As readers may already know, Germans head to the polls on Sunday September 26 to elect a new Bundestag, or federal parliament. In all likelihood, two or three parties will have to form a coalition after the initial results to decide who will succeed Angela Merkel, who is standing down after 16 years as chancellor.

In the lead up to the hotly-contested election, we’ll share a series of articles analysing how major markets may react under different scenarios. Over the last two weeks, we’ve covered the possible implications for the euro and Germany’s DAX index, and today we’ll examine the Euro Stoxx 50, a popular index that aims “to provide a blue-chip representation of the Supersector leaders in the Eurozone” and is made up of roughly one-third German stocks including giants like Adidas (DE:ADSGN), BMW (DE:BMWG), Volkswagen (DE:VOWG) and SAP (DE:SAPG).

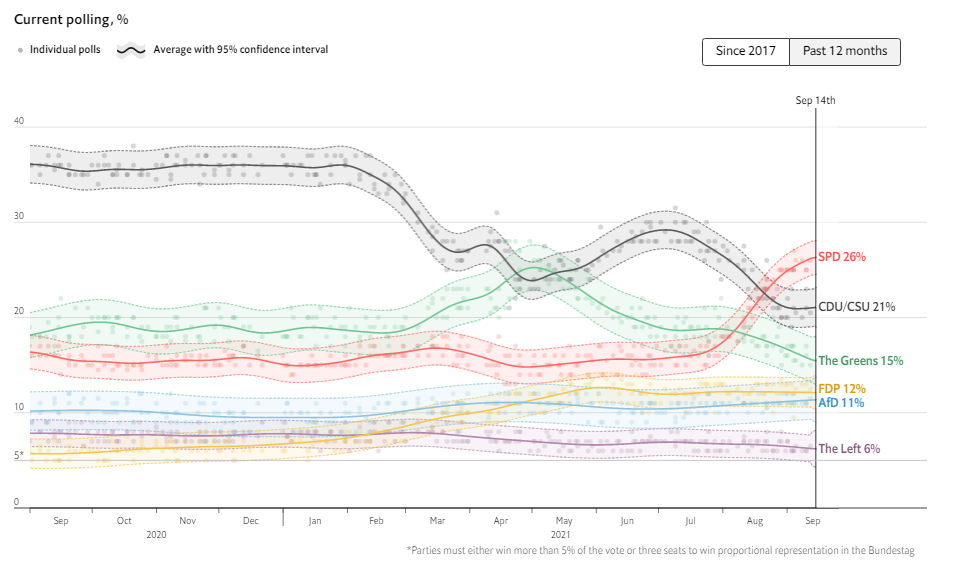

After more than a decade and a half of rule by Merkel’s conservative Christian Democratic Union / Christian Social Union (CDU/CSU) party, the polls are pointing to a tightly-contested race between the CDU/CSU, the centre-left Social Democratic Party (SPD) and the liberal Green party:

Source: The Economist

Below, we explore the possible implications for the Eurostoxx 50 under coalitions led by each of these three parties, though of course the coalition partner(s) will also have a major impact on policies and the market’s reaction:

1) An SPD-led coalition

With a marginal, but growing lead in the polls as we go to press, a coalition led by the centre-left SPD is the most likely scenario – indeed, Goldman Sachs (NYSE:GS) is currently projecting about a 70% of an SPD chancellorship led by Olaf Scholz. As a more left-leaning party than the established CDU/CSU, an SPD-led coalition could be a relatively bearish development for German stocks, as the party has advocated for raising minimum wages, raising taxes, and supporting “labour” at the expense of “capital” at the margin. Of course, the likelihood of more liberal-leaning policies getting enacted will depend on the coalition partner(s) and their priorities.

2) A CDU/CSU-led coalition

Angela Merkel will be a tough act to follow, and that responsibility may well fall on Armin Laschet, the premier of North Rhine-Westphalia, Germany’s most populous state. With the CDU/CSU and SPD seemingly at odds after eight years of a coalition, a CDU/CSU victory later this month would likely result in a new coalition and a conservative shift in policy. All else equal, this may be a bullish outcome for the German companies within the Eurostoxx 50, with a lower likelihood of higher taxes, additional regulations, and labour reforms. That said, if a CDU/CSU victory leads to Germany isolating itself and avoiding deeper integration with the rest of Europe, it could weigh on the other companies in the index as time moves along.

3) A Green-led coalition

It’s said that markets absolutely hate uncertainty, and a victory by the left-leaning Green party, led by Annalena Baerbock, would certainly introduce a heavy dose of uncertainty into Germany’s politics. The party advocates for an ambitious climate-change policy, widespread public investment, and deeper European integration, all of which could increase costs for German businesses. Therefore, a Green-led coalition could well be the most bearish election result for the Eurostoxx 50, and one that should have bullish traders keeping a close eye on the polls in the coming weeks.

While the above outlines three different high-level scenarios to watch, along with the potential implications for the Eurostoxx 50, there are countless permutations of coalitions that traders will have to sift through in the wake of the election.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI