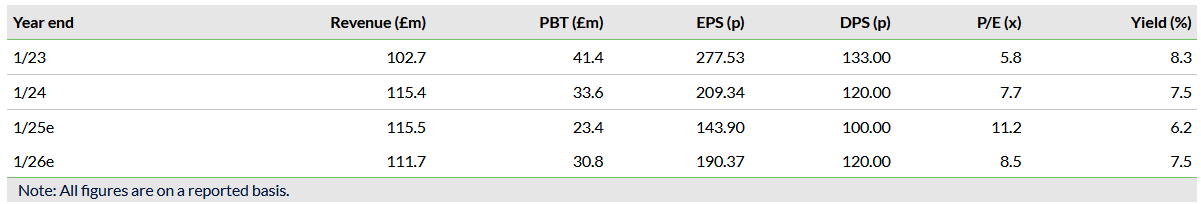

S&U (LON:SUS) published an update on trading to 31 January (end-FY25) and will release its annual results on 15 April.

Group performance continues to be characterized by strong growth in the property lending division, with regulatory headwinds for motor finance.

The Supreme Court has agreed to hear an appeal against the lower court ruling on undisclosed commission payments, which is of great significance to lenders across the consumer finance sector and to the FCA. We see significant upside potential for the shares, contingent on a successful resolution of the matter.

Business trends have continued

At end-FY25, group net customer receivables of £435m compared with £463m at end-FY24. Aspen Bridging, the property lending business, grew net receivable by 17% to c £152m, while the motor lending business, Aspen Finance, saw a 15% decline to c £283m.

Motor repayments are yet to show any material pickup and, combined with lower lending balances, profitability will be well below FY24. With its lending and credit quality strong, Aspen PBT was up c 50% versus the prior year. We have reduced our group PBT forecasts by £0.9m for FY25 and £0.4m for FY26.

The strong growth that we forecast in FY26 is driven by recovery at Advantage and further growth at Aspen. At this stage, it is impossible to estimate the potential impact of regulatory or legal matters regarding legacy collections practices or commission payments.

The Supreme Court has agreed an appeal

The Supreme Court hearing is scheduled for April 1st to 3rd, although a decision will likely come later. It stems from an Appeal Court ruling, involving other lenders rather than S&U. Based on its interpretation of common law, the court found that car dealers or other finance brokers (‘brokers’) could not lawfully receive commission from a lender without informed borrower consent, including knowledge of the exact amount of commission paid.

FCA rules have long required that borrowers should be informed if their loan costs include commission paid by lenders to brokers, but not necessarily the amount, and the court ruling opened the door to claims against both brokers and lenders, with wider implications across the wider consumer finance sector. We find it difficult to see the unfairness, harm or case for redress where FCA rules have been adhered, as is the case with S&U.

Valuation: Significant ‘risk’ discount

The uncertainty surrounding commission disclosure weighs on the shares. The FY26e P/E multiple is 7.5x, with a return on equity (RoE) of 9.5% (10-year average of 15%). Assuming a cost of equity capital (CoE) of 10% and long-term growth of 2%, the share price is consistent with an RoE of 8.3%, not much above the depressed FY25e level of 7.3%., and below the 9.5% we expect in FY26.

Advantage Finance

Advantage has continued to lend selectively as it adjusts to new collections practices and strikes an appropriate balance between risk and return on capital. At the end of the period, net receivables were c £283m, down from £295m at 10 December and £326m at H125.

This was below the £290m reflected in our forecasts. In H125, average transactions per month were c 1,450 (compared with an average c 1,800 per month in the preceding three years) but, having dipped sharply in H225, had recovered somewhat to over 900 in January. We expect a further recovery in transactions although, in the near-term, the natural run-off of existing loans will likely result in a lower receivables balance in the first half of FY26, returning to growth in H2. We, nonetheless, expect end-FY26 receivables to be lower than previously forecast.

We also anticipate a steady, but material, improvement in collections going forward. The FY25 collection rate was 85% (FY24: 92%), with a modest improvement to 87% through January.

While the temporary restrictions on collections agreed with the FCA have been lifted, there is a significant backlog of non-paying customers and vehicle recoveries to be worked through, for which Advantage has introduced new processes and procedures. We also suspect the significant media coverage of industry regulatory issues and the Appeal Court judgement, combined the vigorous activities of claims management companies, may be having some impact on some borrowers and their propensity for repayment.

Regulatory developments

As previously reported on, with enhancements to Advantage’s lending and collections practices agreed with the FCA and implemented, the review process is drawing to a close. However, pending completion, there is no new guidance from the company regarding potential remediation for any adverse impact on customers who may be affected by legacy practice.

This has previously been treated as a contingent liability, too uncertain to be reliably assessed. We do not expect a material impact, which in any case would be one-off in nature.

In December, the Supreme Court agreed to hear an appeal against the October 2024 Court of Appeal decision regarding car finance commission payments. Importantly, this is a separate issue from that of discretionary commission, to which S&U is not exposed. The two matters are sometimes erroneously conflated. At this stage, it is impossible to estimate the potential impact on S&U should the Court of Appeal ruling be upheld by the Supreme Court, but it has the potential to be very material.

More positively, the calls for a more pragmatic, lighter touch, more growth-friendly approach to financial services regulation have continued to increase, including from the prime minister, the chancellor in her Mansion House speech in November and from industry practitioners. During the past two months, UK Finance, the Finance and Leasing Association and S&U have all made presentations to government and to parliament on the subject of ensuring a regulatory framework that is both robust and predictable.

Aspen Bridging

Profit growth at Aspen is being driven by much higher lending and receivables balances, while credit quality remains strong, and the blended yield on lending has been above the level budgeted by management. The number of transactions increased by 16% in FY25, to 190, and net receivables grew c 17%, to £152m, a new record for the business. Collections were up 25% to £157m. S&U expects Aspen’s reported profits to be up by c 50% for the year.

Aspen enters FY26 with a strong pipeline of bridging finance for smaller developers and builders and market conditions continue to be robust. Residential property transactions remain healthy, with a positive impact from the changes in stamp duty that come into effect on 1 April, and house price indices have continued to climb. Interest rates cuts should continue to support the residential property market, set against positive long-term structural drivers.

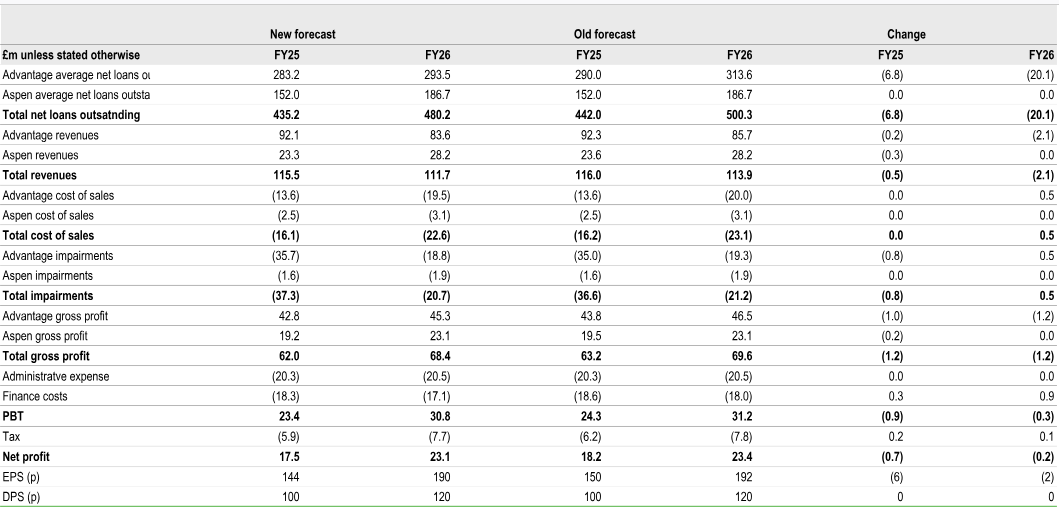

Forecast revisions

The table below shows our revised forecasts. For group PBT, we now expect £23.4m in FY25 (previously £24.3m), with an increase in our expectations for Aspen partly offsetting a reduction in Advantage. We continue to expect a significant uplift in Advantage profitability on FY26 and further strong growth in Aspen, with only a modest adjustment to group PBT. Reduced borrowings, combined with lowering interest rates, provide a partial offset to our reduced receivables forecasts.

The second interim dividend takes the total year to date to 60p, compared with 70p in the prior year. We continue to expect a final DPS of 40p, making a total of 100p for the year. Although our earnings forecast reductions maintain upwards pressure on the payout ratio, traditionally in the range of 50%, we expect S&U’s dividend decisions to take account of the future propects.

We estimate a payout ratio of 69% for FY25, falling to 63% in FY26. Supporting our DPS assumption, the decline in Advantage receivables is reflected in lower borrowings, which were £192m at the end of the period, down £47m from H125, with significant headroom to the current borrowing capacity of £280m.

Forecast revisions

Source: Edison Investment Research

Significant Valuation Upside Potential

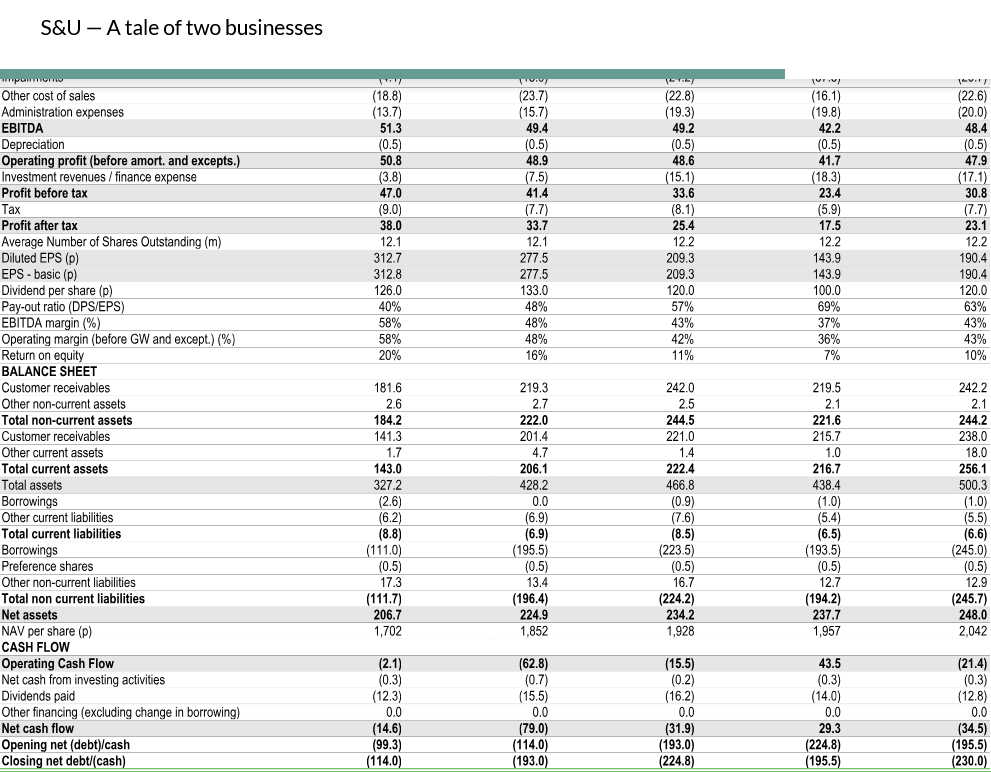

Regulatory uncertainty, primarily with respect to the Supreme Court decision and its potential subsequent impact, weighs heavily on the shares. We continue to frame our valuation using our RoE/CoE calculations, an approach that is widely used in the financial sector.

The sector is highly regulated and competitive, thus sustainable growth depends on the ability to generate capital. If we assume a CoE of 10% and long-term growth of 2%, then the share price at the time of writing (1,605p) would be consistent with an RoE of 8.3%.

This is not much above the depressed level of 7.3% that we forecast for FY25, but below the 9.5% that we expect in FY26, and well below the long-term average of c 15%. Alternatively, with an RoE of 10%, the implied CoE is 12.1%.

The 18% discount to the FY25e book value per share of 1,957p implies an inability for S&U to achieve a medium-term RoE at least in line with its CoE, which appears to represent a material undervaluation and significant upside potential as the regulatory risks subside and trading at Advantage normalizes.

On traditional measures, S&U trades on 10.7x FY25e EPS (which we regard as depressed by temporarily elevated impairment charges) and 8.3x FY26e EPS. Based on our FY25e DPS of 100p, the dividend yields is 6.2% for FY25e. We forecast an increase in the FY26 DPS to 120p, representing a yield 7.5%, although the payout ratio implied remains above the longer-term average.

Financial Summary

Source: S&U historical data, Edison Investment Research forecasts