International Consolidated Airlines Group (LON:IAG) has had an eventful year in 2024. As the parent company of British Airways, Iberia, Aer Lingus, and Vueling, IAG is a major player in the aviation industry. This article provides a comprehensive analysis of IAG's performance throughout 2024 and what investors can expect moving forward.

Performance Overview

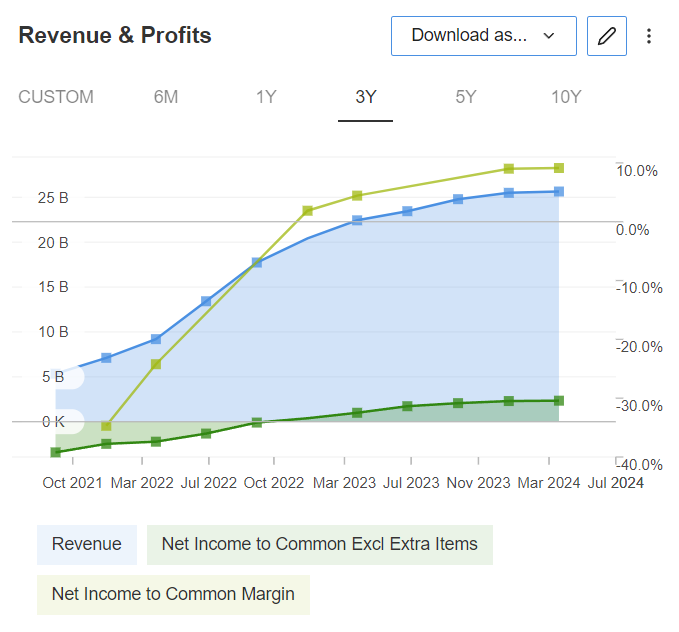

Throughout 2024, IAG has faced a mix of challenges and opportunities. The year started on a strong note, with the company benefiting from the continued recovery of the travel industry post-pandemic. In the first quarter, passenger numbers surged, reflecting a pent-up demand for travel. This boost in demand led to increased revenues, helping the company recover from the financial setbacks experienced in previous years.

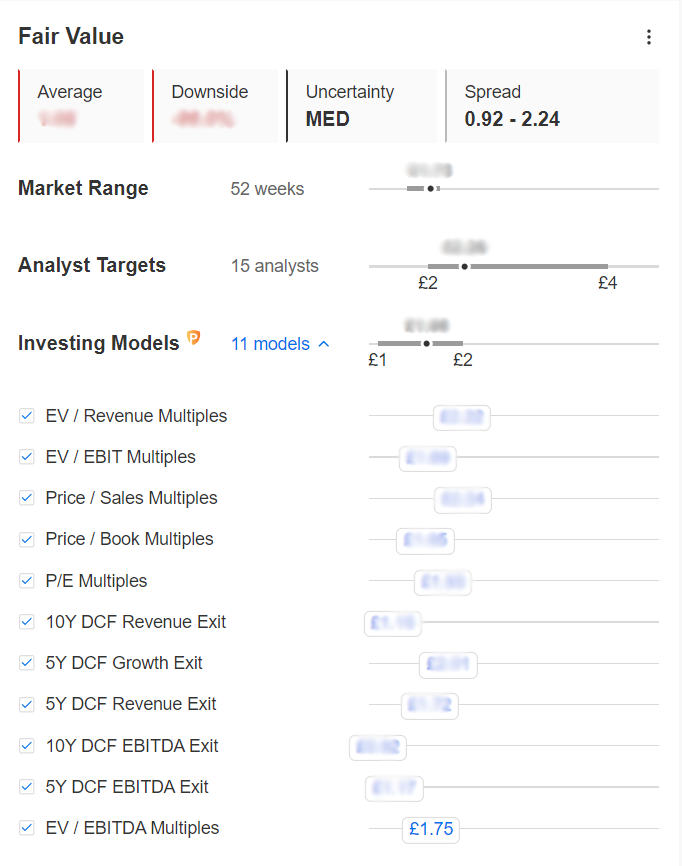

However, IAG's stock (IAG) has experienced volatility. As of the end of second week of July, the stock is trading at 173.30 GBP, which represents a 17% increase from the beginning of the year. This rise is largely attributed to strong passenger demand and cost-cutting measures implemented by the company. Despite this, the stock has faced pressure due to rising fuel costs and economic uncertainties in Europe.

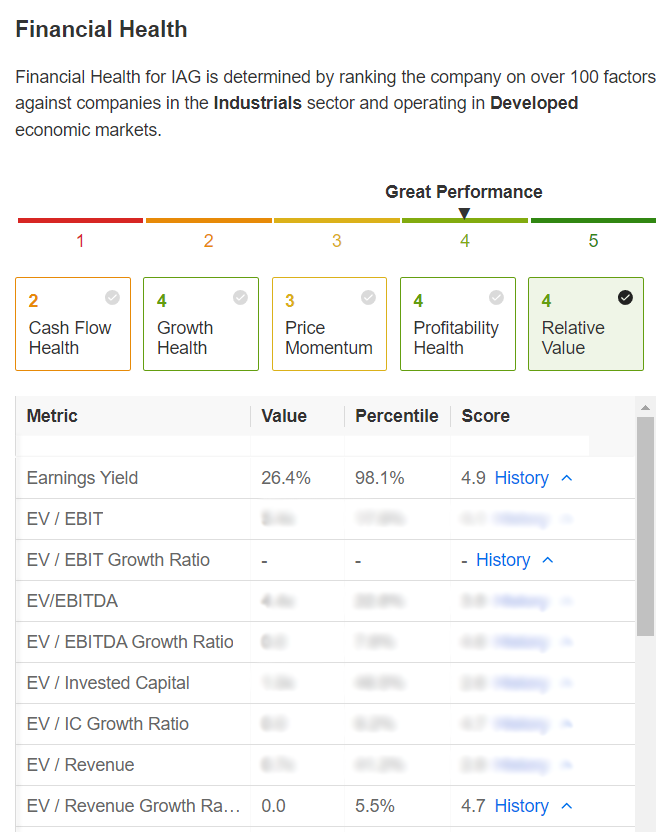

Financial Health

IAG's financial health has seen notable improvements. The company reported a net profit of €800 million in the first half of 2024, a significant turnaround from the €300 million loss reported in the same period in 2023. This recovery has been driven by a combination of higher passenger revenues and effective cost management strategies.

A key highlight has been IAG’s focus on reducing debt. The company has managed to cut its net debt by €1 billion, bringing it down to €6 billion. This has been positively received by analysts, with Morgan Stanley (NYSE:MS) noting on March 2024, “IAG’s debt reduction strategy is a step in the right direction and provides a more solid foundation for future growth.”

Market Challenges

Despite the positive developments, IAG faces several market challenges. Rising fuel prices have been a major concern, impacting the company’s operating costs. Additionally, geopolitical tensions in Europe have created uncertainties in travel demand, particularly for routes to and from Eastern Europe.

Brexit-related issues continue to affect the company. The complexities of operating in a post-Brexit environment have led to increased regulatory and operational costs. According to an analysis by The Financial Times on April 2024, “IAG must navigate the turbulent waters of Brexit with caution to maintain its market position and profitability.”

Future Outlook

Looking ahead, IAG’s future seems cautiously optimistic. The company plans to expand its fleet with more fuel-efficient aircraft, aiming to reduce its carbon footprint and operational costs. This move is expected to enhance the company’s long-term sustainability and competitiveness.

Additionally, IAG is focusing on expanding its market presence in Asia and North America. The anticipated launch of new routes to these regions is expected to drive passenger growth and revenue. As highlighted by Bloomberg on May 2024, “IAG’s strategic expansion into new markets is a promising step towards diversifying its revenue streams.”

Conclusion

In conclusion, International Consolidated Airlines Group S.A. has shown resilience and adaptability in 2024. While the company faces challenges such as rising fuel costs and geopolitical uncertainties, its strategic initiatives and financial improvements provide a positive outlook. Investors should keep a close eye on IAG’s performance, as the company navigates through these dynamic market conditions.

Feel ready to dive into details and start finding interesting stocks to invest? Try our AI supported solution InvestingPro today!

Get an extra discount up to 10% by applying the code FTSEINVEST on our 1&2 year plans. Don't wait any longer!

How to buy pro InvestingPro