Gold buyers: Think 2022—not 2020.

Anyone buying the yellow metal as an inflation hedge and expecting a rerun of the breath-taking rise that took it to record highs two years ago might be disappointed, to say the least.

In what some are already calling 'The Year of the Great Inflation,' gold could be just the asset to shield investors from price hikes, which are growing at their fastest pace in four decades, and to give investment portfolios that little extra shine.

But do not expect its moves to be commensurate with inflation.

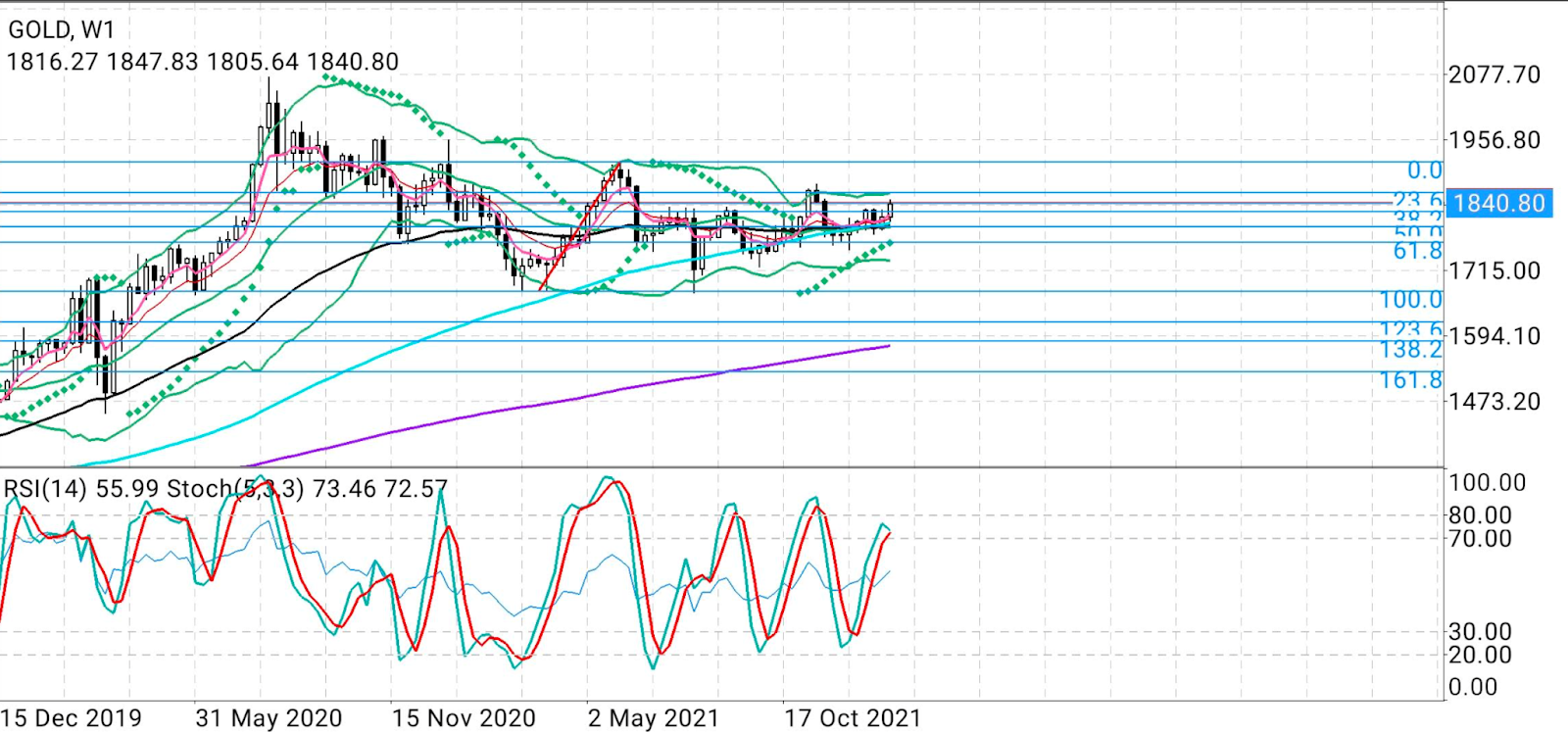

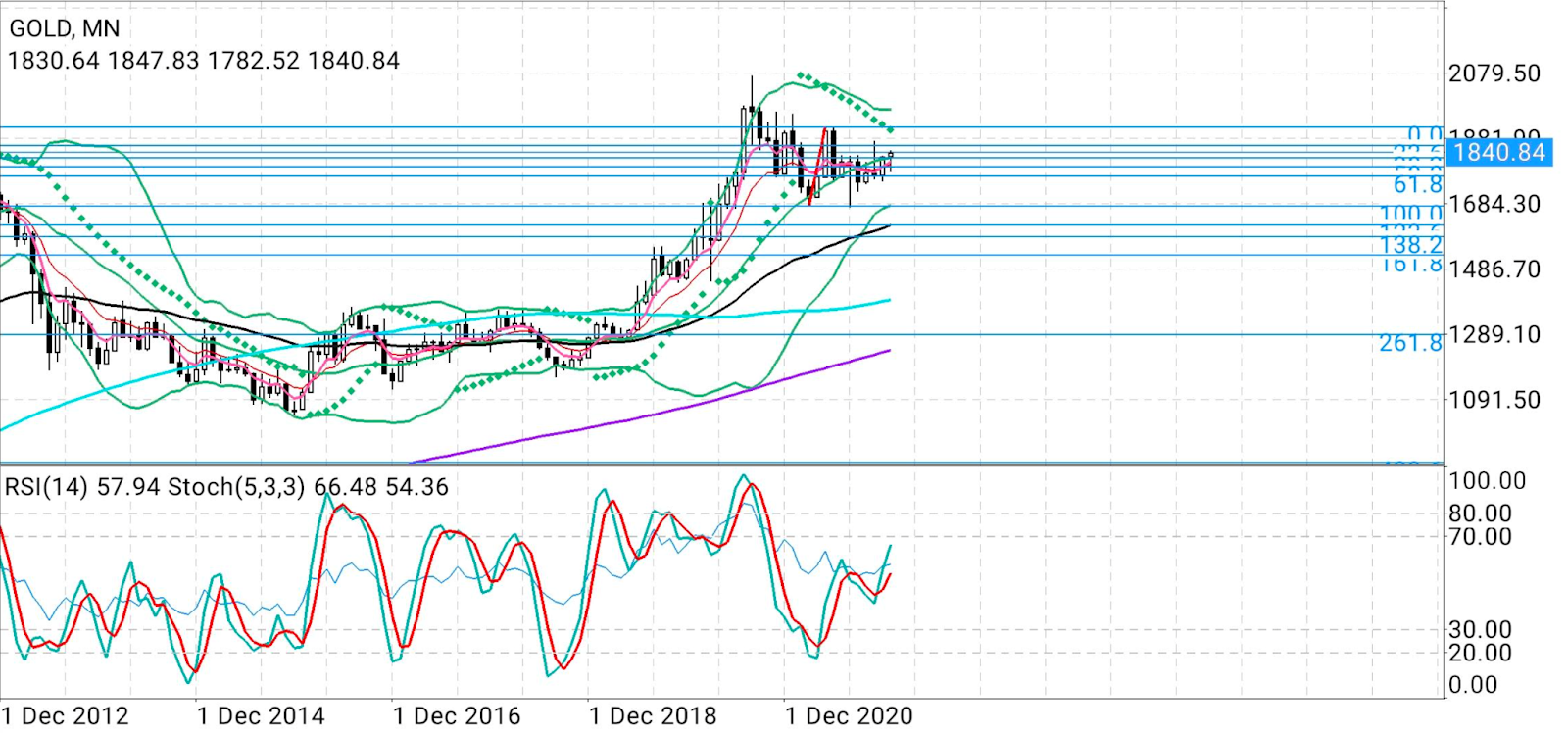

All charts courtesy of skcharting.com

If anything, gold in 2022 will likely gain by moving two steps forward and one back, much like how it has behaved since the start of January. Think of a slow motion clip instead of a blazing trailer.

Such an analogy characterizes how gold moves these days compared with recent years. Since this year began, the yellow metal has gained just $13 net, or 0.6%.

What has made it stand out is its ability to hold ground in the $1,800 territory, despite pressure from the two-year highs in US 10-year Treasury yields and the accompanying rally at times in the dollar—both of which act as 'twin evils' to gold.

The yellow metal has shown resilience despite expectations that the US Federal Reserve will embark on a series of interest rate hikes this year to combat 40-year highs in inflation, which grew by 7% in the year to December. Rate hikes are typically beneficial to the dollar and negative to gold.

Gold also smashed past the key $1,830 resistance this week to reach a two-month high above $1,848. For six previous weeks, since early November, the $1,830 level was almost like an impregnable fortress to gold bulls. Technically, there are just three more key resistance points to clear in the quest for the next major level of $1,900.

Despite this, gold’s moves for this year almost seem pedestrian compared with the lightning pace of 2021's losses, when it fell 3.6% for its first annual dip in three years, and for its sharpest slump since 2015.

The change is even more dramatic when compared with 2020—gold’s most glorious year in a decade when it went from a March low of $1,485 an ounce to an all-time high of just over $2,121 by August. It, of course, gave back a portion of those gains before another bumper gain in December.

So, what stands in gold’s way in a move toward the much-watched $1,900 and higher levels?

It is resistance levels at $1,860, $1,880 and $1,899, say Sunil Kumar Dixit, chief technical strategist at skcharting.com and a regular contributor of commodity technicals to Investing.com.

“Strong momentum above $1,836 and consolidation above the $1,843-$1,848 level may resume gold's bullish move toward its next target of $1,860, which is 23.6% Fibonacci level,” said Dixit in an analysis of spot gold.

“As long as gold holds above $1,825, look for $1,860 as the next target, followed by $1,880 and $1,899,” he added.

Dixit said firm price action since the start of the year and the breach of the long contested $1830-1835 wall had reinforced gold bulls’ minds to go for the $1,900 level, last attained in June.

The yellow metal was also amply backed by strong stochastic readings across the daily, weekly and monthly charts, he said.

As a concession, in the short term, gold may take a small break and start some sideways consolidation between $1,843 and $1,836 before the significant move, said Dixit.

All said, gold remained vulnerable to the downside at under $1,836, he said.

“Trade below $1,836 may push gold down toward the horizontal support of $1,830 and next, to retest $1,825, which marks the 38.2% Fibonacci level,” Dixit cautioned.

“Weakness below this level may extend correction to $1,818 and $1,813.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.