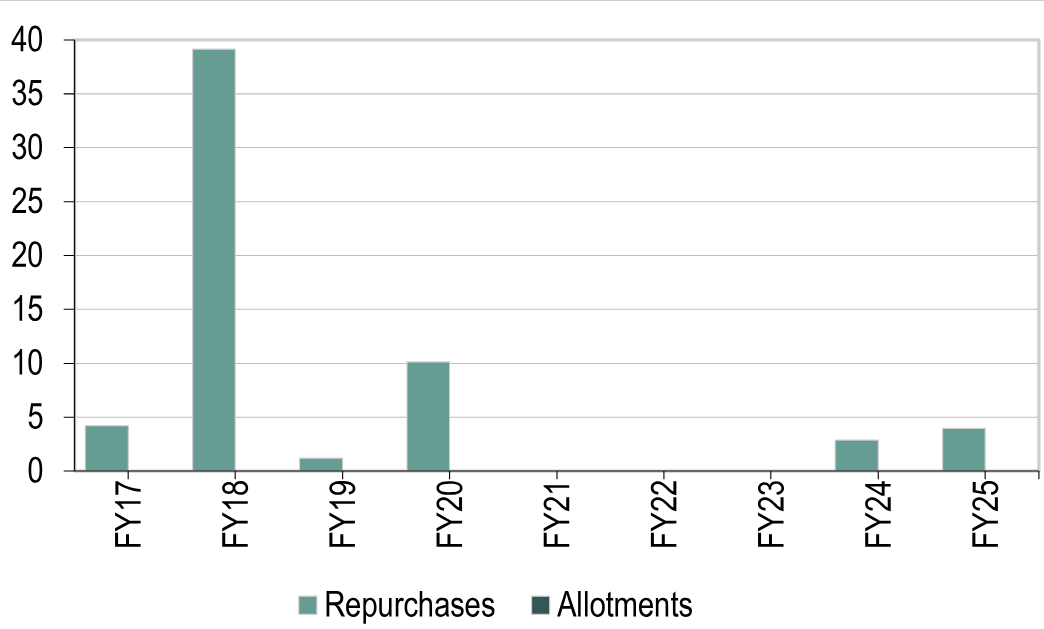

Exhibit 13: Buybacks and issuance

Source: Morningstar, Edison Investment Research

Dividend policy

Based on the dividend policy revised in August 2020, the board aims to pay dividends in November and April each year, each equivalent to 2% of the NAV at the end of September and February, respectively. This means that the dividend per share may be lower year-on-year during financial years with an NAV decline. IAT will pay dividends from a combination of the company’s revenues, revenue reserves and capital reserves if required (under the previous policy, dividends were usually fully covered by income). As a result, IAT is not restricted to stocks that are pure income plays. Following the above change to the dividend policy, IAT maintains a relatively low revenue reserve on its balance sheet at £1.9m at end-FY24, equivalent to c 20% of its FY24 total dividend payment. Invesco Asia Dragon Trust will maintain IAT’s enhanced dividend policy of paying 4% of NAV on an annual basis and move from semi-annual to quarterly payments. The IAT board’s intention is to pay out two quarterly dividends of 3.90p per share in January and April 2025, which at the current share price implies an annualised dividend yield of 4.6%.

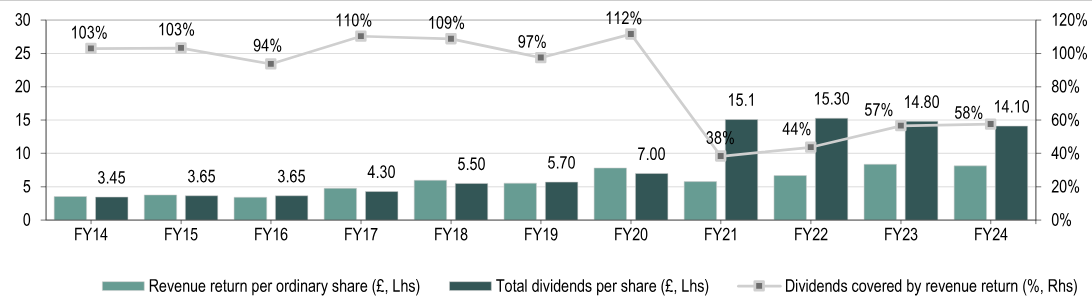

Exhibit 14: IAT’s historical dividend payments and cover

Source: IAT data, Edison Investment Research

Approach to ESG

Invesco has been a signatory to the United Nations Principles for Responsible Investment (PRI) since 2013 and IAT’s manager has been recently rated four stars for its Investment & Stewardship Policy by PRI. This followed five consecutive years of achieving an A+ rating for Strategy & Governance under PRI’s previous methodology. Climate change remains high on Invesco’s agenda given its commitment to the Net Zero Asset Managers initiative. Factors taken into account when evaluating portfolio companies include: (1) historical capital allocation decisions and corporate governance; (2) approach to addressing ESG-related negative externalities; (3) track record of meeting guidance and internal targets; and (4) feedback from competitors, suppliers and clients.

IAT’s managers prefer an active approach to ESG considerations over following a simple exclusion list. Therefore, they are equally interested in top performers in terms of ESG metrics, as well as active engagement and stewardship with companies that the managers consider well positioned to improve their ESG credentials, and in turn create additional value. IAT’s managers look at the ESG profile of an investment through a valuation lens, seeking to quantify the impact of material ESG factors on earnings growth, valuation multiples’ re-rating potential, as well as dividend payouts. This in turn feeds into the return expectations and positioning of the respective stock within IAT’s portfolio. The above ESG analysis is facilitated by a dedicated ESG team and a proprietary ESG ratings tool (ESGintel) at Invesco, which provides data and insights across more than 18,000 companies. On top of regular, day-to-day monitoring, IAT’s portfolio undergoes a formal ESG review twice a year.

The approach of IAT’s manager to ESG also involves considered voting at general meetings, with 35% of their votes in the 279 ballots in 2023 being contrary to management recommendations and 25% being against the Institutional Shareholder Services recommendations, according to IAT.

Gearing

As per its investment policy, IAT is permitted to apply gearing of up to 25% of net assets but, under normal circumstances, IAT does not expect this to exceed 15% of net assets. IAT currently has a revolving credit facility with maximum possible gearing of £20m (maturing in July 2025), which is the equivalent of c 8% of total assets at end-December 2024. IAT also has available an uncommitted bank overdraft arrangement with the custodian for settlement purposes, with an end-FY24 balance of £50k. Over the 10 years to end-December 2024, IAT’s net gearing (defined as total debt less cash and equivalents over NAV) remained (except for a few instances) in the range negative 5% to 5% and at end-December 2024 stood at c 5%.

Fees and charges

IAT is currently subject to a management fee of 0.75% on NAV up to £250m and 0.65% on any net assets in excess of £250m (paid quarterly in arrears). Importantly, IAT is not being charged a performance fee by its manager. Invesco Asia Dragon Trust will be subject to a new tiered management fee: 0.75% on the first £125m of NAV, 0.60% on £125–450m, and 0.50% above £450m. The significant size and new fee structure will allow the trust to target an attractive ongoing charges ratio of around 70bp in future financial years (vs 103bp and 86bp for IAT and DGN currently, respectively). Moreover, IAT’s investment manager will make a ‘significant contribution’ to help absorb the costs associated with the combination (c £2.26m estimated in the circular published by IAT in December), thus avoiding any NAV dilution.

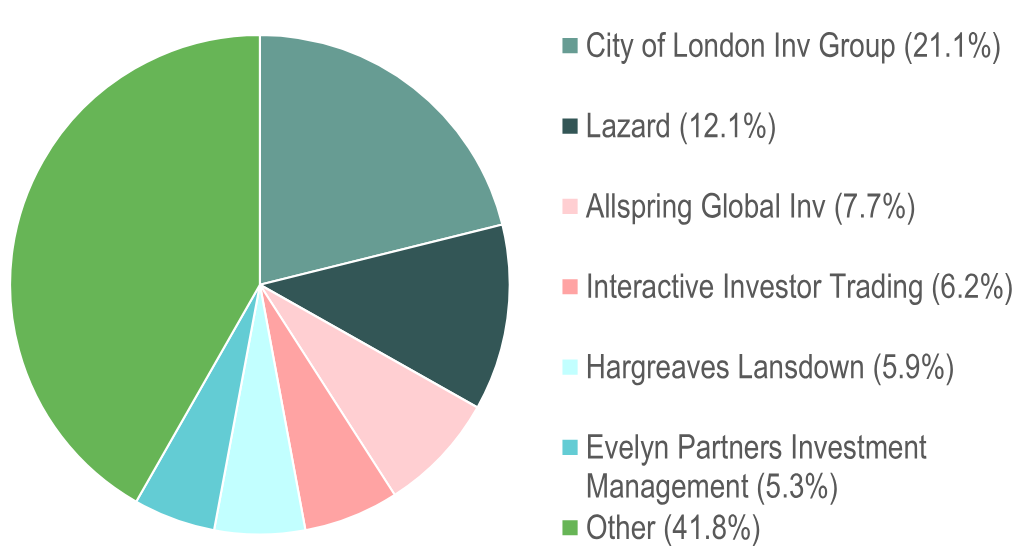

Capital structure

IAT’s issued capital consists of 64,691,287 shares outstanding, with a further 10,308,594 shares held in treasury. IAT’s major shareholders include City of London Investment Group (20.3%), Lazard (12.0%), Evelyn Partners Investment Management (11.1%), as well as Allspring Global Investments (6.9%).

Exhibit 15: Major shareholders

Source: LSEG Data & Analytics as of 14 January 2025

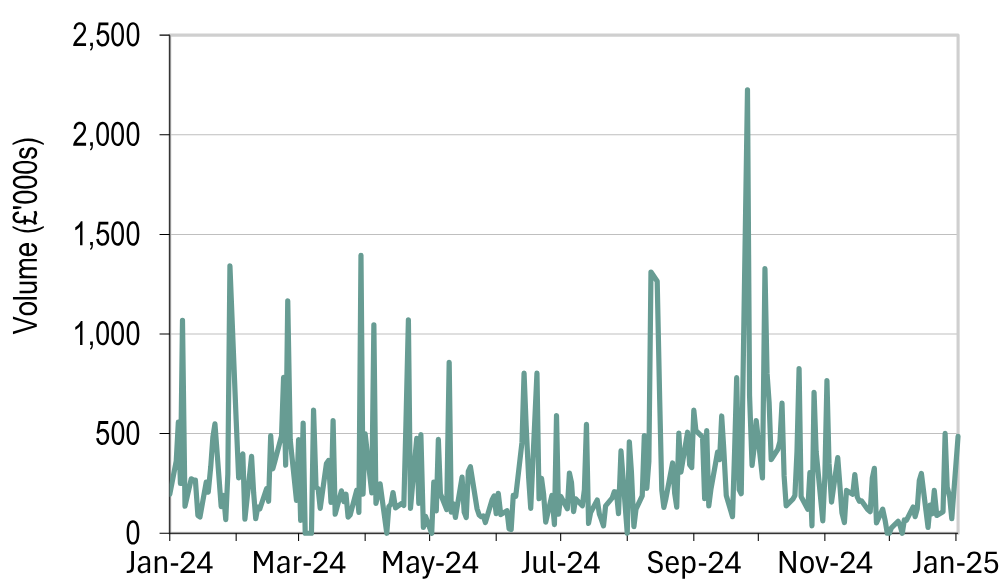

Exhibit 16: Average daily volume

Source: LSEG Data & Analytics as of 14 January 2025

Board

IAT’s board consists of four directors, all of whom are independent. Neil Rogan (chairman) has more than 30 years of experience as investment manager, ranging from managing Asian portfolios for Flemings and Jardine Fleming to becoming head of global equities at Gartmore. Currently, he is also the chairman of Murray Income Trust, as well as non-executive director of JPMorgan Global Growth & Income.

Vanessa Donegan has 37 years of fund management experience in investing both institutional and retail portfolios in Asian equities, including single-country China and India funds. She was head of the Asia Pacific desk at Threadneedle Investments and then head of Asia Pacific equities, EMEA region, at Columbia Threadneedle for 21 years in total. At present, she also serves as senior independent director of Fidelity China Special Situations (LON:FCSS), as well as a non-executive director of Herald Investment Management, JPMorgan Indian Investment Trust and State Street (NYSE:STT) Global Advisors Luxembourg SICAV.

Myriam Madden has board member experience across several regulated sectors, following an international, multi-sector career as a finance executive leading transformation programs. She is a qualified chartered accountant and was a board member of the International Ethics Standards Board for Accountants, the International Federation of Accountants and the American Institute of Certified Public Accountants. Moreover, she was global president and chairman of The Chartered Institute of Management Accountants. She is currently non-executive director of the Office of Gas and Electricity Markets, Home Group and Golden Charter Trust.

Sonya Rogerson has more than 20 years of experience in legal, governance and compliance across a range of industries (including financial services) and countries in Asia Pacific, Australasia and emerging markets. She led the legal and compliance department at the Bank of China in London and held other senior positions including general counsel Asia Pacific for the British Standards Institution. She is currently head of legal transformation and REFS at Novartis (LON:0QLR) Operations. Sonya is a fellow of the Corporate Governance Institute UK & Ireland and a qualified solicitor in New South Wales, Australia, and England and Wales.

Upon successful merger, the current directors of DGN will join the board of the enlarged trust, bringing the total number of board members to eight, with a medium-term intention to reduce it to six. Given the expected increase in board members, IAT’s board proposed an increase to the aggregate cap on director’s remuneration to £400k from IAT’s current £200k. As at the date of IAT’s prospectus published in conjunction with the planned merger with DGN, Rogan, as chairman of the board, is entitled to receive £43,400 per annum, Madden, as chair of the audit committee, is entitled to receive £37,200 per annum and all other directors (including the DGN directors once they have been appointed to the board) are entitled to receive £31,000 per annum.

Exhibit 17: IAT’s board of directors

Source: Invesco Asia Trust. Note: *Appointed chairman on 31 July 2018.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI