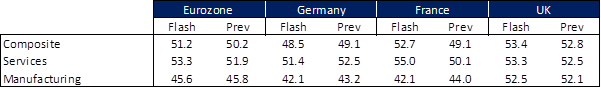

European economic activity expanded by more than expected in August, according to the latest flash PMI numbers. The composite reading for the bloc rose to 51.2, up from 50.2 in July.

Even so, the wider growth picture remains grim. Once adjusting for the impact of the Olympics, we think that underlying private sector activity in the eurozone flatlined this month. This contrasts strongly with UK figures that signalled another robust expansion in activity, signalling further divergence in economic fortunes playing out on either side of the English Channel. This dynamic is showing up in currency markets too, with GBPEUR taking a leg higher this morning on the back of continued UK outperformance.

Looking at the details of today’s reports, the upside surprise to aggregate eurozone activity stemmed almost exclusively from French services, where the PMI rose sharply to hit 55.0 in August. This was up markedly from 50.1 in July, and well above the 50.3 reading expected by markets.

We are inclined to chalk this jump in the reading up to the Olympic games, the impact of which should have been captured in this month’s figures, a point echoed in the PMI report.

It also suggests that the resurgence in French services is likely to be temporary, with underlying activity otherwise continuing to underwhelm. Indeed, the French manufacturing PMI, which should have seen only a minimal impact from the month’s sporting festivities, fell from 44.0 to 42.1, undershooting expectations for a modest recovery to 44.5. Germany, meanwhile, continues to be a drag on eurozone growth, delivering a composite PMI reading of 48.5 – a fall of 0.6 points from last month. The contraction in German private sector activity was once again led by manufacturing, where the August PMI slipped to 42.1, down from 43.2. Services growth also slowed, albeit remains in expansion with a print of 51.4.

Taken as a whole, while the uptick in eurozone activity seen in headline readings looks good at first glance, it is unlikely to last. This point is supported by forward-looking indicators too, with new orders decreasing for the third month in a row, led by new export orders.

Combined with a further rundown in order backlogs, this saw a drop in employment for the first time in over half a year, while sentiment took a broad-based knock, continuing to chart new year-to-date lows this month. We expect a return to trend in September, with a contraction in overall activity looking likely. That said, for the ECB, today’s report does contain some silver linings.

The reduction in labour market tightness is seeing input costs into the services sector ease, suggesting that inflation pressures continue to be squeezed out of the economy, keeping the door open for an ECB rate cut in September.

Even as eurozone growth disappoints, the UK economy continues to exceed market expectations, with today’s report signalling both faster growth and slower inflation. The composite UK PMI rose from 52.8 to 53.4 in August, beating consensus estimates of 53.0. In contrast to the eurozone, this rise was broad-based too, with both manufacturing and services recording expansions, with readings of 52.5 and 53.3 respectively.

The details of the report also contained several nuggets of further good news for the BoE.

While employment growth accelerated marginally and service providers continued to note elevated wage inflation, input cost inflation eased to its lowest in just over three-and-a-half years, while average prices charged rose at close to the slowest rate seen over the same period.

While we are inclined to view today’s PMIs as broadly supporting the case for further policy easing in both the eurozone and the UK, continued economic expansion in the latter offers a more favourable backdrop for markets, in line with our longstanding base case.

This has been reflected in FX market price action post-release, with GBPEUR notching gains of 0.3% to trade just shy of our month-end target for the cross of 1.18.