The Biden administration announced significant tariff increases on China last week, targeting roughly $18 billion in strategic industries, with a sharp focus on electric vehicles (EVs). These tariffs, which quadruple to 100% on Chinese-made EVs, are designed to counter China’s unfair trade practices and overcapacity while boosting U.S. industries. The move also aims to strengthen President Biden’s lagging poll numbers heading into the November presidential election.

For decades, China has moved to dominate various industries, from toys and clothing in the 1980s to semiconductors and renewable energy today. As of now, China produces a third of the world’s manufactured goods, surpassing the combined output of the U.S., Germany, Japan, South Korea and the U.K. This industrial might has given China a trade surplus in manufactured goods equal to a 10th of its entire economy.

The world’s second-largest economy was a minor player in car exports just four years ago, shipping about 1 million low-priced vehicles annually to less affluent markets. Today, China has surged past Japan and Germany to become the world's biggest car exporter, with shipments running at an annual pace of nearly 6 million vehicles. China's car exports, in fact, hit a record high in April, with a year-on-year increase of 38%.

The $12,000 EV Challenging Tesla

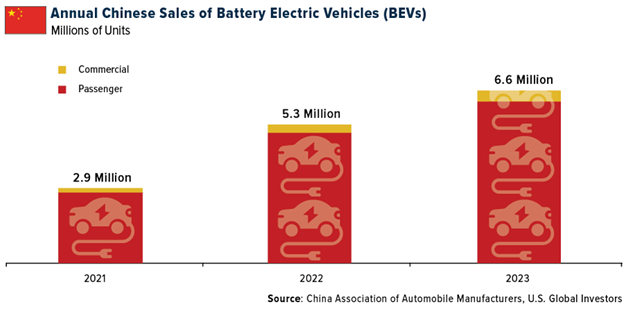

As for EVs, domestic Chinese sales have been strong and are growing. Last year, consumers purchased some 6.6 million EVs, according to the China Association of Automobile Manufacturers (CAAM). That represents a nearly 25% increase from the number of EV sales during the previous year, and a remarkable 128% jump from 2021.

And demand doesn’t appear to be slowing down. China is reportedly introducing as many as 71 models of EVs this year, many of them equipped with advanced features and priced lower than comparable models in the West.

The model that has U.S. companies worried is the Seagull, a small EV manufactured by BYD (OTC:BYDDY) (SZ:002594) (“Build Your Dreams”) that sells for around $12,000. Some people are already calling BYD a “Tesla killer,” but with a 100% tariff imposed on the company’s vehicles, it’s unlikely that you’re going to see them on U.S. roads and highways anytime soon.

Protecting U.S. Industries in an Election Year

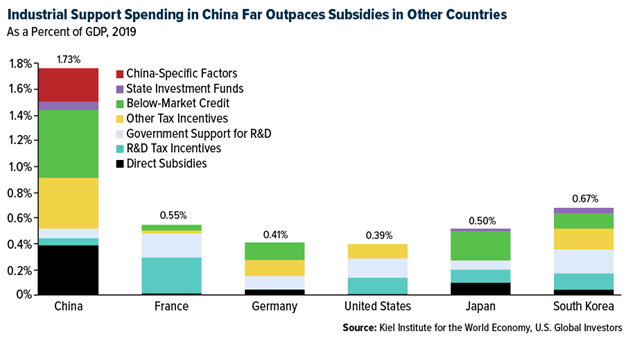

Historically, China has benefited from substantial subsidies, a key gripe from American and European business leaders and politicians. Chinese subsidies relative to GDP are about three times higher than in France and about four times higher than in Germany or the U.S., according to a report by the Germany-based Kiel Institute for the World Economy. This is what allows companies to price their vehicles at such artificially low costs.

President Biden's tariffs aren’t just about pushing back against China's unfair trade practices; they’re also about protecting American industries. Through the Chips and Science Act and the Inflation Reduction Act, Biden has already provided support to American companies in sectors like semiconductors and renewable energy. The tariff increases on China are an extension of that protection, ensuring that American businesses can compete on a more level playing field.

As I said earlier, we should view Biden’s actions through the lens of the upcoming U.S. presidential election. President Biden is trailing former President Donald Trump in national polls, including in several swing states, and this move is likely aimed at rallying support among voters who are concerned about job losses and industrial decline.

Potential Setbacks

Having said all that, tariffs are not ideal instruments, and I believe they should be used sparingly. It’s important to remember that tariffs are taxes paid not by the exporting country—China in this case—but by importers, which pass the additional cost on to domestic consumers.

Biden’s tariffs could also have unintended consequences on the nation’s efforts to decarbonize its grid, warns the Atlantic Council, a Washington, D.C.-based think tank. China is the largest exporter of lithium-ion batteries to the U.S., which are crucial for grid storage that complements solar power. Depending on the details of the tariffs, U.S. efforts to transition to renewable energy could face slowdowns if storage capacity is impacted.

Another factor to consider is the declining consumer demand for EVs in the U.S. According to the J.D. Power 2024 U.S. Electric Vehicle Consideration (EVC) Study, the percentage of new vehicle buyers considering an EV has dropped for the first time since 2021. Key issues include a shortage of affordable models, concerns about charging infrastructure and limited consumer understanding of EV incentives. Economic factors like lower fuel prices and high inflation further dent demand.

Remarkably, Biden’s tariffs aren’t the worst-case scenario for China. Trump has said he would impose 60% tariffs on all imports from China if reelected, which Bloomberg Economics estimates would effectively eliminate all trade between the two nations.

New Energy Metals on the Rise

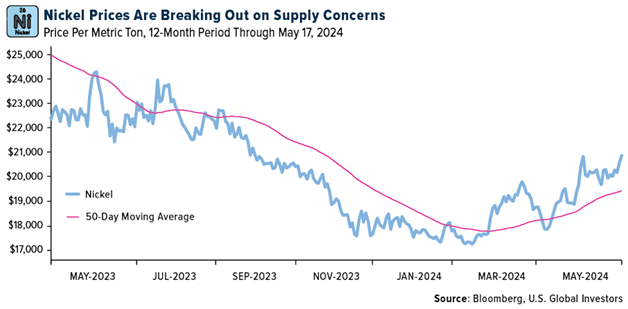

With EVs gaining in popularity across the globe and governments spending to build out wind and solar facilities, we’re seeing prices for key metals and materials start to break out. Copper futures have recently hit a record high, while nickel prices are breaking out on near-term supply concerns. Unrest in New Caledonia, a French territory in the South Pacific and the world’s number three nickel producer, has disrupted output of the white metal, which is used in the production of batteries. Nickel traded above $21,000 per metric ton last week for the first time in about a month.

Government Policy Is a Precursor to Change

Biden’s sweeping tariff increases on China are a calculated move to protect American industries, counter unfair trade practices and gain political clout ahead of the November election. While these measures are necessary to level the playing field, they come with challenges and potential unintended consequences. As investors, it’s important to stay informed and understand the broader implications of these policies on the market and the economy.

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2024): Tesla (NASDAQ:TSLA).