More investors are asking the question lately, in part because markets are seemingly defying gravity and ignoring various macro and geopolitical risks.

Yet, a broad reading on market trends has yet to signal trouble ahead, based on a review of ETF pairs. That doesn’t ensure the bull run will continue, but at this point the idea of calling a top and going defensive is based primarily on contrarian-based forecasting. Trend analysis, by comparison, still reflects optimism, rational or otherwise. Pick your poison.

This upbeat trend view is more or less unchanged from our previous analysis of relative price behavior using various sets of ETFs. In late-May we noted that “Market Trends Continue To Lean Into A Bullish Signal.” A similar profile prevails, based on data through Friday’s close (July 5).

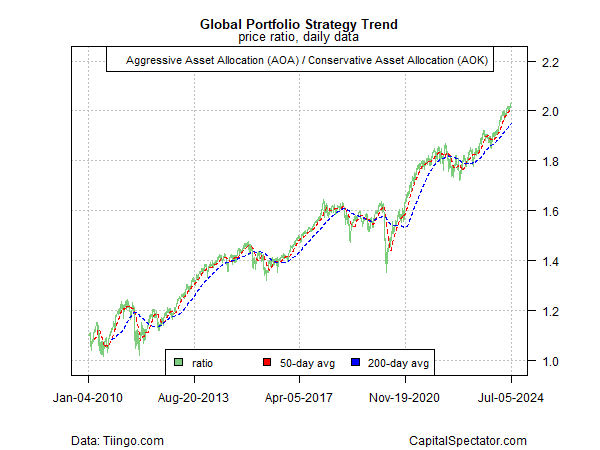

Let’s start with a big-picture profile for a pair of global asset allocation funds. The aggressive portfolio (AOA) continues to outperform its conservative counterpart (AOK) by a wide margin, suggesting that animal spirits continue to favor a risk-on position.

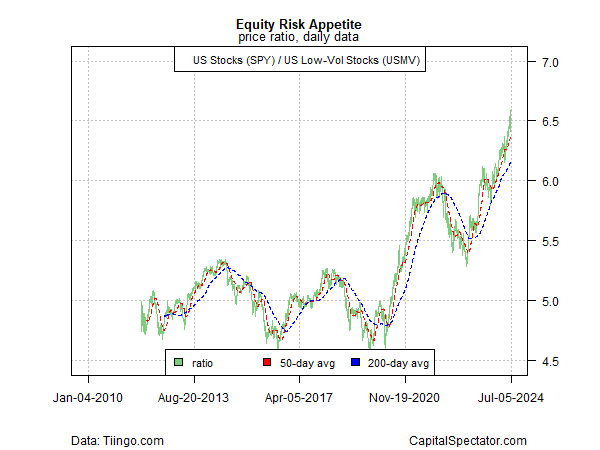

The US stock market’s risk appetite also continues to skew bullish, based on the ratio of the broad market (SPY) vs. low-volatility shares (USMV).

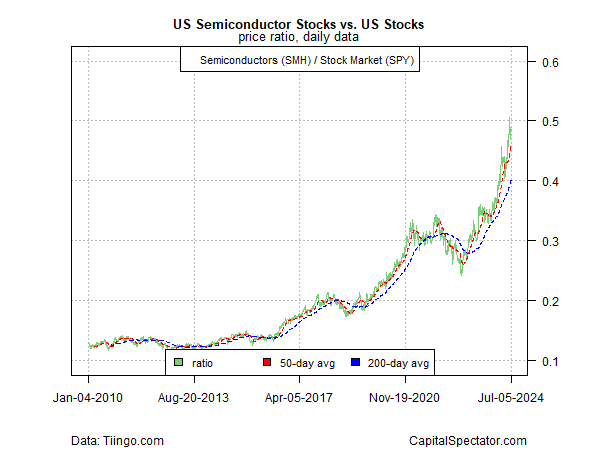

A key market proxy for the business cycle is also sending positive trend signals, based on the semiconductor industry (SMH) relative to a broad measure of stocks (SPY).

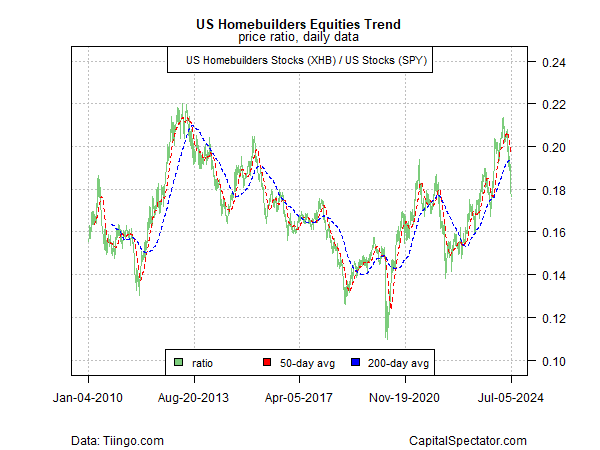

Contrarians, however, will highlight the sharp downturn in housing stocks (XHB) vs. US shares overall (SPY). As noted in late-May, the downshift in housing equities in relative terms could be an early warning for the risk appetite. The ongoing slide in XHB extends and deepens the warning.

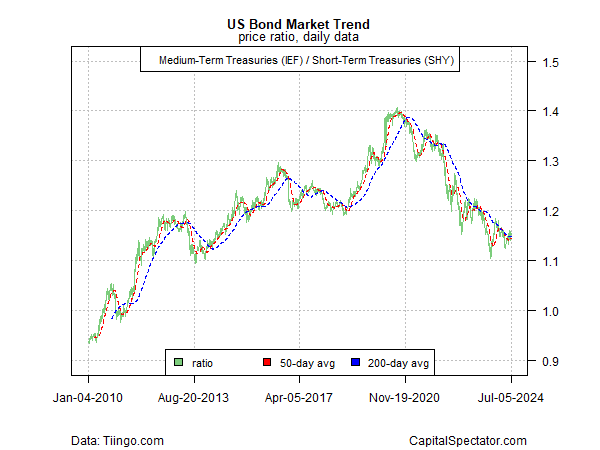

On a related note, the ratio of medium-term US Treasuries (IEF) vs. shorter-term counterparts (SHY) appears to be forming a base after an extended slide. That may be a sign that the appetite for risk-off is starting to rebound. If and when this ratio begins trending higher, the case for regime change to a defense posture will strengthen.

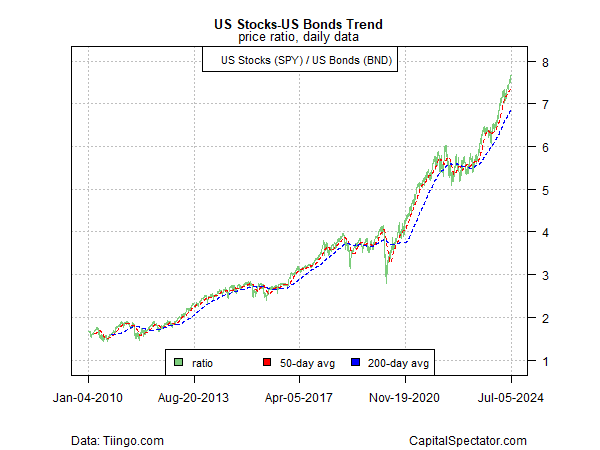

Similarly, when the rally in US stocks (SPY) vs. US bonds (BND) starts to roll over, the change may signal a regime change for the risk appetite. At the moment, animal spirits show few signs of fading. The bull run will end eventually, but current data still suggests we’re not yet at the tipping point. In the wake of a powerful rally, however, it’s timely to look for early warning signs that trend is cracking.