Gresham House Energy Storage Fund (GRID) invests in a diversified portfolio of utility-scale battery energy storage systems (BESS) in the UK and Ireland. It is the largest UK listed BESS fund and the largest operator in the market, and it is growing rapidly. GRID owns 17 operational projects with capacity totalling 425MW, which have delivered a good performance since inception. It also has eight projects (comprising a further 415MW) under construction and due to begin operating in 2022, and expects total capacity to exceed 1,500MW by 2024. BESS are a key part of the UK’s commitment to reach net zero carbon emissions by 2050. Demand for these units is projected to rise from 1.4GW today to an estimated 42GW by 2050, according to National Grid (LON:NG). We believe GRID’s asset valuation policy is conservative relative to its peers, providing scope for potential NAV uplift. GRID’s manager, Ben Guest, has the funding to deliver the current pipeline and in our view, it is possible that GRID may raise further funds in 2022 to drive growth in 2023 and beyond. The fund has a high dividend policy, currently paying a dividend of 7.0p per share.

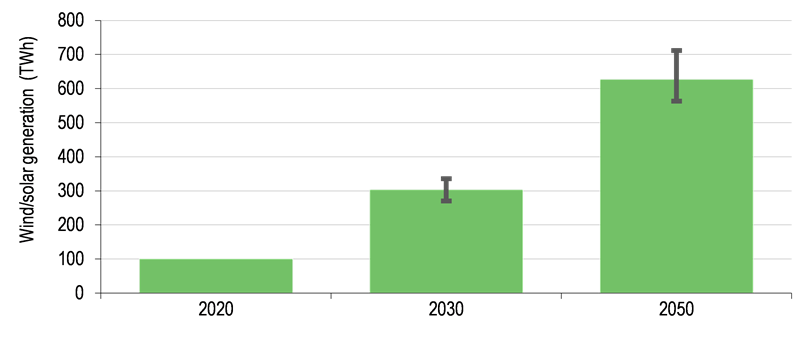

Intermittent renewable supply must triple by 2030 and grow sixfold by 2050

Source: National Grid Future Energy Scenarios. Note: Based on an average of Consumer Transformation, System Transformation and Leading the Way scenarios, all consistent with 1.5°C average temperature increase. Grey vertical bars indicate margins of error.

Fund objective

Gresham House Energy Storage Fund seeks to provide investors with an attractive and sustainable dividend over the long term by investing in a diversified portfolio of utility-scale battery energy storage systems located in the UK and Ireland. In addition, the company seeks to provide investors with capital growth through the reinvestment of net cash generated in excess of the target dividend.

Bull points

■ A high and regular dividend and the prospects of significant capital growth as GRID’s projects become operational and are re-valued upwards.

■ Returns are not corelated to the absolute level of wholesale power prices and are not dependent on any subsidies.

■ BESS are making a significant contribution to the UK’s transition to ‘net zero’ emissions.

Bear points

■ Competition in the BESS market is increasing as more players enter the sector.

■ GRID has a short track record of trading power prices.

■ While degradation is assumed in financial projections, batteries still need to be used and managed carefully to avoid battery degradation that limits their useful life.

Analyst’s view

GRID generates revenues from various sources, including energy trading, which the manager expects will become the fund’s greatest source of revenue over the long term. There is also the possibility of NAV uplifts as the fund’s pipeline projects come online. GRID may therefore appeal to investors seeking a high and regular income, capital growth and portfolio diversification from assets uncorrelated to conventional financial markets. The fund may also interest those focused on sustainable investments contributing to climate change mitigation.

Premium may decline on NAV uplifts

GRID’s share price has traded at a premium to cum-income NAV since inception, thanks to strong investor demand for exposure to this asset class, the attractive, regular dividend, healthy dividend cover and the possibility of NAV uplifts, given GRID’s conservative valuation policy. However, in the absence of further share price rises, the premium may narrow as and when any such uplifts are realised.

Fund profile: Battery fund generating income & growth

Gresham House Energy Storage Fund (GRID) was launched in November 2018 and is listed on the Specialist Fund Segment (SFS) of the London Stock Exchange. The fund seeks to provide investors with an attractive and sustainable dividend and capital growth over the long term, by investing in a diversified portfolio of utility-scale BESS located in the United Kingdom and the Republic of Ireland. It is the largest UK fund listed in the battery storage sector and the largest operator in the market, being more than twice the size of its closest competitor, Gore Street Energy Storage Fund (GSF) in terms of operational capacity. The fund’s dividend policy currently targets dividend payments of 7p per share. Dividends are paid quarterly in equal instalments. GRID also targets a net asset value (NAV) total return of 8% pa (unlevered) and 15% levered once leverage is fully utilised and other value-adding activities (such as project extensions and battery size increases) have taken place. Returns are not corelated to the absolute level of wholesale power prices and are not dependent on any subsidies.

In July 2021, GRID raised £100m in equity at a price of 112p/share and in September 2021, it established a new five-year debt facility totalling £180m. The company has scope to assume gearing up to 50% of gross asset value (GAV) and, once fully drawn, GRID expects this new debt facility to result in gearing of 25–30%. The trust publishes its NAV quarterly and its results for the financial year to end December 2021 will be published in early April 2022.

GRID’s Alternative Investment Fund Manager (AIFM) is Gresham House Asset Management. Ben Guest has managed GRID since inception and he and his family owned 3.3% of the fund’s shares (as at end December 2021). The fund is a constituent of the Association of Investment Companies (AIC) Renewable Energy Infrastructure sector.

Click on the PDF below to read the full report: