- U.S. housing affordability hampered as real estate values soar, mortgage rates remain above 5%

- Major home building stocks exhibit some upward momentum

- Traders should stand guard for volatility this week as two major companies in the ITB ETF report quarterly numbers

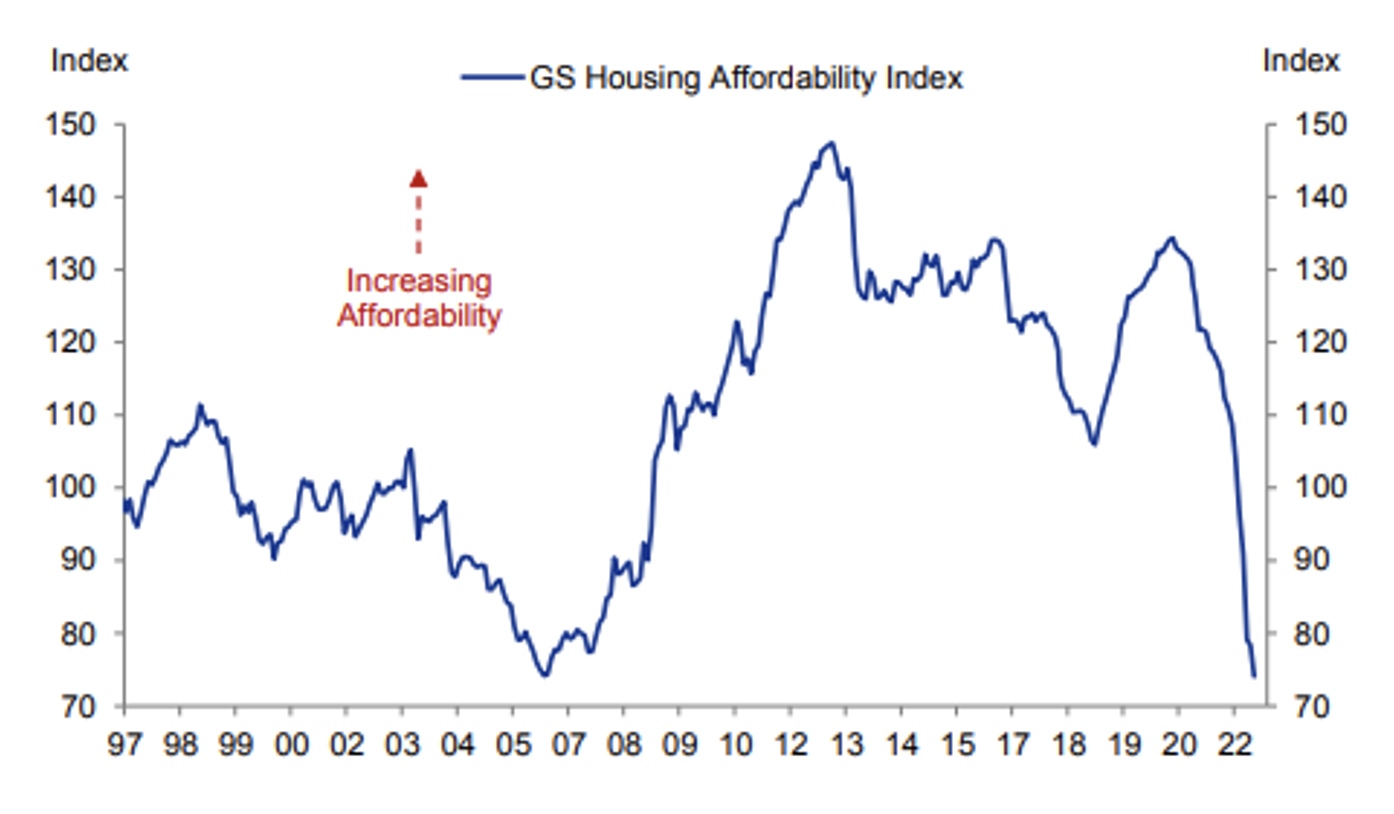

The National Association of Realtors publishes a monthly Housing Affordability Index. It measures how easy or difficult it is for the typical American family to purchase a home at today’s real estate prices and mortgage rates. A key variable is average income. As you might imagine, affordability today is downright awful. Surging mortgage rates, which moved from less than 4% late last year to more than 6% at times over the last two months, coupled with still-rising home values, have priced out many would-be first-time buyers. Goldman Sachs issued its own housing affordability update earlier this month that showed the national market is the priciest in 25 years.

Source: Goldman Sachs Investment Research

What does this all mean for the housing market and housing stocks?

After all, you might be enticed by extremely low price-to-earnings ratios among the popular homebuilders. The widely traded ETF in the space is the iShares U.S. Home Construction ETF (NYSE:ITB). Its top four holdings, all consumer discretionary stocks, are DR Horton (NYSE:DHI), Lennar (NYSE:LEN), NVR (NYSE:NVR) and PulteGroup (NYSE:PHM), according to iShares. The forward P/E on DHI, for example, is just 5.3, according to Investing.com. The other trio of major homebuilding stocks is similarly priced.

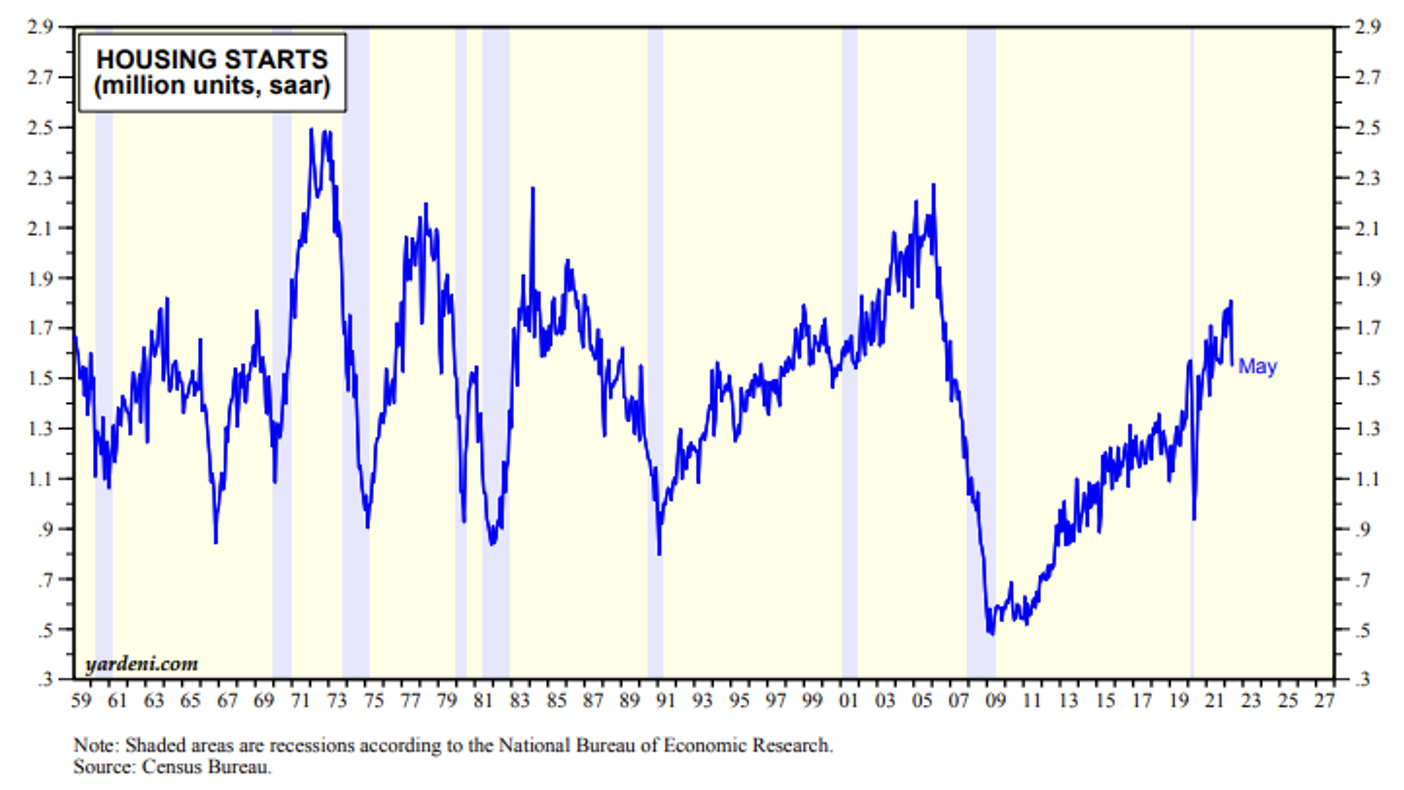

The problem, of course, is that we do not know what the “E” will be. Earnings are uncertain across the corporate spectrum, but they are particularly unknown among the heavily cyclical homebuilders. Consider that housing starts are still about 35% below the all-time high and have recently dropped. Investors should closely watch housing starts numbers as well as building permit reports to see if these key barometers of economic activity hold up or if they will succumb to recessionary pressures. The good news is that so many commodities, like lumber futures, have retreated sharply in price.

Source: Yardeni.com

Despite the dour depiction of the housing market, there are encouraging signs among the major homebuilding stocks. The chart of ITB is particularly interesting right now. The chart below illustrates a potential bullish inflection.

Notice how ITB dropped during much of the first half of June. It was then, after falling under $50 for a time, that shares began to rally. Heading into the trading week, ITB has been down just five times over the last month. The ETF is up almost 20% from the June 17 low as it climbs above its 50-day moving average (which might turn upward sloping very soon). Traders can play it from the long side here with a target near the pivotal $65 level, which was support in 2021.

Source: Investing.com

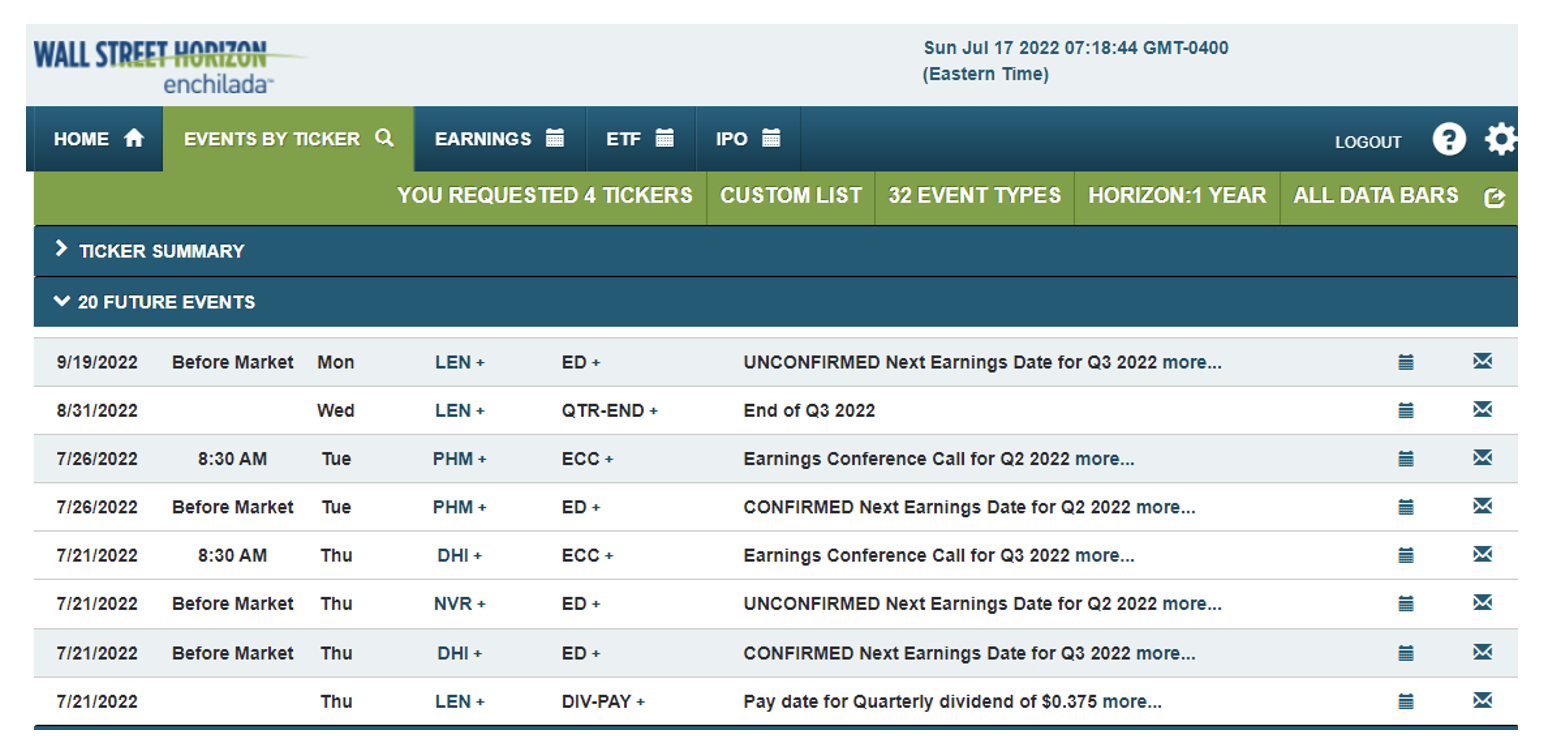

Earnings are on tap. Wall Street Horizon corporate event data show quarterly results are due from DHI and NVR this Thursday BMO.

Source: Wall Street Horizon

The Bottom Line

Expect volatility this week as a pair of major homebuilding stocks report quarterly earnings. The chart of ITB looks impressive right now despite lousy sentiment and fundamentals. Stocks often move before turns in the underlying economy, so if we see more upside through Q2 earnings season, it could bode well for the broad economy later this year.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned.